Stock Market Bearish Test

Stock-Markets / Stock Market 2022 Jul 26, 2022 - 08:34 PM GMTBy: Monica_Kingsley

S&P 500 bears took over from the 4,010s area but didn‘t close convincingly – and bonds didn‘t tank, which means this rally isn‘t yet over. It may extend beyond Monday‘s premarket, and even cover all this time of upcoming key tech earnings reports. These wouldn‘t be as disastrous as is the market‘s expectation – suffice to look at Tesla. And if they are smart to avoid guidance for 2H 2022 (second half), S&P 500 may not stop above 4,030s in the least. HYG holds the key now, VIX isn‘t about to spike sharply, and the dollar isn‘t on a tear either.

Macroeconomically, we have many leading indicators dipping negative – such as the new orders component of the Philladelphia Fed manufacturing index, which makes U.S. recession at the end of 2022 / early 2023 a foregone conclusion. S&P global composite is now negative as namely Europe is struggling already. So, the stock market bulls are running on borrowed time, yet in the best case scenario, it can take longer than the next week for prices to resume their downswing – reality of not lower P/E multiples, but of lower earnings over the quarters ahead, would catch up with stocks as much as the stubborn inflation keeping above 5% no matter the coming two Fed rate hikes. Think stagflation with stocks in a trading range, and reversion to the mean strategies having a good time. More thoughts are reserved for premium subscribers.

Precious metals are cautiously trying to bottom here, and miners easpecially are weak. Bottoming is a process, and this one doesn‘t look to be over yet. When the dollar reverses to the downside, the selling of gold is bound to stop – we‘re getting there, and the new strong upleg would reflect the still unpleasantly high inflation, lower yields, and further deterioration of economic prospects. Crude oil would still do fine in such an environment as newly dented Fed credibility (coming from the current crowd of the central bank getting inflation under control and engineering soft landing at the same time) would help drive a new upleg in commodities as well. That‘s when we can look forward for better days in copper too. Cryptos in the short run are leaning towards the no slide in risk assets scenarios.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article features good 6 ones.

S&P 500 and Nasdaq Outlook

S&P 500 didn‘t reverse for good yet – the bulls haven‘t spoken their last word. 50-day moving average is flattening, meaning that the bulls would be gaining short-term advantage each day that prices don‘t meaningfully return below the blue line.

Credit Markets

I view Friday‘s HYG move as consolidation – the fact that junk bonds are short-term leading higher, is positive for the stock market. One would expect that they would reflect the worsening economic outlook and be avoided, but the imemdiate economic circumstances aren‘t catastrophic.

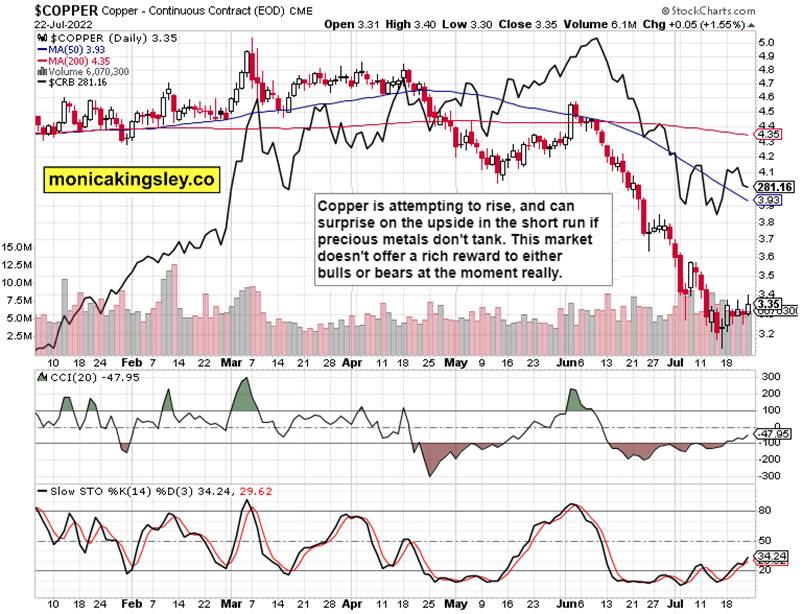

Copper

Copper is only relatively resilient, and while it‘s likely to extend Friday‘s gains a little, it‘s far from out of the woods. Further downside or a prolonged sideways consolidation before rising again, is most likely in the medium term.

Bitcoin and Ethereum

Cryptos are deceptively weak today, and the bulls would likely step in next. I‘m not looking for steep gains, but for sideways to gently upwards price action.

Thank you

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.