Swiss Gold Referendum “Propaganda War” Begins

Commodities / Gold and Silver 2014 Oct 14, 2014 - 03:03 PM GMTBy: GoldCore

The referendum for the Swiss Gold Initiative is scheduled for November 30th and the propaganda war - between the Swiss National Bank (SNB) and the Swiss Parliament on one side and the Swiss People's Party (SVP) on the other - has begun and we expect it to escalate as the day draws nearer.

The referendum for the Swiss Gold Initiative is scheduled for November 30th and the propaganda war - between the Swiss National Bank (SNB) and the Swiss Parliament on one side and the Swiss People's Party (SVP) on the other - has begun and we expect it to escalate as the day draws nearer.

Swiss Gold Coin

The SNB, who oppose the initiative, has warned that a 'yes' vote would severely hamper the ability of the central bank to conduct its business. A proposal that the SNB should hold a fifth of its assets in gold and be prohibited from selling the precious metal in the future would severely restrict its ability to conduct monetary policy, Vice President, Jean-Pierre Danthine, told the Wall Street Journal.

The gold referendum was proposed by the SVP and backed by the necessary 100,000 signatures required the put an issue to referendum in Switzerland. The SVP is one of the largest political parties in Switzerland. The party is the largest party in the Swiss Federal Assembly, with 54 members of the National Council and 5 of the Council of States.

This indicates a degree of popular support for the measure and all eyes are on November 30th. If the referendum is passed, it would result in the following:

*the repatriation of Swiss gold reserves currently believed to be in the UK and Canada

*an increase in gold holdings of the SNB to reflect an allocation of 20% of total reserves (today gold accounts for 7.7% of total reserves)

*and a moratorium on the sale of Swiss gold reserves

The SNB opposes the repatriation issue on the somewhat flimsy grounds that in a dire national emergency foreign holdings could be sold quickly whereas domestic holdings may be tied up.

This appears to be disingenuous as many international buyers including the People’s Bank of China and other central banks would likely be willing to buy the Swiss gold reserves in loco Switzerland, and then repatriate or take delivery to their own country.

Many Swiss look with alarm at the recent German experience, when Germany attempted to have their sovereign gold repatriated from the U.S. Of the 300 tonnes requested it has, to date, received a mere 5 tonnes.

Speculation, even among more sober gold analysts, is that the central banks of the world no longer have the gold they claim to have. Some of the gold belonging to the people of the west appears to have been loaned, leased or indeed sold onto the market.

This may have been done in an attempt to suppress to gold price and maintain faith in the dollar, euro and other fiat currencies and indeed maintain faith in the fragile monetary and financial system.

Much of the physical bullion is now in the very strong hands of store of wealth buyers in India, China and Asia. Other strong hands who have been allocating to gold are Asian and other central banks including Russia’s central bank as stealth currency wars continue.

That central banks have likely been involved in manipulating the gold price was confirmed again recently by Alan Greenspan in his recent essay in Foreign Affairs on gold as an invaluable monetary asset where he wrote "[the western central banks] all agreed to an allocation arrangement of who would sell how much, and when..."

The requirement for the SNB to hold 20% of its reserves in gold is also opposed by the central bank on the basis of the jaded and disingenuous argument that gold does not pay interest and does not yield a dividend. Therefore, the stipends it regularly pays to the state and the cantons would have to be curtailed.

This overlooks the fact that with interest rates at record low levels near 0%, central banks are receiving very little yield on their dollar and foreign exchange reserves.

It also ignores the very purpose of holding gold. As we consistently emphasise, gold is a real tangible, safe haven asset that cannot be debased by politicians, bankers and central bankers.

In this time of continuing QE, it is more prudent than ever to hold a greater balance of gold as a hedge against fiat currencies being further devalued and from potential declines in stock, bond and property markets.

Indeed, as Bloomberg reported over the weekend, Mario Draghi has intimated that the ECB may disregard German objections and begin to expand its balance sheet and print euros in a last-ditch attempt to stave off deflation.

This, despite the fact that the same policies have been an abysmal failure in Japan and are not working in the U.S.

Indeed, the weak data out of Europe last week spurred Stanley Fischer, vice-chair of the Fed, to state that the European situation would have to factor into any decision to raise interest rates in the U.S.

This weak data and the apparently dovish tone of last weeks Fed statement had already had an adverse affect on the dollar - reversing a 12-week run-up - and equities in recent days- indicating, once again, that currencies are as volatile as gold and, in extremis, far less safe.

The reserve status of the dollar grows ever-more precarious as confirmed, yet again, over the weekend when Bloomberg reported that the governor of the central bank of China claimed that some countries were already using the yuan as a reserve currency, albeit informally.

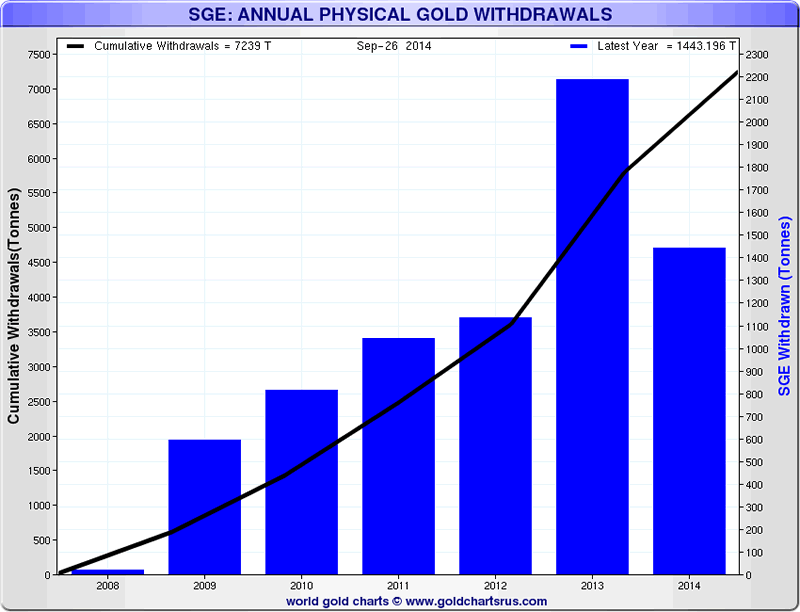

While on the subject of China it is worth noting that Chinese gold demand last year - previously regarded as voracious - was actually twice as high as had been estimated and is on track for over 2,000 tonnes again this year.

The previous estimate was based on flows of gold through Hong Kong. But Xu Luode from the Shanghai Gold Exchange confirmed what more astute gold analysts have been asserting in recent months, that other cities in China are now also importing large volumes of gold - far more than through Hong Kong alone.

Demand from the growing middle classes of China, India and the East continues to grow ever stronger. Clearly, China, India and Asia’s appetite for gold is far from sated.

Back in Switzerland, the SNB also objects to the third aspect of the Swiss Gold Initiative i.e. the moratorium on sales of Swiss gold. From their perspective it would encumber their ability to conduct business.

In a shameless display of attacking the man and not the ball and with tongue planted firmly in cheek, we would question the SNB's skill in conducting effective monetary policy at all - at least insofar as gold is concerned.

We would recall how, in 1999 - around the same time as Gordon Brown's infamous blunder, the SNB sold a whopping 50% of the gold belonging to the Swiss people at the very bottom of the market in what appears to have been an attempted coup de grace on the "barbarous relic."

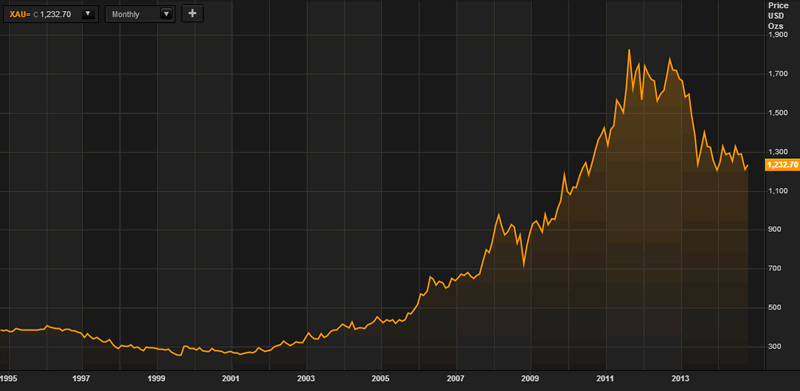

Gold in U.S. Dollars- 20 Years (Thomson Reuters)

Well fifteen years later and gold has risen from $250/oz in 1999 to over $1,230/oz or nearly 5 times, and gold is as valued as it has ever been, particularly by non western central banks and by the people of Asia.

The maxim that all fiat currencies eventually revert to their intrinsic value has generally been vindicated in monetary and economic environments such as we are now witnessing.

And if the mass of what has historically been regarded as a true store of wealth, gold bullion bars, are now sitting in vaults in the East - it suggests that we in the West could be in store for further currency devaluations and a further decline in our living standards.

With this in mind we hope the Swiss people display their fierce independence and reject the advice of the "experts," many of whom got us into this mess, in favour of the policies that have kept them peaceful and prosperous for centuries.

The referendum has the potential to become a lightning rod that leads to an increase in awareness about the importance of gold as a hedging instrument and a monetary, safe haven asset. It could also potentially lead to a marked increased in official or central bank gold demand and substantially higher gold prices.

Must Read Guide To Gold Storage In Switzerland

GOLDCORE MARKET UPDATE

Today’s AM fix was USD 1,233.00, EUR 974.55 and GBP 772.41 per ounce.

Yesterday’s AM fix was USD 1,228.00, EUR 969.14 and GBP 763.82 per ounce.

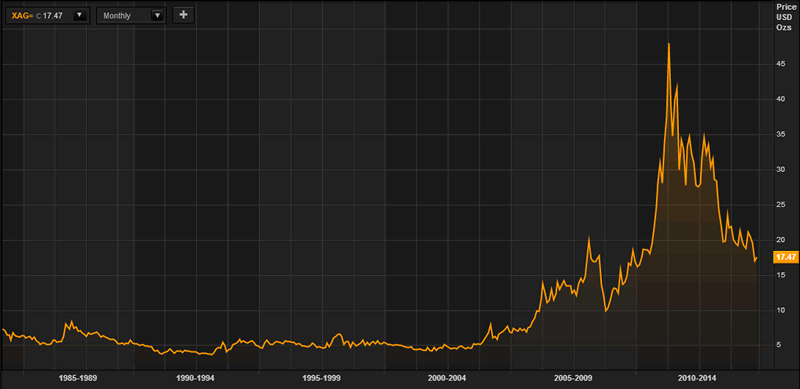

Gold climbed $9.00 or 0.74% to $1,232.70 per ounce and silver rose $0.10 or 0.58% to $17.45 per ounce yesterday.

Silver in U.S. Dollars - 1984 to October 14, 2014 (Thomson Reuters)

Gold in Singapore ticked marginally higher initially but then saw slight falls and it remains largely unchanged from yesterday's close in New York.

SPDR Gold Trust holdings, a gauge for investor demand, climbed 1.79 tonnes to 761.23 tonnes on Monday, making it the fund's first inflow since September 10th.

News of the latest delay in interest rate hikes from the Fed and concerns about the Eurozone and global economy has seen sharp sell offs in stock markets. This coupled with the dollar registering its worst day in a year, sent investors into safe haven gold bullion.

Must Read Guide To Gold Storage In Switzerland

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.