Important: Are your Stocks in Stage 1, 2, 3, or 4?

Stock-Markets / Stock Market 2022 Jul 21, 2022 - 09:50 PM GMTBy: Submissions

Every investor is asking the same question: When will stocks bottom?

As you know, the S&P 500 is down 20% this year and firmly in a bear market.

Since 1929, the S&P 500’s had 14 bear markets... lasting around 19 months, on average. Which means if the current bear market lasts an “average” length, we’ll see the bottom next summer.

But asking when stocks as a whole will bottom is the WRONG question. Instead, investors should be asking…

Which stocks will bottom first?

Because certain stocks appear to already be bottoming…

This is important.

Stocks that bottom out first after a bear market tend to emerge as new leaders.

In other words… they’re the stocks you want to own.

So, how do you find them?

- Print out the following graphic—it’s that important...

Most folks don’t know this—but many stocks follow a predictable pattern.

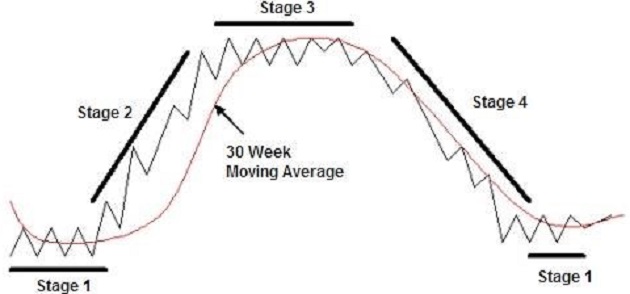

You’re looking at the typical life cycle of a stock.

As you can see, stocks tend to go through 4 different “stages”...

In Stage 1, a stock trades sideways and builds a base.

Stage 2 begins when a stock breaks out of Stage 1 and begins rising. This is when you want to own it.

Stage 3 is when a stock stops going up and tops out. This is when you want to sell it.

Then, you get to Stage 4, when a stock rolls over and enters a downtrend. You want to avoid stocks during this phase.

You can get an idea of what stage a stock is in by looking up its 30-week moving average. The 30-week moving average is a technical indicator that tells you the average closing price of a specific stock over the previous 30 weeks.

Generally speaking, the best time to buy a stock is when it decisively crosses above its 30-week average and begins to emerge from its Stage 1 base.

- This patten often repeats itself over and over in the same stocks…

Here’s a perfect example. This chart shows the performance of STAAR Surgical Company (STAA), a medical device company disrupting the massive glasses and contact lenses industry.

You can see it recently went through all four stages. It built out a massive Stage 1 base between late 2018 and early 2020.

Then it began an explosive Stage 2 advance that lasted from around April 2020 to July… during which it more than tripled.

My Disruption Trader subscribers caught part of that gain.

We entered STAA in October 2020 and rode it until May 2021 for an 89% gain (accounting for our “Free Ride”.)

Source: StockCharts

STAA now appears to be in the early stages of building a new Stage 1 base.

Keep in mind, some stocks will never recover from their first Stage 4 decline. They go down… then never go back up again.

You can avoid these traps by looking at a stock’s 30-week moving average. I want nothing to do with a stock if its 30-week average isn’t turning up… or at the very least flattening out.

Other stocks haven’t declined after their Stage 2 surge, like Enphase (ENPH).

As you can see, it just based, and unlike many stocks today, has been holding steady in a sideways range:

Source: StockCharts

High-quality stocks will often go through the four stages many times.

- Today, many growth stocks are emerging from Stage 1 bases…

You can see what I mean with solar stock Maxeon Solar Technologies (MAXN).

Source: StockCharts

It had its Stage 4 decline, but is now emerging from its Stage 1 base.

It’s up around 40% over the past nine weeks and is trading above its 30-week moving average.

Then there’s Gitlab (GTLB), a software company I highlighted a couple of weeks ago. It’s up around 80% from its May lows, is trading above its 30-week moving average, and appears to be in the early phase of Stage 2.

Source: StockCharts

I’ve recently recommended two other promising growth stocks in my premium advisories.

One of them has rallied about 10% in less than three weeks.

- In short: Don’t wait for the S&P 500 to officially bottom out to start buying quality stocks…

Many great growth names are already in Stage 1 of their life cycles. Some are already entering Stage 2.

Now’s the time to take a close look at top growth stocks.

If they’re trading above their 30-week moving average and trending higher, now could be a good time to put new capital to work.

3 Breakthrough Stocks Set to Double Your Money in 2022

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

© 2022 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.