Tencent - TCHEY Stock Price Analysis Forecast 2023

Companies / China Stocks Jan 09, 2023 - 10:00 PM GMTBy: Nadeem_Walayat

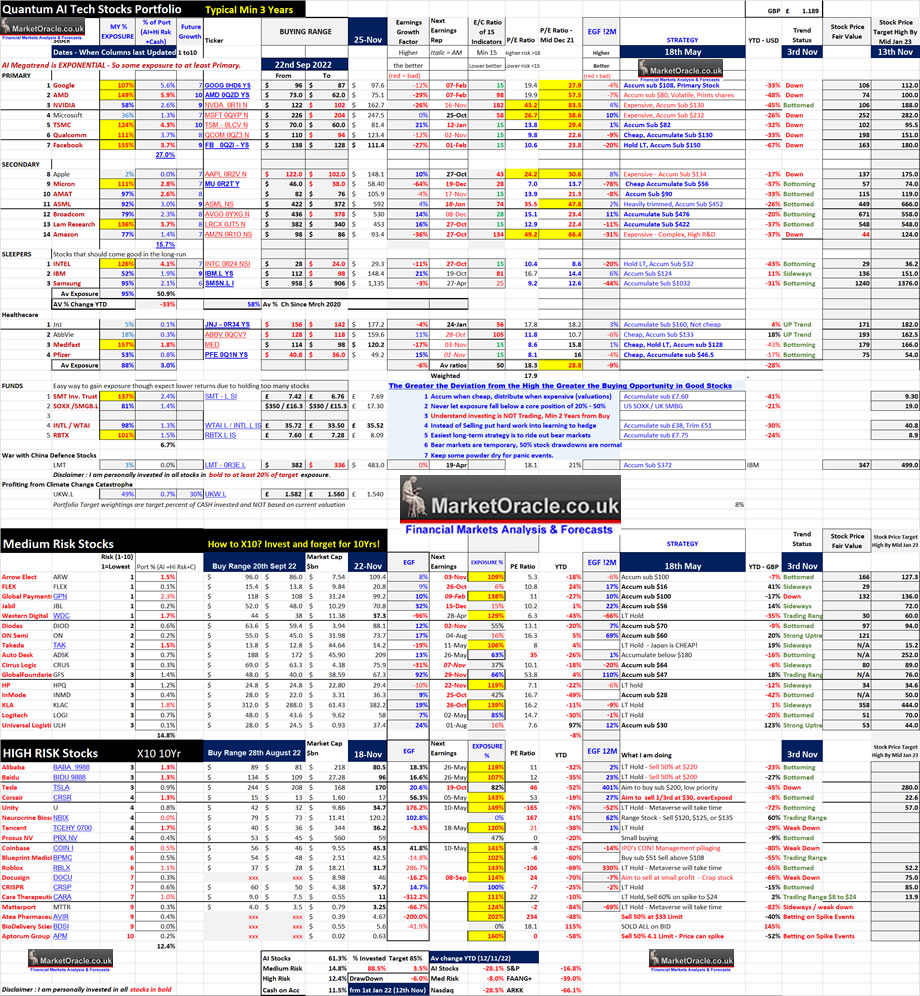

Ai Stocks Portfolio

A quick look at the current state of my portfolio which is now 88.5% invested after arrival of approx 5% of fresh cash and after I sold all of my NBIX holding given that it earlier retreated from a multi year high, and that it tends to trade within a range of $125 to $76. I have update the table to indicate when columns were last updated. I have also replaced the beta column with something more useful called Future Growth (1-10), which is basically how I see the COMPANY doing in terms of future growth potential where 10 is the highest and 1 is the lowest, note this does not mean that the stock prices will match growth potential due to a myriad of factors such as sentiment, valuation and politics, but it gives insight into the underlying prospects for the businesses where the two stocks that score 10 are AMD and TSMC which is why I am heavily invested in both and don't fret about stock price drops in either as recently experienced because the underlying businesses have huge long-term future growth potential. Stocks that score 9 are Nvidia, Facebook, ASML and IBM, which again means I am not too phased by what we recently witnessed with the likes of META and and Nvidia, stock prices rarely reflect the actual state of the underlying business as they oscillate between extreme fear and extreme FOMO as illustrated when one watches the Cartoon Network (CNBC).

Table Big Image - https://www.marketoracle.co.uk/images/2022/Nov/AI-stocks-portfolio-25th.jpg

Tencent - TCHEY $36 - EGF -3.5%, +1%, P/E 21

China's META that operates the Chinese market dominant Wechat, a year ago was trading at $69 on a P/E of 25.5, since which time it has near halved in price to $36 whilst the P/E has only moderated to 21. A year ago META was trading at X24, today 11. So why buy Tencent when one can get META much cheaper! Perhaps to bet on the Chinese social media market though we all paid a painful price to learn the lesson that China is NOT a western market where the CCP literally dictates what corporations can and can't do unlike in the West where the Tech giants buy politicians like trading cards, which means a lower multiple was warranted. What's my average price paid? $49. Would I buy more? No, 120% invested is more than enough exposure especially given that earnings growth rate remains low with EGF -3.5% / +1%. Still it could have turned out a lot worse! Another plus for Tencent is that they are very savvy long-term investors in other tech stocks at an early stage so tend to get get in very cheap.

You often here talk about how stocks tend to bottom when they capitulate well Tencent spiking down to $25 near 1/4 it's 2021 high definitely fits the capitulation bill by trading to BELOW the previous bear markets low of $31. Back when it seemed like a done deal that $40 would hold the line but broke and now acts as heavy overhead resistance. So whilst Tencent has probably bottomed it's going to take time to build a base to break above $40, and then it will need to do the same for $50 and so on all the way towards the $55 to $65 zone within which are a lot of investors nursing deep wounds eager to exit near break even. Time wise it could take another whole year to base build before Tencent starts tentatively trending higher.

(Charts courtesy of stockcharts.com)

The bottom line is Tencent is down but not out and some years down the road will be testing it's $97 all time high on break of which a new FOMO will begin towards $200 likely resulting in a similar outcome to what followed the early 2021 high. My objective will be to reduce my exposure to about 2/3rds at a small profit in the $50 to $60 chop zone.

This article is an excerpt form my recent analysis on the current state of the embryonic stocks bull market Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION! that was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this rises to $5 per month in th new year.

Also access to my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

Most recent analysis includes -

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Santa Battles Grinch to Deliver Stock Market Last Gasp Rally into the New Year

- Santa Sledge on the Launch Pad for Stock Market Post CPI To the Moon Rally

- Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION!

- How High Could the Impossible Stocks Bull Market Fly Into Christmas 2022

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- UK House Prices Trend Forecast - Complete

- Stock Market Trend Forecast to December 2023 - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 85%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock in now as this increases to $5 per month in the new year.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your mega-trend investing analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.