Category: Gold and Silver 2010

The analysis published under this category are as follows.Monday, November 15, 2010

Gold Standards, the World Bank, and Fiscal Responsibility / Commodities / Gold and Silver 2010

By: Midas_Letter

Since World Bank president Robert Zoellick put forth the idea for a new global currency that was influenced by the price of gold, the global media has pounced on his remarks, and completely misconstrued them to report that he was advocating for a ‘return to the gold standard’.

Since World Bank president Robert Zoellick put forth the idea for a new global currency that was influenced by the price of gold, the global media has pounced on his remarks, and completely misconstrued them to report that he was advocating for a ‘return to the gold standard’.

Monday, November 15, 2010

Is Gold a Bubble, If So When Will it Pop? / Commodities / Gold and Silver 2010

By: Washingtons_Blog

When everyone from Jim Cramer to Mr. T is hawking gold - and when the price has risen to all-time highs - it sure feels like a bubble.

When everyone from Jim Cramer to Mr. T is hawking gold - and when the price has risen to all-time highs - it sure feels like a bubble.

On the other hand, the super rich - who presumably know a thing or two about investing - are buying gold by the ton.

Read full article... Read full article...

Monday, November 15, 2010

Gold Tumbles, What's Going to Happen Next? / Commodities / Gold and Silver 2010

By: INO

Last week everyone was cheering as gold and other commodity markets were making new highs. This week however, things have changed as everyone seemed to want to jump through the same door, at the same time, putting a great deal of downside pressure on many markets.

Last week everyone was cheering as gold and other commodity markets were making new highs. This week however, things have changed as everyone seemed to want to jump through the same door, at the same time, putting a great deal of downside pressure on many markets.

This phenomenon sometimes happens when people have multiple positions in multiple markets in the same direction. When they start to take profits, there is no one left to buy.

Read full article... Read full article...

Monday, November 15, 2010

Gold Tracking Euro as Ireland Refuses Bail-Out / Commodities / Gold and Silver 2010

By: Adrian_Ash

THE PRICE OF GOLD fell back towards Friday's 1-week low in Asian and London trade on Monday, holding above €1000per ounce for Euro investors as Irish bonds rallied but the single currency continued to drag along 7-week lows to the Dollar.US stock markets opened higher after their worst week in 3 months, as new data showed a surprise jump of1.2% in Retail Sales, plus a 0.9% rise in Business Inventories.

Read full article... Read full article...

Monday, November 15, 2010

Protect Your Gold From the Government, Simple Asset Protection Secrets from Switzerland / Commodities / Gold and Silver 2010

By: DailyWealth

Steve Sjuggerud writes:

As you read this, I'm in Zurich, Switzerland...

My publisher is hosting a seminar there for our lifetime subscribers. We're covering the best ideas in asset protection today.

From what I've seen, most Americans these days haven't even thought about protecting their assets.

Monday, November 15, 2010

How to Forecast and Profit From the Bursting of the Gold Bubble / Commodities / Gold and Silver 2010

By: Money_Morning

Amos Richards writes:

Gold last week careened to a record high $1,414.85 an ounce in a surge that was sparked by the U.S. Federal Reserve's plan to purchase $600 billion of U.S. Treasuries in a second phase of quantitative easing (QE2).

Amos Richards writes:

Gold last week careened to a record high $1,414.85 an ounce in a surge that was sparked by the U.S. Federal Reserve's plan to purchase $600 billion of U.S. Treasuries in a second phase of quantitative easing (QE2).

The yellow metal may have yet more room to run, as uncertainty in the marketplace remains high and the dollar low.

Read full article... Read full article...

Monday, November 15, 2010

MarketWatch Attempts to Explain "Why Gold is a Bad Investment" / Commodities / Gold and Silver 2010

By: Mike_Shedlock

Jonathan Burton at MarketWatch attempts to present a case Why gold is a bad investment.

Jonathan Burton at MarketWatch attempts to present a case Why gold is a bad investment.

Read full article... Read full article...Gold isn’t like a stock or a bond. It offers no income, no dividend, no earnings. It is considered a store of value, an alternative currency that’s safe beyond reproach, but it is not cash in the bank, or even the mattress. Gold has no untapped intrinsic value; it is worth only what people are willing to pay for it. And lately, many people have been only too willing.

Sunday, November 14, 2010

Why You Should Have Silver as well as Gold in Your Portfolio / Commodities / Gold and Silver 2010

By: Lorimer_Wilson

Jerry Western writes: Silver has had quite a run the last couple months so it’s no surprise that it has gained much attention and interest from investors – even more so than gold. It is extremely volatile, however, and tends to rise or fall in spurts so I’d like to focus on its attributes as compared to gold, make a case for holding some, and discuss some ultimate price possibilities.

Jerry Western writes: Silver has had quite a run the last couple months so it’s no surprise that it has gained much attention and interest from investors – even more so than gold. It is extremely volatile, however, and tends to rise or fall in spurts so I’d like to focus on its attributes as compared to gold, make a case for holding some, and discuss some ultimate price possibilities.

Sunday, November 14, 2010

Gold Price Worst Plunge Since February, Will it Do the Same Again? / Commodities / Gold and Silver 2010

By: Merv_Burak

Ouch! That was some decline on Friday, the worst single day decline since early Feb. The Feb decline ended the next day and gold took off for a $350 advance until this past week. Will it do the same again?

Ouch! That was some decline on Friday, the worst single day decline since early Feb. The Feb decline ended the next day and gold took off for a $350 advance until this past week. Will it do the same again?

Sunday, November 14, 2010

iShares Silver Trust (SLV) Growing at a Blistering Pace / Commodities / Gold and Silver 2010

By: Bob_Kirtley

We kick off with a quick look at the ‘weekly’ chart of iShares Silver Trust (SLV) which shows the sudden jump in the volume of shares traded last week largely attributable to the surprise changes to the rules governing the use of margin, which were introduced with immediate effect, causing investors to scramble to meet higher margin requirements.

Read full article... Read full article...

Saturday, November 13, 2010

Why Some Think a Gold Standard Wouldn’t Work / Commodities / Gold and Silver 2010

By: Richard_Daughty

There is a lot of wailing and gnashing of teeth from Moron Keynesian Trash (MKT) about the brave Robert Zoellick, president of the World Bank, saying that what the world needs is a modified gold standard for currencies, which it does, in spades.

There is a lot of wailing and gnashing of teeth from Moron Keynesian Trash (MKT) about the brave Robert Zoellick, president of the World Bank, saying that what the world needs is a modified gold standard for currencies, which it does, in spades.

The Financial Times, long a champion for Keynesian stupidity despite constant inflation in prices, had an editorial from one of these MKT, who opines, “Could a gold standard help international currency co-ordination? In theory it could, if the state were willing to accept the restrictions on national monetary policy and the currency account adjustments that a gold standard entails.”

Read full article... Read full article...

Saturday, November 13, 2010

Volume Signals Gold and U.S. Dollar Counter Trend Move / Commodities / Gold and Silver 2010

By: Jeb_Handwerger

Price action that comes after a major announcement reveals a lot about underlying economic trends and the psychology of the market. Leading up to the election investors became enthusiastic on precious metals and commodities as QE2 was celebrated. Then the official announcement of QE2 caused the precious metals to gap higher as euphoria of the Fed's move were celebrated. As the celebration continued for gold bugs, as hard as it was, I believed was time to fight the investment herd and take profits. I warned readers that a healthy correction could begin and do not buy the recent breakout. Key high volume reversal days and negative divergences indicated there could be 15-20% correction and a countertrend rally in the dollar.

Price action that comes after a major announcement reveals a lot about underlying economic trends and the psychology of the market. Leading up to the election investors became enthusiastic on precious metals and commodities as QE2 was celebrated. Then the official announcement of QE2 caused the precious metals to gap higher as euphoria of the Fed's move were celebrated. As the celebration continued for gold bugs, as hard as it was, I believed was time to fight the investment herd and take profits. I warned readers that a healthy correction could begin and do not buy the recent breakout. Key high volume reversal days and negative divergences indicated there could be 15-20% correction and a countertrend rally in the dollar.

Friday, November 12, 2010

Trading Gold Options with Long-term Calendar Spreads / Commodities / Gold and Silver 2010

By: J_W_Jones

At this point anyone following financial markets realizes that current market conditions are directly impacted by the movement of the U.S. dollar. Recently the dollar has shown strength and could potentially be putting in an intermediate or potentially longer term bottom. At this point it is a fool’s game making predictions, but the current Dollar Index daily chart shows that the price is above the 20 day simple moving average which is generally a bullish signal. The daily chart of the Dollar Index (.DXY) can be seen below.

At this point anyone following financial markets realizes that current market conditions are directly impacted by the movement of the U.S. dollar. Recently the dollar has shown strength and could potentially be putting in an intermediate or potentially longer term bottom. At this point it is a fool’s game making predictions, but the current Dollar Index daily chart shows that the price is above the 20 day simple moving average which is generally a bullish signal. The daily chart of the Dollar Index (.DXY) can be seen below.

Friday, November 12, 2010

Silver Consolidation and Monetary Reforms Give Gold Seal of Approval / Commodities / Gold and Silver 2010

By: Przemyslaw_Radomski

Now it’s official! The yellow metal has gotten the golden seal of approval. This week none other than the President of the World Bank said leading economies should consider readopting a modified global gold standard to guide currency movements. Writing in the Financial Times, Robert Zoellick, the bank’s president since 2007, says we need a successor to what he calls the “Bretton Woods II” system of floating currencies.

Now it’s official! The yellow metal has gotten the golden seal of approval. This week none other than the President of the World Bank said leading economies should consider readopting a modified global gold standard to guide currency movements. Writing in the Financial Times, Robert Zoellick, the bank’s president since 2007, says we need a successor to what he calls the “Bretton Woods II” system of floating currencies.

Friday, November 12, 2010

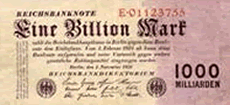

Can Gold Do Now What The Rentenmark Did For Germany In 1923? / Commodities / Gold and Silver 2010

By: Julian_DW_Phillips

What was a "Rentenmark"?

What was a "Rentenmark"?

At the left you see a one billion Mark note that was among the last printed notes of the Weimar Republic which saw the dreadful hyperinflation from the war's end to August 1923. At the right was a currency that replaced it and which helped terminate the hyperinflation that infested Europe, but was at its worst in Germany.

Read full article... Read full article...

Friday, November 12, 2010

Silver Extremely Overbought, Tops Analysis / Commodities / Gold and Silver 2010

By: Zeal_LLC

Since emerging out of the usual summer doldrums, silver’s performance has been dazzling. Buyers are returning to this hyper-speculative metal en masse, driving some fast-and-furious gains. And the Fed poured rocket fuel on silver’s hot rally last week when it announced its newest inflationary campaign.

Since emerging out of the usual summer doldrums, silver’s performance has been dazzling. Buyers are returning to this hyper-speculative metal en masse, driving some fast-and-furious gains. And the Fed poured rocket fuel on silver’s hot rally last week when it announced its newest inflationary campaign.

The broad commodities rally the Fed sparked helped catapult silver up a massive 11.4% in just 3 trading days! This amazing surge capped a total run of 58.3% in the several months since silver’s summer lows. It’s been a lot of fun watching some life return to this long-neglected metal, and we’ve enjoyed some big realized gains in silver stocks thanks to this silver upleg.

Read full article... Read full article...

Friday, November 12, 2010

Gold and Silver Tumble as Dollar Rises on Irish Crisis / Commodities / Gold and Silver 2010

By: Adrian_Ash

THE PRICE OF GOLD gave back the last of this week's move to new Dollar and Sterling record-highs in London trade on Friday, but held nearly 1.8% stronger for Eurozone investors as the Irish debt crisis forced a joint statement from European leaders attending the G20 summit in Seoul.

THE PRICE OF GOLD gave back the last of this week's move to new Dollar and Sterling record-highs in London trade on Friday, but held nearly 1.8% stronger for Eurozone investors as the Irish debt crisis forced a joint statement from European leaders attending the G20 summit in Seoul.

US stock markets opened the day 0.5% lower – and broad commodity markets fell over 1.5% – as rumors spread of a possible tightening in Chinese interest rates following yesterday's stronger-than-expected consumer price inflation figures.

Friday, November 12, 2010

The Gold Standard Never Dies, Despite Bankster's Best Efforts to Kill it / Commodities / Gold and Silver 2010

By: LewRockwell

John Maynard Keynes thought he had pretty well killed gold as a monetary standard back in the 1930s. Governments of the world did their best to help him. It took longer than they thought. Gold in the money survived all the way to Nixon, and it was he who finally drove the stake in once and for all. That was supposed to be the end of it, and the beginning of the glorious new age of paper prosperity.

John Maynard Keynes thought he had pretty well killed gold as a monetary standard back in the 1930s. Governments of the world did their best to help him. It took longer than they thought. Gold in the money survived all the way to Nixon, and it was he who finally drove the stake in once and for all. That was supposed to be the end of it, and the beginning of the glorious new age of paper prosperity.

Friday, November 12, 2010

Gold Profit Opportunities and Threats from The Debt Bomb Exploding / Commodities / Gold and Silver 2010

By: DeepCaster_LLC

Here is the glaring hole in the United States Federal Reserve's approach to what it calls stimulus, and what history will one day categorize as fraud: You can't use your own debt to purchase more debt when you can't repay the original debt. The crime is compounded when you know you're never going to repay the debt. It amounts to treason to intentionally destroy the integrity of the nation's money."

Here is the glaring hole in the United States Federal Reserve's approach to what it calls stimulus, and what history will one day categorize as fraud: You can't use your own debt to purchase more debt when you can't repay the original debt. The crime is compounded when you know you're never going to repay the debt. It amounts to treason to intentionally destroy the integrity of the nation's money."

Thursday, November 11, 2010

When to Sell Gold / Commodities / Gold and Silver 2010

By: Casey_Research

Terry Coxon, Senior Editor, Casey Research writes: By now you have plenty of reason to congratulate yourself for having boarded the gold bandwagon. The early tickets are the cheap ones, and you've already had quite a ride. The best of the ride, I believe, is yet to come, and it should be very good indeed. It should be so much fun that your wallet may start to feel a bit giddy - which can be dangerous. So it would be wise to consider, now, how things will be and how they will feel when the current bull market in gold reaches its "end of days." Because it will end.

Terry Coxon, Senior Editor, Casey Research writes: By now you have plenty of reason to congratulate yourself for having boarded the gold bandwagon. The early tickets are the cheap ones, and you've already had quite a ride. The best of the ride, I believe, is yet to come, and it should be very good indeed. It should be so much fun that your wallet may start to feel a bit giddy - which can be dangerous. So it would be wise to consider, now, how things will be and how they will feel when the current bull market in gold reaches its "end of days." Because it will end.