Category: Gold & Silver

The analysis published under this category are as follows.Sunday, April 29, 2007

Weekly Gold and Silver Technical Analysis Report - 29h April 2007 - Technically Precious with Merv / Commodities / Gold & Silver

By: Merv_Burak

Time to start wondering if this is the start of a new bear or just a normal correction after a several week advance. There are analysts on both sides.

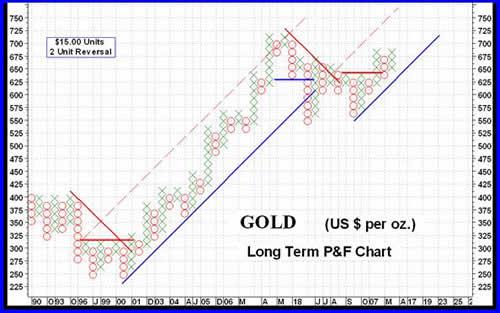

GOLD : LONG TERM

That Merv's Composite Index of Precious Metals Indices shown last week must be on to something. The initial reaction from a previous high last week, making a potential double top, accelerated this week. It's still in a “no panic yet” zone but another week or two of this kind of action and who knows?

Saturday, April 28, 2007

Gold and Silver Analysis - Precious Points: Why Not Gold? / Commodities / Gold & Silver

By: Dominick

"Despite a minor struggle last week, the trend continues to be up until it's not. Weaker consumer confidence and existing home data could be the start of that reversal." ~ Precious Points: Sailing the Seas of Liquidity , April 21, 2007

The dollar is sharply lower for April, and stocks are up largely on that fact, but precious metals, which would traditionally be the beneficiaries of a sinking dollar, are looking to come out roughly flat. Once again, recovery in the metals from softness earlier in the week was foiled by a Friday rally in the dollar. But the real damage started on Tuesday's economic data.

Read full article... Read full article...

Friday, April 27, 2007

Inflation - Different This Time? / Economics / Gold & Silver

By: Adrian_Ash

"...Previous explosions in the cost of living had taken decades...even centuries...to unfold. But the '70s bubble in guns and butter put the pedal to the metal. Inflation raced ahead as never before..."

"PEOPLE RIGHTLY buy gold when they see inflation ahead," said William Rees-Mogg at a private investment seminar in the City of London on Thursday evening.

Read full article... Read full article...

Friday, April 27, 2007

Gold, the Markets and India: A return to Tradition? / Commodities / Gold & Silver

By: Bob_Kirtley

As the United States stock market goes through the 13000 level and India 's Bombay Stock Exchange heads towards 14500 and possibly new highs we ponder the ramifications for demand for gold in India .

As the United States stock market goes through the 13000 level and India 's Bombay Stock Exchange heads towards 14500 and possibly new highs we ponder the ramifications for demand for gold in India .

Wednesday, April 25, 2007

Gold Thoughts - Is Gold Vulnerable to the Carry Trade Unwinding? / Commodities / Gold & Silver

By: Ned_W_Schmidt

How much has Gold benefited from the carry trade loans? How much of the run from US$640 to US$690 has been fueled by the same borrowed money that has pushed paper equities higher? Is Gold vulnerable when the carry trade loans are forced to unwind?

How much price vulnerability might occur? These are the questions being mulled by serious investors in Gold. Unfortunately, these same questions as they apply to paper equities are being largely ignored. Too many speculators in paper equities believe the rise in the prices of their stocks is because they are talented, rather than being due to cheap money from foreign sources.

Read full article... Read full article...

Monday, April 23, 2007

Commodities Market Wrap - Gold, Silver, Crude Oil and Mining Stocks / Commodities / Gold & Silver

By: Douglas_V_Gnazzo

OilJune crude lost $2.22 to $64.11. May gasoline was down 1.9% and Natural Gas fell 5.4%. As the chart below shows, crude is at a critical stage - it either rallies up from here to hold support, or it breaks through support and starts a new leg down.

Read full article... Read full article...

Monday, April 23, 2007

Gold Forecast & Analysis - Ounces Aren't Just Ounces / Commodities / Gold & Silver

By: Neil_Charnock

Gold broke out last week and now looks set to run up at US$730 but a few resistance levels above here first. Back at the start of the year I made an educated guess at a May $730 top for the first half of 2007, time will tell. This is not a technical article, if is a fundamental one for my PDF clients and resource investors. Tread warily here is my current take – the ASX is toppy and needs a pull back but there are still some opportunities in the resource arena short term. Full technical and fundamental coverage of this is in the latest GoldOz Newsletter.Read full article... Read full article...

Monday, April 23, 2007

COT Warning of possible near-term top in Gold and Breakdown in Resource Stocks / Commodities / Gold & Silver

By: Clive_Maund

Resource Stock investors have become increasingly excited as gold, silver and oil have advanced over the past 7 weeks or so, with the usual cheerleaders advancing plausible reasons why gold and silver will soon break out to new highs. However, as we will shortly see, big money is positioning itself to fleece the little guy yet again, with the same old music playing over, as it has done countless times in the past.

On shorter-term charts all seems to be OK - gold and silver were wildly overbought after their strong run in late 2005 and early last year, and were entitled to take a lengthy breather to let the extremely overbought condition unwind, and as they now approach the highs of last year they are nowhere near as overbought, and thus on the face of it, they appear to be ready to break to new highs at last.

Read full article... Read full article...

Sunday, April 22, 2007

Gold, Metals and US Dollar Analysis : Sailing the Seas of Liquidity / Commodities / Gold & Silver

By: Dominick

Oroborean writes “A corrective dollar rally, as short-lived as it might be, could become a hurdle for metals going forward … When support finally kicks in, as it may have on Friday, there could be some correction and consolidation in metals. ”

~ Precious Points: Got Discipline? , April 14, 2007

Everywhere you turn, economists and commentators are talking up the benefit of the weak dollar – how it's good for exports, how it will boost the profit margins of multinational corporations. What you don't hear quite as much of is how it makes your cash savings worse less and less and how your wealth would be more than keeping pace with inflation if it was stored in metals.

Read full article... Read full article...

Sunday, April 22, 2007

Weekly Gold and Silver Technical Analysis Report - Potential Double Top / Commodities / Gold & Silver

By: Merv_Burak

Lots of speculation about the next great gold boom – or not ? My Composite Index of Precious Metals Indices shows a serious double top. Let's hope it's just a short term aberration.

COMPOSITE INDEX of PRECIOUS METALS INDICES

At the end of most of these commentaries you will find a table of Precious Metals Indices. The table includes the major North American precious metals Indices, the various FTSE Gold Mines Indices, the seven Merv's Indices as well as gold, silver and the US$. Subscribers to my weekly precious metals service get the full expanded table along with a weekly Composite Index chart that shows the average weekly performance of all of these Indices. This week the chart may be giving a very serious warning so I thought I'd show it to all my commentary readers.

Saturday, April 21, 2007

Gold Forecast - The Short-Term Prospects for Gold / Commodities / Gold & Silver

By: Julian_DW_Phillips

Brown Again ?  Two of the chief qualifications for a Minister of the Crown in the U.K. are a complete disregard for the opinions of others and absolutely no regard for the consequences of his actions. Mr. Brown is superbly qualified to be Prime Minister in this regard.

Two of the chief qualifications for a Minister of the Crown in the U.K. are a complete disregard for the opinions of others and absolutely no regard for the consequences of his actions. Mr. Brown is superbly qualified to be Prime Minister in this regard.

Despite the overwhelming evidence of the foolishness of the sale of half Britain 's gold in a manner to guarantee a low price, Mr. Brown unashamedly continues to press for the sale of other people's gold.

Read full article... Read full article...

Friday, April 20, 2007

Bring on the Empty Silver ETFs? / Commodities / Gold & Silver

By: Roland_Watson

This week has been a busy week for silver as announcements of two silver ETFs were made to the media. When I read the words "silver" and "ETF" I was part hoping it was finally the silver stocks ETF I mentioned in the latest issue of my newsletter. However, it was not to be as the third silver ETF was announced by the Zurich Cantonal Bank along with their platinum and palladium ETFs. It will start trading on the 10th May.

I asked for the prospectus and got some documents in German. I ran it through Google translator and got some extra items of information.

Read full article... Read full article...

Friday, April 20, 2007

Gold: More than Just a TIP, Gold is Money and Store of Wealth / Commodities / Gold & Silver

By: Michael_Pento

It is still common for market commentators to denigrate gold as a relic of little value. They claim that since it offers no dividend its only appropriate use is for jewelry--never calling to mind the hubris it takes to ignore 5,000 years of civilization that viewed gold as money.

Most market strategists still don't realize that gold is money and its value is as a store of wealth and it holds its value against fiat currencies better than any Treasury asset, including TIPS. So, I thought it may be enlightening to compare the returns of gold versus Treasury Inflation Protected Securities and determine which offers a better hedge against inflation.

Read full article... Read full article...

Thursday, April 19, 2007

Silver Update - Under-performs Gold as yet to reach Resistance of $15 / Commodities / Gold & Silver

By: Clive_Maund

The silver chart looks considerably less inspiring than the gold chart at this juncture, which is perhaps not so surprising as after outperforming gold last year, it has been under performing it so far this year.

On the 10-year chart the trading range that has followed the ramp from September 2005 through April last year does not look to be of sufficient duration to support another strong advance, and the uptrend channel drawn on this chart looks unsustainably steep and for these reasons the chances of a breakdown are considered to be quite high.

Read full article... Read full article...

Wednesday, April 18, 2007

Gold Rallies back to Resistance at $700, Though COT Signals Potential Warnings / Commodities / Gold & Silver

By: Clive_Maund

The gradual uptrend of the past 6 weeks has brought gold once again to a critical juncture. This rise has brought it up to the late February high and within $40 of last year's highs at about $730, raising hopes that it may soon break out to a new high.Read full article... Read full article...

Wednesday, April 18, 2007

Gold Thoughts - Gold Outperforms US Stocks by more than 300% / Commodities / Gold & Silver

By: Ned_W_Schmidt

Much talk about this index or that index making a new high, or near a new high. The level for an index is interesting, but the return being earned is more important. A stock market index could conceivably make a new high each and every day without providing a desirable return. Today's graph compares the return over the past five years of an investment in $Gold and U.S. stocks, as measured by the total return on the S&P 500.

As is readily apparent from that graph, $Gold has substantially outperformed an investment in U.S. equities. Why these results? Gold's price is a mirror reflection of the global purchasing power of the U.S. dollar. As the Federal Reserve has grossly mismanaged U.S. monetary policy over the years, the global forex market has pushed down the value of the dollar. That depreciation of the dollar's value is not reflected in the equity market.

Read full article... Read full article...

Monday, April 16, 2007

Gold Mega Trend - KEEP FOCUSED / Commodities / Gold & Silver

By: Aden_Forecast

Gold is on the rise. Investors are excited, especially after last month's volatility, which proved to be nerve wracking for many gold investors. This alone reinforces why it's important to focus on the major trend.

Chart 1 shows gold's mega uptrend and as you can see, the volatility over the past year doesn't look like much. On the contrary, this chart illustrates gold's strength as it sits near the high side of the rise that started in 2001. This is the most important picture to keep in mind when investing in gold. The bull market since 2001 is clearly underway.

Read full article... Read full article...

Monday, April 16, 2007

Trading Thoughts - Gold and Sillver Bullish, Equities at risk on Yen Carry Trade unwinding / Commodities / Gold & Silver

By: Ned_W_Schmidt

Last weekend we noted that the U.S. dollar had closed out that previous week at a new low, based on the Median U.S. Dollar Index. That weakness suggested that more weakness for the dollar would develop. Such was what happened this week as the dollar was sold against almost all other national monies. The latest valuations have the U.S. dollar closing at another new low on Friday. That condition makes the U.S. dollar over sold in the short-term, but continuing in a major bear market.

The strategic view that precious metals will do well is being confirmed.

Read full article... Read full article...

Sunday, April 15, 2007

Silver Analysis - Trending higher towards Resistance / Commodities / Gold & Silver

By: Roland_Watson

Here are the latest numbers on silver as of this weekend with changes on the week in parentheses (acronyms are explained at bottom):London Silver Fix Price: $13.88 (+$0.30 on week)

NYMEX Spot Price: $14.01 (+$0.33)

RSI: 64.88 (+5.76) ( 70 overbought/30 oversold - short term top-bottom indicator )

RMAR: 1.02 (+0.01) ( 1.30 overbought - monthly to yearly top indicator )

NYMEX SLI: 1.51 (-0.01) (1.80 overbought - multi-year top indicator )

Read full article... Read full article...

Sunday, April 15, 2007

Weekly Gold and Silver Technical Analysis Report - Technically Precious with Merv / Commodities / Gold & Silver

By: Merv_Burak

A couple of ups and downs during the week but mostly ups. Are we heading for new highs ahead?

GOLD : LONG TERM