Category: Stock Markets 2019

The analysis published under this category are as follows.Sunday, February 24, 2019

$SPY Stock Market Index Heading for All-Time High / Stock-Markets / Stock Markets 2019

By: ElliottWaveForecast

The ETF is rallying from the blue box after forming the low on 12.26.2018, Blue box is an area where buyers and sellers agree in the next direction. We have developed a system in which we present the boxes to members on our charts and combine it with the right side to enter the market. The decline in $SPY from all-time high is in a classic ABC which is a set of 2 cycles. Each cycle has a subdivision of 5 waves and it’s commonly called zigzag Elliott Wave structure.

After ending the zigzag, the ETF has reacted higher in what looks like an impulse. The Elliott Wave Theory describes an Impulse as a sequence of 5-3-5-3-5. The Impulse main rules are :

Read full article... Read full article...

Sunday, February 24, 2019

Trade Talks Drive Stock Market / Stock-Markets / Stock Markets 2019

By: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend – Long-term trend resuming?

Intermediate trend – Initial rally is likely coming to an end.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Sunday, February 24, 2019

Stock Market Up 9 Weeks in a Row. What’s Next / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

The Dow and NASDAQ are up 9 weeks in a row when you compare this week’s CLOSE to the previous week’s CLOSE, while the S&P is up 9 weeks in a row when you compare this week’s CLOSE to this week’s OPEN.

The Dow and NASDAQ are up 9 weeks in a row when you compare this week’s CLOSE to the previous week’s CLOSE, while the S&P is up 9 weeks in a row when you compare this week’s CLOSE to this week’s OPEN.

The most likely path forward is a short term pullback, with more gains ahead for 2019. Above all else, remember that the short term is extremely hard to predict, no matter how much conviction you have in it.

Read full article... Read full article...

Friday, February 22, 2019

Stock Traders Must Be Cautious Part III / Stock-Markets / Stock Markets 2019

By: Chris_Vermeulen

Welcome back, If you’ve missed any part of this multi-part research post, please visit www.TheTechnicalTraders.com/FreeResearch/ to review and read our previous posts. This, Part III, of our multi-part research post where we are attempting to rationalize the continued bearish analysis of some other analysts as well as review some key data that may support our interpretation that the global markets are transitioning through a “revaluation phase” right now – headed for a breakout rally eventually will continue with more detailed information. Our premise is that global investors and traders should stay cautiously optimistic at the moment and prepare for some volatility as this “revaluation phase” continues to play out. Our overall analysis suggests that the US Federal Reserve and global central banks have “primes the cylinders” of the global economic engine sufficiently and that a spark is all that is needed to see massive new valuation and GDP increases within the next 10~20+ years.

Welcome back, If you’ve missed any part of this multi-part research post, please visit www.TheTechnicalTraders.com/FreeResearch/ to review and read our previous posts. This, Part III, of our multi-part research post where we are attempting to rationalize the continued bearish analysis of some other analysts as well as review some key data that may support our interpretation that the global markets are transitioning through a “revaluation phase” right now – headed for a breakout rally eventually will continue with more detailed information. Our premise is that global investors and traders should stay cautiously optimistic at the moment and prepare for some volatility as this “revaluation phase” continues to play out. Our overall analysis suggests that the US Federal Reserve and global central banks have “primes the cylinders” of the global economic engine sufficiently and that a spark is all that is needed to see massive new valuation and GDP increases within the next 10~20+ years.

Friday, February 22, 2019

Stock Traders Must Stay Optimistically Cautious II / Stock-Markets / Stock Markets 2019

By: Chris_Vermeulen

This Part II of our research post regarding the future potential of any very deep market correction and/or a potential new-age market rally based on our presumption that the global market dynamics have changed dramatically over the past 20+ years. Are the market gurus correct in thinking the next big move will be to the downside? Or are they missing key aspects of the global market dynamics that point to a massive upside rally that is setting up for the future. Today, we continue to explore some of the key elements that we believe present a total scope of the potential for the global markets.

This Part II of our research post regarding the future potential of any very deep market correction and/or a potential new-age market rally based on our presumption that the global market dynamics have changed dramatically over the past 20+ years. Are the market gurus correct in thinking the next big move will be to the downside? Or are they missing key aspects of the global market dynamics that point to a massive upside rally that is setting up for the future. Today, we continue to explore some of the key elements that we believe present a total scope of the potential for the global markets.

In Part I of this article, we highlighted how globalization changed the planet and increased inter-dependence across the globe for economies and governments. The point we wanted to make from the first segment was to highlight the fact that the current world economies are vastly different than the global economy prior to 1980 or 1970. Over the past 20+ years, the world’s economies have become more and more connected and interdependent on one another. Additionally, global investors and financial institutions have become heavily interconnected and reliant on the global market economies of the world. The reality is, the world is vastly different than it was 40+ years ago in terms of finance, banking, and investment objectives.

Read full article... Read full article...

Thursday, February 21, 2019

Stocks Closer to Medium-Term Resistance Level / Stock-Markets / Stock Markets 2019

By: Paul_Rejczak

Wednesday's trading session was virtually flat, as investors hesitated following the recent run-up. Will the broad stock market continue higher despite some clear short-term technical overbought conditions?

Wednesday's trading session was virtually flat, as investors hesitated following the recent run-up. Will the broad stock market continue higher despite some clear short-term technical overbought conditions?

The U.S. stock market indexes were mixed between 0.0% and +0.2% on Wednesday, as investors sentiment remained bullish despite some clear short-term technical overbought conditions. The S&P 500 index retraced more of its October-December downward correction of 20.2% (2,713.88) recently. It got closer to the previous local highs along the 2,800 level. The Dow Jones Industrial Average gained 0.2% and the Nasdaq Composite was unchanged on Wednesday.

The nearest important resistance level of the S&P 500 index remains at around 2,785-2,800, marked by the previous medium-term local highs. On the other hand, the support level is at around 2,760, marked by the Friday's daily gap up of 2,757.90-2,760.24. The support level is also at 2,720, marked by the last Tuesday's daily gap up of 2,718.05-2,722.61.

Read full article... Read full article...

Thursday, February 21, 2019

The Stock Market’s Momentum is Extremely Strong. What’s Next for Stocks / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

The S&P 500’s nonstop rally continues, and is nearing several resistances at the 2800-2813 level. Meanwhile, the stock market is overbought for the first time in a long time.

Read full article... Read full article...

Wednesday, February 20, 2019

So Many Things are Not Confirming Stock Market Rally / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

A  lot of things are not “confirming” the stock market’s rally right now.

lot of things are not “confirming” the stock market’s rally right now.

Standard traders look for “non-confirmations” in the market. They typically plot a fundamental/technical indicator ontop of the S&P 500, demonstrate how the 2 lines have mostly had a strong correlation over the past 2 years, and then demonstrate how the S&P has “diverged” from the indicator recently and how the indicator is not “confirming” the stock market’s rally.

Then, they come to the conclusion that the stock market is going to reverse because “DIVERGENCE!”

In reality, most divergences don’t amount to anything and are not much better than a 50/50 coin toss. These correlations are optical illusions, and work until they don’t.

Read full article... Read full article...

Tuesday, February 19, 2019

Wall Street is Chasing Ghosts / Stock-Markets / Stock Markets 2019

By: Michael_Pento

Wall Street’s absolute obsession with the soon to be announced most wonderful trade deal with China is mind-boggling. The cheerleaders that haunt main stream financial media don’t even care what kind of deal gets done. They don’t care if it hurts the already faltering condition of China’s economy or even if it does little to improve the chronically massive US trade deficits—just as long as both sides can spin it as a victory and return to the status quo all will be fine.

But let’s look at some facts that contradict this assumption. The problems with China are structural and have very little if anything to do with a trade war. To prove this let’s first look at the main stock market in China called the Shanghai Composite Index. This index peaked at over 5,100 in the summer of 2015. It began last year at 3,550. But today is trading at just 2,720. From its peak in 2015 to the day the trade war began on July 6th of 2018, the index fell by 47%. Therefore, it is silly to blame China’s issues on trade alone. The real issue with China is debt. In 2007 its debt was $7 trillion, and it has skyrocketed to $40 trillion today. It is the most unbalanced and unproductive pile of debt dung the world has ever seen, and it was built in record time by an edict from the communist state.

Read full article... Read full article...

Tuesday, February 19, 2019

Why Stock Traders Must Stay Optimistically Cautious Going Forward / Stock-Markets / Stock Markets 2019

By: Chris_Vermeulen

The one interesting facet of the various research posts our team continues to digest is the continued bearish sentiment that exudes from some analysts. It appears these technical gurus have become married to the concept that global economic issues will crash the US stock market in the near future. We have to give them some credit though. We wanted to take a few minutes of your time to try to highlight how and why we believe these technical gurus are making these points so clearly now and why we believe there are multiple catalysts that they are simply failing to comprehend.

The one interesting facet of the various research posts our team continues to digest is the continued bearish sentiment that exudes from some analysts. It appears these technical gurus have become married to the concept that global economic issues will crash the US stock market in the near future. We have to give them some credit though. We wanted to take a few minutes of your time to try to highlight how and why we believe these technical gurus are making these points so clearly now and why we believe there are multiple catalysts that they are simply failing to comprehend.

Our team of researchers continues to learn from other skilled researchers, clients, and technicians. Every time we read some news item or someone’s research post, we don’t take the research with a pretense that “these researchers are wrong in their conclusions”. We start off with the pretense that “maybe these people are highlighting something we missed – let’s investigate it”. Thus, our quest is never-ending in the search for greater knowledge and practical application of price theory and technical analysis.

Read full article... Read full article...

Monday, February 18, 2019

Get ready for the Stock Market Breakout Pattern Setup II / Stock-Markets / Stock Markets 2019

By: Chris_Vermeulen

Get ready for one of the most complicated price pattern setups we’ve seen in 4~5 years. Within this multi-part article, we’re highlighting many aspects of our predictive modeling solutions, as well as some very clear patterns that we believe, are tell-all investors to prepare for the next big move. This is the second part of our research, please take a minute to read PART I of this article.

Get ready for one of the most complicated price pattern setups we’ve seen in 4~5 years. Within this multi-part article, we’re highlighting many aspects of our predictive modeling solutions, as well as some very clear patterns that we believe, are tell-all investors to prepare for the next big move. This is the second part of our research, please take a minute to read PART I of this article.

Now for the fun part, lots of charts and a few new predictions…

Recently, the YM (the Dow Futures Contracts) have begun an upside price breakout that we believe is setting up for an incredible price pattern. We’ve been suggesting that capital will focus on certain sectors over the past few months (Finance, Technology, Blue-Chips, and Mid-Caps). We believe the safety provided by these US stocks have become a critical component for many global investors. Thus, we believe the YM, Transports, and sector analysis are critical for skilled traders.

Read full article... Read full article...

Monday, February 18, 2019

It's Blue Skies For The Stock Market As Far As The Eye Can See / Stock-Markets / Stock Markets 2019

By: Avi_Gilburt

We have all heard it. Many times through history, the hubris of analysts, economists, and market participants has been on display when markets rally extremely strongly. In fact, such hubris often accompanies major market tops. And, history has taught us that most of them are quite severely near sighted.

We have all heard it. Many times through history, the hubris of analysts, economists, and market participants has been on display when markets rally extremely strongly. In fact, such hubris often accompanies major market tops. And, history has taught us that most of them are quite severely near sighted.

Allow me to show you some examples.

Read full article... Read full article...

Monday, February 18, 2019

Stock Market Correction is Due / Stock-Markets / Stock Markets 2019

By: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend – Long-term trend resuming?

Intermediate trend – Initial rally is coming to an end.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Sunday, February 17, 2019

Dow Jones Gann Angle Update / Stock-Markets / Stock Markets 2019

By: readtheticker

Let's review the Dow Jones Industrial Gann Angles and its secret sauce dominate cycle.

Dow Jones hit upper resistance Gann angle early 2019, a sell of followed, now the bounce works its way through the down ward Gann Angle, a fail at either make or break point will see the bounce sell off, and that may get very interesting!

Sunday, February 17, 2019

Here We Go – Get ready for the Stock Market Breakout Pattern Setup / Stock-Markets / Stock Markets 2019

By: Chris_Vermeulen

We are writing this post today with a few forward-looking expectations while attempting to warn traders that some extended rotation is likely to enter the markets over the next 30+ days. If you’ve been following our research, you’ll know that we’ve been calling these move months in advance of other researchers and analysts. Our September 17, 2018 research post highlighting our Adaptive Dynamic Learning predictive modeling system suggested the US stock markets were poised for a massive price rotation followed by a very unique price setup that we are experiencing now.

Read full article... Read full article...

Saturday, February 16, 2019

After 8 Terrific Weeks for Stocks, What’s Next? / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

It’s been a terrific 8 weeks for the stock market. If anything, this proves that in the stock market, an objective investor/trader needs to have a long term bullish bias.

Read full article... Read full article...

Saturday, February 16, 2019

What Could Happen When the Stock Markets Correct Next / Stock-Markets / Stock Markets 2019

By: Harry_Dent

I hate to be so cynical, but the markets love to fool as many people as possible, bulls and bears alike. This is especially true at key turning points and even more so in extreme bubbles like the one we’ve been in since late 1994, with this final phase – and it’s unprecedented QE and tax cuts – since early 2009.

I hate to be so cynical, but the markets love to fool as many people as possible, bulls and bears alike. This is especially true at key turning points and even more so in extreme bubbles like the one we’ve been in since late 1994, with this final phase – and it’s unprecedented QE and tax cuts – since early 2009.This final rally (since 2009) is all “hot air.”

This recovery has been the weakest ever in real GDP, capital spending, employment growth, and productivity (I’ll talk about this in more detail in the upcoming February edition of The Leading Edge).

Read full article... Read full article...

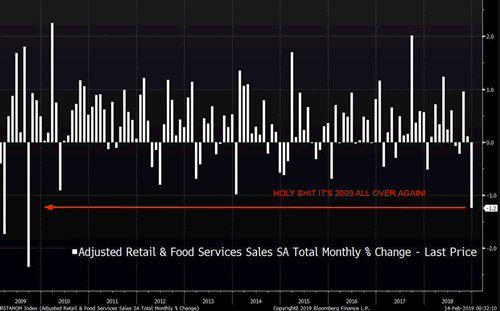

Friday, February 15, 2019

Retail Sales Crash! It’s 2008 All Over Again for Stock Market and Economy! / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

On a slow moving day for the U.S. stock market, today’s big news is that “Retail Sales crashed, just like in 2008/2009!!!”. Financial media jumped all over this – nothing sells like bad news.

On a slow moving day for the U.S. stock market, today’s big news is that “Retail Sales crashed, just like in 2008/2009!!!”. Financial media jumped all over this – nothing sells like bad news.

Friday, February 15, 2019

2019 Starting to Shine But is it a Long Con for Stock Investors? / Stock-Markets / Stock Markets 2019

By: Chris_Vermeulen

An odd thing happened at the beginning of 2019 for the markets – price levels across almost all sectors were deeply depressed as a result of the October through December 2018 price correction. We’re noticing that almost all sectors of the SP500 were relatively deeply depressed just before Christmas 2018 and the recent price rally has set up an interesting psychological phenomenon – a self-propelling bullish mantra for US Stocks.

An odd thing happened at the beginning of 2019 for the markets – price levels across almost all sectors were deeply depressed as a result of the October through December 2018 price correction. We’re noticing that almost all sectors of the SP500 were relatively deeply depressed just before Christmas 2018 and the recent price rally has set up an interesting psychological phenomenon – a self-propelling bullish mantra for US Stocks.

Yes, 2018 ended with a drop – almost a CRASH. Yet, 2019 is starting off on a terror rally that is beginning to lay the grounds for a very dramatic Q1 and possibly Q2 recovery for many in the managed and passive funds. Remember the news in early January 2019? Hedge funds losing 12~22% or more for the 2018 end of year returns? Remember the feeling that these firms just couldn’t find any means of success when almost the entire 2018 year was mired in deep price rotations and sideways trading?

Read full article... Read full article...

Thursday, February 14, 2019

Will Stock Market 2019 be like 1999? / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

As the stock market pushes higher, the year “1998” keeps popping up in our market studies recently. 1998 saw a rapid stock market crash, a retest (something we have yet to see today), followed by a massive nonstop rally. Everyone at the time thought that the 1998 crash was the start of a much bigger crash. To their surprise, the bull market (already late-cycle) surged for another 1.5 years before topping.

As the stock market pushes higher, the year “1998” keeps popping up in our market studies recently. 1998 saw a rapid stock market crash, a retest (something we have yet to see today), followed by a massive nonstop rally. Everyone at the time thought that the 1998 crash was the start of a much bigger crash. To their surprise, the bull market (already late-cycle) surged for another 1.5 years before topping.

There is indeed the possibility that today is similar to 1998. There are fundamental and technical parallels.

Read full article... Read full article...