Danger, Will Robinson, Stock Market Crash Dead Ahead!

Stock-Markets / Stock Market Crash Oct 17, 2016 - 06:27 AM GMTBy: Brad_Gudgeon

When I mean crash, I mean about an 11-14% stock market panic in a few days. The astro is there, the e-wave is there and so are the cycles and chart formation (plus some technical information like the MACD daily below the zero line).

When I mean crash, I mean about an 11-14% stock market panic in a few days. The astro is there, the e-wave is there and so are the cycles and chart formation (plus some technical information like the MACD daily below the zero line).

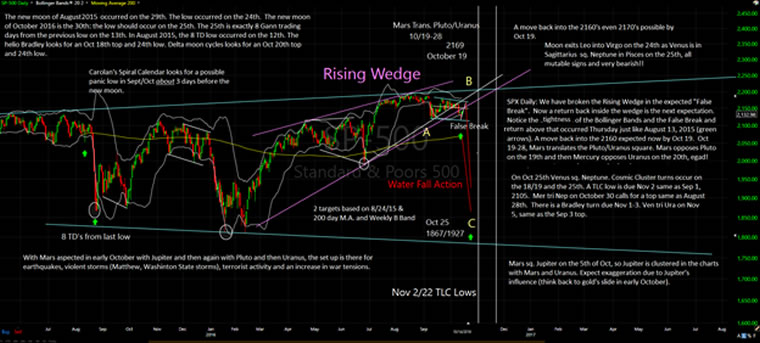

I’ve been talking about a Rising Wedge building for a while now. I also talked about the expected False Break, which we just had on Thursday when the S&P 500 went down to the 2114 level and then bounced. It pierced the bottom of the daily Bollinger Bands and closed back above them. Now we must go back into the wedge itself before turning back down in expected waterfall action in the coming waning days of October. The SPX will likely be up nicely on Tuesday with some follow through into Wednesday in most indexes. I look for either a bearish evening star pattern or bearish Harami to form on the 19th.

The e-wave formation is completing a bearish “B Wave” flag before “Wave C “, the devastating bear wave arrives. Astro-wise we have Mars translating the Uranus/Pluto Square October 19-28, with Jupiter square Mars still in the mix from October 5th. To add to the mix, Mercury opposes Uranus on the 20th bringing back the power of the Sun translation to the Uranus/Pluto square October 7-15. Quite a mix!

To add to that, we have the Autumn new moon of October 30th, which in the past, has lead to a possible panic low around 3 trading days before the new moon (October 25). The moon turns from Leo to Virgo on the 24th as Venus in Sagittarius squares Uranus in Pisces on the 25th! All these mutable signs in square and opposition and WOW, watch out! The 24th to the 25th look interesting!

The Lunar Delta factor sees a top on the 20th and low on the 24th. The Helio Bradley looks for turns on the 18th and then 24th. We have cosmic tension on the 18/19 and then 25th. Negative days of the sun in Scorpio occur October 24-26th. For the moon as mentioned late Leo into early Virgo (24/25th).

The similarities to the August 18-24, 2015 panic and the expected October 19-25 panic are quite striking. August 29th was the new moon, 5 calendar days after the panic. The new moon this time is October 30th! Cycle wise, the next 8 TD low is due October 25 and combines with the larger 9 month cycle low from January 20, 2016.

The August 2015 rout was caused by the Chinese stock market and currency devaluation. Because Mars is involved, this one may be initiated by either a terrorist attack or war tensions. Damaging storms and earthquakes are also possible (Matthew and the Pacific Northwest).

In August 2015, gold had just finished a multi month drop. Recently, we see gold has plunged from a July top. If all things remain the same, we may see an attempted rally after Monday this week into the time of the expected stock market bottom. GDX may stall out early on the 24th and drop hard into the 27th.

If I’m right about this plunge, there is a lot of money that can be made on this kind of drop. There are volatility ETF’s and put options on stock indexes, which may very well make a ton of money come October 25th! We’ll see!

We now offer free auto trading. BluStar subscribers now have access to free auto trading via Auto Shares.

We are now offering a 2 for 1 sale on our volatility and option packages. Offer ends October 21, 2016.

Another thing I wish to mention: please don’t trade this or any other forecast verbatim without getting proper updates from the author. Tracking the stock market is much like tracking the weather: you need to have regular updates. Things can and do change. With the changes, come strategy changes.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com.

Copyright 2016, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.