Still Bullish on Bonds, Don't Buy the Stock Market Yet

Interest-Rates / International Bond Market Oct 05, 2010 - 05:17 AM GMTBy: John_Mauldin

As readers know, I was in Europe a few weeks ago, making a LOT of presentations. My London-based partners seem to feel that an hour or two of down time is wasted and only for sissies. I learn as much as I impart, and come away with lots of interesting information. Every now and then I learn something that gets into the category of what in the wide, wide world of (multiple expletives deleted) economics is going on? Subprime was like that when I first read about it. Could you really design CDOs that were so patently absurd and then sell them to the Europeans and Asians? Turns out you could.

As readers know, I was in Europe a few weeks ago, making a LOT of presentations. My London-based partners seem to feel that an hour or two of down time is wasted and only for sissies. I learn as much as I impart, and come away with lots of interesting information. Every now and then I learn something that gets into the category of what in the wide, wide world of (multiple expletives deleted) economics is going on? Subprime was like that when I first read about it. Could you really design CDOs that were so patently absurd and then sell them to the Europeans and Asians? Turns out you could.

Last week, Niels Jensen (head of Absolute Return Partners) and I were talking with a variety of pension funds. They started telling us about this thing called Solvency II. Outside the arcane world of European pension funds and insurance companies, it is not on the radar screen of most people. But it may be one of the more explosive problems in our future. Cutting to the chase, the new rules require insurance companies and pension funds to buy more bonds to match their liabilities. But as yields go down they are required to buy yet MORE bonds and then yields go down some more. And so on. The possibility of serious defaults by these same pension funds in the wake of these new rules (setting aside whether it makes sense to actually require pension funds to set aside enough assets to pay their obligations) is all too real. And more pervasive than we now think.

Niels, in his latest Absolute Return Letter, wrote up what we learned, and it is Today's Outside the Box. Wonder why yields in Europe are falling? Read on.

One quote:

"I am not sure if policy makers understand how potentially dangerous this situation is. We are on the road to insolvency. And, even if pension providers manage to stay solvent, future generations of retirees are likely to run into serious financial difficulties as their retirement savings earn next to nothing, because our political leaders forced new rules on the industry, the implications of which they did not grasp."

(You can read more of his work at www.arpllp.com and look at the absolute return funds on their platform by writing to info@arpllp.com.

I know, I am just a bundle of fun. But this really is stuff we should be aware of. And tomorrow I am off to discuss this and more (with some serious play time thrown in) at the Barefoot Ranch Symposium. Enjoy your week!

Your ready for some R&R analyst,

John Mauldin, Editor

Outside the Box

Insolvency Too

The Absolute Return Letter

October 2010

"There are those who don't know and those who don't know they don't know." ~ John Kenneth Galbraith

On 1st January 2013, a new directive regulating insurance companies which conduct business within the EU will come into effect. It is called Solvency II and unless you work in the insurance or the pension industry the chances are that you will never have heard of it before. I suggest you do your home work as this is important stuff. The indications are that the directive has already had a meaningful impact on bond markets and there could be a lot more to come over the next 24 months.

Let's begin with a re-cap of our position on bonds, as that is very much part of the story. In the April 2010 Absolute Return Letter (see here) I argued the case for falling bond yields and concluded the following:

"All other things being equal, this puts a very effective lid on real rates and is one of the key reasons why I am gradually coming around to the realisation that long dated bonds could be one of the great surprises of the next few years."

Still bullish on bonds

The only thing I regret about that statement is that I wrote "years" instead of "months". Having said that, it hasn't exactly been plain sailing these past six months. A constant bombardment from investors and commentators, high and low, why bond yields can only go up, has forced me to re-visit my bullish view at fairly regular intervals but, at least until now, I have seen no convincing reason to change tack.

So what drives our bullish stance? A combination of structural and cyclical factors:

- Ageing baby boomers' rapidly growing appetite for income;

- Deflationary pressures driven by private sector de-leveraging;

- The global economic recovery losing momentum; and

- Central banks' use of quantitative easing.

And, finally, the one that most investors ignore, and which is the focus of this month's Absolute Return Letter:

- Asset/Liability re-allocations driven by Solvency II.

At a critical juncture

Solvency II is at a critical juncture. The implementation is now just over two years away. Many insurers (and many of those pension funds which are impacted by the new rules) have already started preparing for life under Solvency II, but others are behind. Meanwhile, the European Union released a Green Paper only a couple of months ago, throwing a cat amongst the pigeons by re-opening the discussion whether Solvency II should also be applied to occupational pension schemes in countries such as the UK and the Netherlands. These schemes are currently outside the scope of Solvency II.

Why is all this important? Because the amounts of money that have already been shifted from equities to bonds are enormous, and there will be more to come if traditional pension schemes are subjected to the new rules as well.

Solvency II will govern capital adequacy standards in the European insurance and life insurance industry. It represents a complete overhaul of the existing rules (Solvency I), which date back to the 1970s. One of the pillars of the new directive is the introduction of a risk-based approach to reserving. Going forward, European insurers will have to be able to pass a 1-in-200 years' event stress test, which has been designed to give the industry enough cushion to withstand even the most severe of bear markets without being forced to sell out in the darkest hour. Risky asset classes such as equities, commodities and other alternative investments will be assigned much higher reserve requirements than less risky asset classes such as bonds.

Solvency II is not without its teething problems, though. One such problem relates to who is and who isn't subject to the new directive. The borderline between the European life insurance industry and pension industry is very blurred. In some countries (e.g. Denmark) pension funds are considered life insurance companies and regulated as such. In other countries (e.g. Germany) pension funds, the way we know them from the Anglo Saxon world, do not even exist, and pension products are provided by insurance companies. Then again, in countries such as the UK and the Netherlands, pension funds operate as a separate industry independently from the life insurance industry.

As already indicated, Solvency II will regulate the insurance industry but not the pension industry. European life insurers, who often compete with the pension industry for business, are obviously keen for pension funds to be part of the new rules. Pension funds, on the other hand, are desperate to stay outside. By one estimate1, should UK pension funds be forced into the Solvency II regime, liabilities will rise by a whopping 30%, caused by the lower discount rate which will be forced upon them under Solvency II. Not exactly good news for an industry that is already seriously underfunded. It is estimated that, should regulators decide to subject UK pension funds to Solvency II, UK companies (the plan sponsors) would have to cough up about £500 billion in order to meet the raised capital standards.

The Dutch are in trouble

In the Netherlands the situation is arguably even worse. Dutch pension funds are quite seriously underfunded (about 40% according to an article in the FT earlier this week2). Even the political leaders in the Netherlands have now woken up to this fact. Jan Pieter Donner, the Minister of Social Affairs, stated the other day that a pension reform can wait no longer. The retirement age must be increased and pensions must be adjustable, reflecting the economic cycle (i.e. you receive more in good times than in bad). There is even talk of allowing Dutch pension funds to bend the rules somewhat in order to carry them through the current crisis.

The Dutch problems appear to be somewhat self-inflicted, though. Pension funds can, and often do, hedge their interest rate exposure. In Denmark, for example, this ability has been the saving grace for many pension funds which would otherwise be in the same sort of trouble as the Dutch pension funds now find themselves in (more about how interest rates affect pension funds later).

Now, across Europe, insurers have been busy preparing for when the new rules come into effect. As you can see from chart 1 below, the average exposure to equities is already very low - around 7% according to Deutsche Bank. As Solvency II (unlike Solvency I) penalises the insurer if there is a duration mis-match between assets and liabilities, forced buying of bonds from the insurance sector may have been a major feature in the bond market rally of the past six months.

Chart 1: European Insurance Industry Asset Allocations:

Source: Deutsche Bank

Yield compression is rife

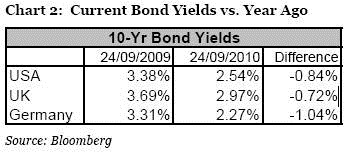

Obviously, interest rates have been impacted not only by Solvency II but by a host of other factors as well. It is noteworthy, though, that in Germany, where the impact of Solvency II has been more profound than in most other markets, the yield compression has been greatest (see chart2).

Insurance companies' low allocation to equities is in stark contrast to the average allocation to equities amongst European pension funds which stands at about 45% according to Goldman Sachs (see chart 3). This has several implications. For starters, you can understand why European insurers are desperate to have the pension fund industry brought into the Solvency II regime because, if they stay outside the new directive, pension funds may have a significant competitive advantage, assuming equities outperform bonds over the long term.

Chart 3: European Pension Fund Asset Allocations:

Source: Goldman Sachs

The political response

In terms of the political response to this quandary, one of three things may happen:

(i) The regulator may decide to subject the pension industry to the new rules as well. This could have massive implications for the relative performance between bonds and equities, as large amounts of capital would have to be re-allocated from equities to bonds across Europe.

(ii) The regulator may turn around and soften the directive to lower the impact on an already beleaguered insurance industry. The introduction of Solvency II has already been delayed once amid fears that a swift introduction would do too much harm to the industry. Any such change would be bullish for equities but could cause bond yields to rise - potentially significantly so.

(iii) The regulator may do nothing.

The prevailing view today seems to be that option (iii) is the most likely. I am not so sure. My moles are telling me that there is a lot of lobbying from both sides in the corridors of Brussels and that the ultimate outcome is impossible to predict. There is tremendous pressure on Brussels from the insurance industry to include the pension funds but, at the same time, there is also a growing realisation that low interest rates could do serious damage to the industry. Knowing how Brussels usually operates, a compromise whereby pension funds are forced in, but the rules are relaxed somewhat, is a possible outcome. It is difficult to predict how stocks and bonds would react to such a compromise, as it depends on how far the regulator is prepared to go in terms of making concessions to the pension fund industry.

Low bond yields are bad news

Going forward, the main issue facing the industry (and that is the same for insurers and pension funds) is the relentless drop in bond yields. As yields come down, so does the discount rate which is used to calculate future liabilities. A lower discount rate in turn leads to a falling solvency ratio3. In the first half of this year alone, solvency fell by 13% on average as a result of falling bond yields4. With Solvency II only two years away, a deeply worrisome situation is developing whereby low inflation forces bond yields down which again forces insurers and at least some pension funds to re-balance their portfolios in favour of more bonds and fewer equities, which will push bond yields even lower. This self-perpetuating mechanism amplifies an already unstable situation.

I am not sure if policy makers understand how potentially dangerous this situation is. We are on the road to insolvency. And, even if pension providers manage to stay solvent, future generations of retirees are likely to run into serious financial difficulties as their retirement savings earn next to nothing, because our political leaders forced new rules on the industry, the implications of which they did not grasp.

Ageing related liabilities are a monster we have to deal with for many years to come (see chart 4).

Demonstrating a lack of responsibility which defies belief, policy makers continue to more or less ignore the problem. Meanwhile, many countries are getting sucked into a deflationary spiral which only makes the problem worse - in fact much worse. Adding to that the likelihood of life expectancies continuing to be extended (a one year extension translates into an increase in pension liabilities of approximately 5%), and countries across the OECD are left with a real shocker of a problem.

Chart 4: Cost of Ageing Dwarfs Current Debt Problems (% of GDP)

Source: Morgan Stanley

Entire countries may have to (read: will) default on their pension obligations either overtly or covertly. A few countries have already started to adapt to the new reality by delaying the retirement age by a year or two; however, in order to solve a problem of this magnitude, we need a work force that is prepared to work until the age of 75. Expect some hard-fought battles in the streets of Paris, Madrid and Athens!

The casino solution

Interestingly, there is a solution. Solvency II does not require for insurance companies to hold any capital against EEA5 government bonds. As pointed out by Deutsche Bank in a recent research paper6, this looks an extraordinarily brave decision by the regulator, considering recent developments in peripheral Europe. But rules are rules. If you can see your pension fund sinking like the Titanic, but you know you have a good shot at saving the ship, if only you fill up the portfolio with high yielding government bonds, it must be very tempting to stuff your portfolio with Greek (10-year currently yielding 10.7%), Irish (6.6%), Portuguese (6.4%) and Spanish (4.1%) government bonds. It is one heck of a gamble but, then again, desperate people do desperate things.

At least one Spanish pension fund is already into this game. The €64 billion state pension fund, Fondo de Reserva, recently revealed that they expect to have 90% of their assets tied up in Spanish government bonds by the end of this year, up from about 50% in 20077. Expect this sort of behaviour to spread. It is a gamble many pension providers will be prepared to take, as the alternative is not that exhilarating either. Let's just hope for the sake of millions of Spanish workers that the pension fund knows what it is doing. Unfortunately, Murphy's Law has an unpleasant habit of popping up at the most inconvenient of times.

Conclusions

So what are my conclusions? For all the reasons above, I continue to be bullish on bonds. Remember what I said earlier this year about inflation being difficult to engineer when you need it the most? Unfortunately, this is truer than ever. We could really do with a bit of inflation and the higher bond yields which would probably follow (it would fix an awful lot of problems in the pension industry), but it is when you need it the most that it is least likely to happen.

Another question altogether is, where does this leave equities? I believe it will ultimately be the bond market that holds the answer to when it is time to buy the stock market aggressively again. Long term readers of this letter will know that I have argued for over 6 years now that we are stuck in a secular bear market (i.e. a market characterised by falling P/E ratios). This doesn't mean you can't make money in stocks. Plenty of people do every day. But you need to be selective.

Don't buy the market yet.

It is still premature. Invest with active managers capable of delivering alpha. The time to buy the market again will probably be when the bond bull finally decides to call it a day. There is only one caveat. Interest rates must go up for the right reasons, but that is a story for another day.

Niels C. Jensen © 2002-2010 Absolute Return Partners LLP. All rights reserved.

2 “Dutch not facing up to pension troubles”, Financial Times, 27th September, 2010. 3 The solvency ratio is the current value of all assets in the pension fund divided by the net present value of future pension liabilities. When the discount rate is lowered, the net present value of future liabilities rises, leading to a lower solvency ratio.

4 Goldman Sachs Fixed Income Monthly, September 2010.

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.