Category: Gold & Silver

The analysis published under this category are as follows.Sunday, June 03, 2007

Gold and Silver Analysis - Precious Points: Why This Rebound Looks Real / Commodities / Gold & Silver

By: Dominick

Joe Nicholson writes : “With the market all but giving up on rate cut relief this week, the proliferation of leveraged buyouts and junk bond issuance, and the steady surge in bank loans and global liquidity, give every indication that real interest rates might be too low.” ~ Precious Points: No Lack of Support , May 27, 2007

Weeks ago this update said that what gold needs to get back its shine is a rebound in the U.S. economy. As you know, this is exactly what recent data has suggested, and the metals have acted accordingly. The focus for some time here has been on the Fed's open market activity, and specifically the “sloshing” repo funds. After breaking the streak of reverses two weeks ago with a modest $3 billion net addition, last week concluded with a net add of $6.75 billion. In a rate-targeting regime, this reflects perception of a stronger economy driving demand for more base money, and the overall liquidity is an ideal environment for appreciation of precious metal.

Read full article... Read full article...

Sunday, June 03, 2007

Weekly Gold and Silver Technical Analysis Report - 3rd June 2007 - Technically Precious with Merv / Commodities / Gold & Silver

By: Merv_Burak

A bounce off the long term moving average line and it looks like more smiles ahead. What could go wrong? We'll soon know if anything.

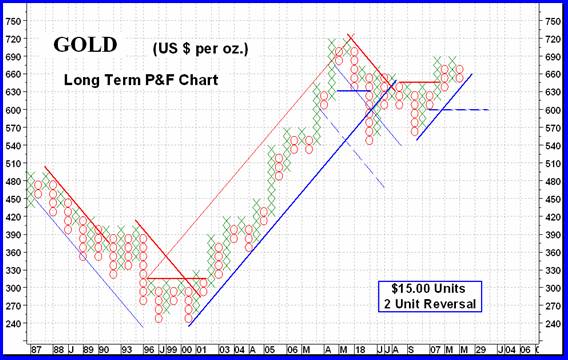

GOLD: LONG TERM

Saturday, June 02, 2007

Silver: The Long Term View / Commodities / Gold & Silver

By: Roland_Watson

Back in the depression year of 1932 silver was suffering. It had hit a low price of 24 cents per troy ounce as the forces of deflation assaulted commodities across the board. Could things get any worse as no end seemed in sight to the widespread massacre of assets across America and the world?

As it turned out, this was the nadir year for silver as prices began an upturn that led to a zenith as yet unparalleled. Between 1932 and 1980 silver advanced from 24 cents to 50 dollars an ounce. That is a 200-fold increase over 48 years!

Read full article... Read full article...

Thursday, May 31, 2007

Silver has Turned the Corner with the Resumption of the Bull Market / Commodities / Gold & Silver

By: Peter_Degraaf

The fundamental outlook for silver continues to be extremely bullish!

In 2003 I remember reading an article by Douglas Kanarowski titled: “ 70 Approaching Forces for Higher Silver prices ”. If Mr. Kanarowski were to re-write the article today, he could add several more reasons! [*]

Silver is being utilized more and more in nanotechnology applications. According to a recent report from NanoMarkets, a leading industry analyst firm based in California, the market for silver conductive inks is expected to rise from the current 176 million dollars per annum to 1.2 billion dollars during next 7 years. A seven-fold increase!

Read full article... Read full article...

Thursday, May 31, 2007

Gold $666 Closes at Fourth Best Month Ever and Rising? / Commodities / Gold & Silver

By: Adrian_Ash

"...Gold just closed out its fourth best month ever. Its monetary opponents, meantime, continue scrapping over which currency can sink the lowest, the fastest..."

OIL DOWN, gold up – and still the mass of investors, led by Wall Street, can't figure out what's driving this six-year bull market in bullion.

Read full article... Read full article...

Thursday, May 31, 2007

Uranium Targets $150 whilst Gold Investors Worry / Commodities / Gold & Silver

By: David_Vaughn

I know this subject probably gets boring to hear about, but it is still at the top of the charts so it deserves coverage.

We are talking about uranium of course. But what about gold? Everyone is panicking over gold and I can tell by the emails I receive that many are wringing their hands in worry and anxiety. Do I know what gold will do tomorrow? Yes, I do. It will do what it wishes to do regardless of projections from optimists or the dooms day club.

Read full article... Read full article...

Wednesday, May 30, 2007

Why is Gold Trending Lower? / Commodities / Gold & Silver

By: Christopher_Laird

Gold and the HUI have been trending down. I hear various reasons proffered about why – central banks are selling – that is why gold is down – etc. Indeed, the Spanish central bank has sold 80 tons of gold in the last two months because they are seriously low on foreign reserves. That is another story.

But, I see very good macroeconomic reasons for gold to be tepid and down now. In fact, things like what the USD does are far more weighty to gold, than temporal central bank selling of gold. True, 40 tons is a lot, but compared to the financial mass of the USD for instance, that is literally a drop in the bucket.

Read full article... Read full article...

Wednesday, May 30, 2007

The Dollar: An Agonizing Reappraisal / Commodities / Gold & Silver

By: Professor_Emeritus

Part One of a New Series Gold Standard University : Gold Vanishing into Private Hoards

Introduction. While doing research in the Library of the University of Chicago in the early 1980's I came across the unfinished manuscript of a book with the title: The Dollar: An Agonizing Reappraisal . It was written in the year 1965. It has never been published (although it has received private circulation). The author, monetary scientist Melchior Palyi, a native of Hungary, died before he could finish it. Monetary events started to spin out of control in 1965, culminating in the default on the international gold obligations of the United States of America six years later in August,1971. Palyi had correctly prophesied that event which occurred after he died.

Read full article... Read full article...

Monday, May 28, 2007

Gold and Silver Analysis - Precious Points: No Lack of Support / Commodities / Gold & Silver

By: Dominick

Oroborean writes: This week saw a full cycle in the 60-min gold trend cycle chart and, as warned, the move up did not see a dramatic increase in price. This, of course became it's own warning signal. Stocks and metals both saw a pullback on Thursday that had most major indices breaking through long-standing trendlines and the 60-min gold chart racing back towards the bottom.Read full article... Read full article...

Sunday, May 27, 2007

Weekly Gold and Silver Technical Analysis Report - 27th May 2007 - Technically Precious with Merv / Commodities / Gold & Silver

By: Merv_Burak

Gold just keeps moving one day up and another day down, but in the end, mostly down. Is there an end?

GOLD : LONG TERM

Friday, May 25, 2007

Fade the Futures Gurus, Gold Futures CoT 2 / Commodities / Gold & Silver

By: Zeal_LLC

Adam Hamilton writes: I have loved reading my entire life, so when I am not studying the financial markets one of my favorite pastimes is reading great fiction. My favorite genre these days is the rich adventure/action stories spun out by brilliant authors like Clive Cussler, Jack Du Brul, and James Rollins. A good book makes even the very best movies seem like shallow grade-school plays by comparison.

Adventure stories often have history woven in as the heroes chase after some priceless artifact. Usually some ancient priest-type caste existed that hid the artifact away to protect it from a calamity in the past so our heroes can unlock its secrets in the present. These historical priests often used special knowledge that only they had, usually scientific in nature, to cement their power in the society.

Read full article... Read full article...

Friday, May 25, 2007

US Housing Discounting and the Gold Bull Market / Housing-Market / Gold & Silver

By: Adrian_Ash

"...The only way US builders can shift unsold homes is to discount. Existing homes, in contrast, won't sell – because the discounting has yet to begin..."

BUY LOW, SELL HIGH – it sounds simple enough. Yet the strategy eludes most people.

Drowning in newsprint, they like to buy what's hot instead – like Tech Stocks in late 1999, oil futures in summer 2005, subprime mortgage-backed bonds in 2006, tulip bulbs in Amsterdam , 1624.

Read full article... Read full article...

Thursday, May 24, 2007

Silver Market Update : Silver Bull Set to Resume / Commodities / Gold & Silver

By: Clive_Maund

While looking weaker than gold at this time, silver is expected to turn up shortly for the same reason as gold - the inflationary implications of an impending sharp rise in the oil price – the expected breakout by oil from its large Head-and-Shoulders bottom formation will project it to a minimum target at $80.Read full article... Read full article...

Thursday, May 24, 2007

Gold and Silver - Yes, they do ring a bell! / Commodities / Gold & Silver

By: Peter_Degraaf

The challenge is to be able to hear it when it is ringing.

The good news is that the bells for silver and gold are starting to ring again! Initially only a few people can hear them. In this essay we will look for these bells, and check to find out if they are loud enough to excite those investors who like to ‘buy low and sell high'. After all before we can sell high, we must first buy low!

Read full article... Read full article...

Wednesday, May 23, 2007

Gold Market Update - Crude Oil Breakout Inflationary for Precious Metals / Commodities / Gold & Silver

By: Clive_Maund

Oil is now very close to breaking out from the large Head-and-Shoulders bottom that we had earlier identified, and from the look of the latest oil COT chart, on which the Commercials short positions have shrunk dramatically, it is close to doing so – and if it does it will be on its way to $80 minimum. Needless to say this will be inflationary, and thus bullish for Precious Metals. Should this breakout occur, it will radically improve the outlook for gold and silver.Read full article... Read full article...

Sunday, May 20, 2007

Gold and Silver Analysis - Precious Points: A Bounce is a Bounce / Commodities / Gold & Silver

By: Dominick

“A continuation of reverses (signaling continued weakness) would most likely continue to trigger liquidation of large gold positions and put downward pressure on metals… What gold needs to get its groove back is a rebound in the economy with an uptick in inflation.” ~Precious Points: Don't Fear the Repo , May 13, 2007

The Fed continued reducing the money supply this week by failing to place as many dollars through repos as were removed at maturity. Not surprisingly then, metals continued their downward slide through the early part of last week.

Read full article... Read full article...

Sunday, May 20, 2007

What's Next for Silver? / Commodities / Gold & Silver

By: Roland_Watson

So silver has once again renewed its acquaintance with the 200 day moving average and the dirges regarding the death of a silver bull renew their solemn chants.

Why the fear and concern amongst silver analysts and silver investors in general? Various indicators suggest a potential breakdown in prices with bearish connotations. Now that raises one or two questions themselves. For one, what constitutes the end of a bull market?

Read full article... Read full article...

Sunday, May 20, 2007

Weekly Gold and Silver Technical Analysis Report - 20th May 2007 - Technically Precious with Merv / Commodities / Gold & Silver

By: Merv_Burak

Wednesday was a decisive downside break below a 7 month up trend line. Is this the start of a new BEAR or is it just a continuation of a wide year long lateral trend?

SOME SURPRISING STATISTICS

This past Wednesday I had the pleasure of making a telecom presentation to the Calgary Chapter of the Canadian Society of Technical Analysts. The Topic was “GOLD – Invest/Speculate/Gamble, Decisions, Decisions”. I wouldn't go into the presentation here but I thought that you might be interested in some of the statistics that I had come up with in the process of putting the presentation together. The statistics involved a review of the performance of various Gold Indices over the past 11 years, encompassing one major bear and one major bull market. The Indices reviewed were grouped into their “quality” sectors of QUALITY, SPECULATIVE and GAMBLING. These were:

Saturday, May 19, 2007

Gold is Setting the Stage for Another Flat Summer / Commodities / Gold & Silver

By: Donald_W_Dony

Though Gold remains in a stable long-term up trend, there is some weakness building over the 2-3 weeks. Is this the beginning of another flat summer season? Technical evidence seems to be pointing in that direction.

Gold has been trading since mid-2006 in a series of gradual ladder steps upward. Each major low has progressed higher or at least equal to the last step. This is the normal pattern for a developing up trend. In the case of the last low in early March 2007 (see Chart 1)

Read full article... Read full article...

Friday, May 18, 2007

Gold Breaks Major Support Levels, So That's It for Gold? / Commodities / Gold & Silver

By: Adrian_Ash

"...Golly – what a great market to short! And isn't it funny to think that gold just recorded fresh all-time highs against the world's major currencies..."

SO THAT'S IT in gold then. The bull market that peaked in May 2006 finally gave up the ghost this week.

At least, that's what Wall Street is saying. No wonder private investors are selling out, too.

Read full article... Read full article...