Category: Gold & Silver

The analysis published under this category are as follows.Sunday, April 15, 2007

Gold, Metals and US Dollar Analysis : Got Discipline? / Commodities / Gold & Silver

By: Dominick

Joe Nicholson writes “Whether the Federal Reserve tightens incrementally to look tough on inflation for which it is almost entirely responsible, or whether it makes a small cut to support a busted housing market for which it is entirely responsible, precious metals are poised to be the long term beneficiaries of either policy choice.”

~ Precious Points: All I Really Need to Know About the Economy I Learned in Kindergarten , April 01, 2007

The last few updates essentially took the position that the short term fundamental outlook was muddled, but that, nonetheless, precious metals stood to benefit in any likely event. Despite the ebb and flow of rate cute expectations, gold and silver (and platinum, too!) indeed extended their rallies over the past two weeks on steady declines in the dollar and persistent inflation data. An 11.9% increase in M2 over the last six weeks probably hasn't hurt either.

Read full article... Read full article...

Friday, April 13, 2007

The Evolution of Gold or Why Gold is Moving Up / Commodities / Gold & Silver

By: Julian_DW_Phillips

This piece is written on the base provided by GFMS, as always, a most competent gold survey of what happened in the gold market last year . Their conclusions highlight the evolution of the gold market over the last 7 years, since the Washington Agreement was signed in 1999.

At that time in an environment of a gold market clouded by the constant threat of Central Bank sales, the treatment of the metal as a commodity and the accelerated gold production fuelled by the hedging of future production at prices persistently higher than those achieved when a new mine came into production.

Read full article... Read full article...

Friday, April 13, 2007

Edward Pastorini and the Gold Fields sting of April 2007 / Commodities / Gold & Silver

By: Adrian_Ash

Investors are moving in on BIZO as acquisition completes...

"Shares climbed 110% yesterday and 14% today. Watch for more news tomorrow and get ahead of this new campaign..."

Or rather, that's what the latest batch of junk-and-pump emails to hit our servers here at BullionVault would have you believe.

Ramping stocks is illegal, of course. Buying into the hype is stupid. Getting one of the world's major news organizations to do both for you at once...well, perhaps that's genius.

Read full article... Read full article...

Wednesday, April 11, 2007

Further Hikes in US Interest Rates Possible - But Gold Just Doesn't Buy It. / Interest-Rates / Gold & Silver

By: Adrian_Ash

"...The price of gold, US consumers and the International Monetary Fund all

agree the US economy is about to slow down dramatically.."

SO FURTHER HIKES in US interest rates could still "prove necessary" according to Ben Bernanke and his team.

Stocks and bonds sold off hard Wednesday on the release of minutes from last month's Fed policy meeting. "They still have their finger on the trigger for raising interest rates," reckons one US fund manager running $23 billion in Los Angeles speaking to Bloomberg in between watching his portfolio wobble.

But gold, on the other hand, just doesn't buy it. Spot gold prices continued to trade in a tight range around $676.50 per ounce. Gold also held steady against the other major currencies, remaining near 6-week highs versus Sterling, the Euro and Japanese Yen.

Read full article... Read full article...

Wednesday, April 11, 2007

The Gold Sector Starts a New 13 Week Bullish Cycle / Commodities / Gold & Silver

By: Donald_W_Dony

From the correction low in early October 2006, gold has shown increasing technical strength as each new 13-week trading cycle unfolds and lifts the metal higher. This sequence of improving prices gives a good indication of expanding strength and also helps forecast the movement of this precious metal over the next few months. With a new 13-week trading cycle developing in the first half of April (see the lower portion of Chart 1), a price peak can be anticipated mid-point (second half of May) at a level of near $720. The next trough should form in late June.Read full article... Read full article...

Monday, April 09, 2007

Commodities Market Wrap - Gold, Silver, Crude Oil and Mining Stocks / Commodities / Gold & Silver

By: Douglas_V_Gnazzo

Gold

Gold put in another good week closing up $10.40 to $679.40 (+1.55%). This was gold's highest weekly close in 6 weeks, and was the daily high close for the week as well.

Gold's next target is the Feb. high of $686.70 on a closing basis and $692.50 on an intra-day basis. From there the next target is the multi-year high of May 2006 at $730.40 (intra-day).

Read full article... Read full article...

Thursday, April 05, 2007

Risk of Stagflation - Key Charts and Major Clues / Economics / Gold & Silver

By: Jim_Willie_CB

Some extremely important charts follow, each with an equally important message. The story can be told from a series of painted pictures. The USEconomy is in deep trouble. The US Federal Reserve is caught in a box. Bankers are one step from being snared in a quagmire, with vivid memories of the insolvent bank system endured by Japan for over a full decade.

The US bank problems seem worse by comparison, when factoring in mortgages, huge spread trades sure to go bad, a mountain of credit derivatives growing at 80% annually in size, and a raft of collateralized debt obligations sitting like an ominous cloud. The Bank of Japan simply cannot continue with rate hikes, given the vulnerable shaky state of all matters financial on a global basis. Gold and silver are moving to center stage, undeterred by the recent shock waves. The main shock is to the Powers That Be (King Henry & His Court of Market Manipulators), who are losing grip at the helm. A wider war, surely beneficial for many private interests, would kill the future economic prospects.

Read full article... Read full article...

Thursday, April 05, 2007

Iran crisis still ready to blow … US preparing to Attack / Politics / Gold & Silver

By: Money_and_Markets

Larry Edelson writes:Yesterday, Iranian President Mahmoud Ahmadinejad announced he will free the 15 British sailors and marines captured on March 23. That's welcome news.

However, I don't think this political maneuver changes the underlying situation one iota. And gold's price is confirming that. Instead of falling on the news of the pending release of the hostages, the yellow metal soared nearly $10 to its highest level since last May!

My view on the Iran crisis hasn't changed one bit: Despite the potential release of the British hostages, a military strike on Iran's nuclear facilities is coming, sooner rather than later.

Read full article... Read full article...

Monday, April 02, 2007

Honest Money - Gold and Silver Technical Report & Forecast / Commodities / Gold & Silver

By: Douglas_V_Gnazzo

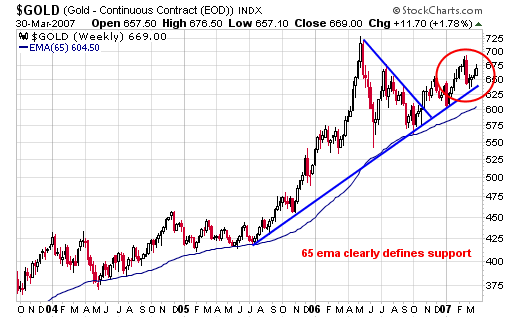

Gold had a good week rallying up $11.70 to close the week out at $669 (+1.78%). It was the highest daily close of the week and the highest weekly close in 5 weeks.

The weekly chart below clearly distinguishes the long term trend line that continues to remain above its 65 week moving average. The rising trend line has support at just under $650.00, while the 65 ema comes in at $604.50.

Sunday, April 01, 2007

Silver's Failure to Breakout above Resistance increases risks of a Sharp Fall / Commodities / Gold & Silver

By: Clive_Maund

The silver chart looks considerably less inspiring than the gold chart at this juncture, which is perhaps not so surprising as after outperforming gold last year, it has been underperforming it so far this year. On the 10-year chart the trading range that has followed the ramp from September 2005 through April last year does not look to be of sufficient duration to support another strong advance, and the uptrend channel drawn on this chart looks unsustainably steep and for these reasons the chances of a breakdown are considered to be quite high.Read full article... Read full article...

Sunday, April 01, 2007

The Gold Bull Market Remembers How Gordon Brown Sold Half of Britains Reserves at the Lowest Price / Commodities / Gold & Silver

By: Clive_Maund

An increasing number of goldbugs and traders are getting bewildered and frustrated at gold's pedestrian performance and refusal to break higher, even with a possible attack on Iran looming, especially as oil has been romping ahead, and are, of course, looking around for people to blame, which usually winds up being the poor old cartel, those dastardly faceless individuals whose job it is to suppress the price of gold and silver so that the financial world at large doesn't cotton on to the precarious state of the world financial system in general and the Fiat money system in particular, much less mortgaged-up-to-the-hilt Joe Sixpack, whose chief distinguishing feature is that he hasn't got a clue about anything, apart from the details of upcoming ball games etc.Read full article... Read full article...

Sunday, April 01, 2007

Gold and Silver Analysis - All I Really Need to Know About the Economy I Learned in Kindergarten / Commodities / Gold & Silver

By: Dominick

“ Bernanke's policies, in fact, represent a paradigm shift away from a past where every boom was expected to, and had to be followed by a bust. The wording of Greenspan's now infamous "recession" comments indicate nothing more treacherous than adherence to this older, possibly even outmoded, economic philosophy .”

~ Precious Points: Lackluster, but not Tarnished , March 17, 2007

Imagine a teeter-totter. On one end is inflation, and on the other, risk of a recession. It remains to be seen which side will grow heavy first and force the Fed's hand.

Read full article... Read full article...

Sunday, April 01, 2007

Weekly Gold and Silver Technical Analysis Report - 1st April 2007 - Technically Precious with Merv / Commodities / Gold & Silver

By: Merv_Burak

Other than Monday, the week's daily gold trading activity closed either lower on the day or at the low of its daily trading range. Not activity fraught with confidence.

TECHNICAL RATING (RATE)

In my tables of technical information and ratings (at the end of these commentaries) is a column called RATE for Technical Rating. Based upon the technical information in the table I had developed a program that then took this information and tried to determine if the stock or Index is technically bullish (POS), bearish (NEG) or neutral (N).

Read full article... Read full article...

Saturday, March 31, 2007

The Illusion of Gold Reserves - Deep Storage, Deeper Holes, Deepest of Troubles / Commodities / Gold & Silver

By: Rob_Kirby

I'd like everyone to take a look at the U.S. Treasury's most recent accounting of its gold:

Current Report : January 31, 2007Read full article... Read full article...

Friday, March 30, 2007

Gold Forecast - Chinese rising demand affecting the gold price much more... / Commodities / Gold & Silver

By: Julian_DW_Phillips

The slow liberalization of the gold market is a fact of life albeit slow and not likely to see huge tonnages [like 3,000 tonnes] flow into the country quickly. But in this gold market it doesn't take huge tonnages to move the gold price.

We hear from China that 90,000 bank accounts are being opened every day. They need a bank account to qualify to buy gold [here is the control from the government and bankers over the rising gold market]. The Chinese public has indicated before that it would be happy to invest between 10 and 30% of their savings in gold, which they must now do through their bank and consequently the Central Bank. We are not even going to attempt to put a figure on what will go into gold in China, but we have to highlight one fairly dramatic likelihood:

We hear from China that 90,000 bank accounts are being opened every day. They need a bank account to qualify to buy gold [here is the control from the government and bankers over the rising gold market]. The Chinese public has indicated before that it would be happy to invest between 10 and 30% of their savings in gold, which they must now do through their bank and consequently the Central Bank. We are not even going to attempt to put a figure on what will go into gold in China, but we have to highlight one fairly dramatic likelihood:

Friday, March 30, 2007

HUI Gold Stocks Index leverage against Gold Price / Commodities / Gold & Silver

By: Roland_Watson

Some weeks back we looked at how the HUI index of unhedged gold producers was leveraging the price of gold. As any seasoned gold investor will know, well chosen gold mining stocks offer gearing on the rising price of gold up to many times depending on the quality and timing of the stock chosen.

However, since 2004, the HUI has failed to live up to that tag as its performance against gold has increasingly diminished until recently. To this end, we present the latest on how the HUI is doing against its main product.

Read full article... Read full article...

Wednesday, March 28, 2007

Moneytization as the US heads towards Recession - Gold bull market to benefit / Commodities / Gold & Silver

By: Ned_W_Schmidt

Moneyization: The global financial phenomenon of individuals and businesses moving their funds to monies in which they have the highest confidence, or money in which they have a higher store of faith.

Or, The Vote of the Markets

To the joy of day traders, the Federal Reserve Open Market Committee, the rate setting arm of U.S. Federal Reserve, announced again their lack of commitment to sound money. For a day U.S. equity markets were filled with joy and short covering. FOMC statement, released after their meeting, suggested diligence on inflation(wink, wink), and suggested some concern for weakening U.S. economy. Easier U.S. monetary policy may require just one more indication of the collapsing U.S. housing industry and could be only one committee vote away.

Read full article... Read full article...

Sunday, March 25, 2007

Honest Money - Gold and Silver Technical Report & Forecast / Commodities / Gold & Silver

By: Douglas_V_Gnazzo

Gold & Silver

Gold closed up $3.40 to $657.30. It was the second lowest daily close of the week. The daily high for the week was put in on Thursday at $664.20. The intra-day high for the week was also on Thursday at $667.30.

The first chart up is the daily chart of gold, which shows the rising lower trend line solidly in place. Higher highs are rising from the lower left corner to the upper right hand corner of the chart. A bullish signature.

Read full article... Read full article...

Sunday, March 25, 2007

How to buy and hold Gold Bullion - Bullionvault update / Commodities / Gold & Silver

By: Nadeem_Walayat

This article is an update to the article Buying gold - The easy and safe way for personal investors to Buy, Sell and hold gold at market price , which covered the technical aspects of buying and holding gold with Bullionvault.com, and now we look at what to expect from holding your own gold investments in terms of real returns after charges.Read full article... Read full article...

Sunday, March 25, 2007

Weekly Gold and Silver Technical Analysis Report - 25th March 2007 - Technically Precious with Merv / Commodities / Gold & Silver

By: Merv_Burak

Friday's sharp reversal almost wiped out the gains from the previous 4 days. Is this a new reversal or just nervous nellies selling prior to a week-end?

Relative Strength (RS)

I don't remember how I got started on this but I guess I'd better finish it off. In my tables of technical information and ratings (an example is usually published at the end of my commentaries) is a column called RS for Relative Strength. As I have explained briefly in previous commentaries what the moving average (MA) and momentum (MOM) columns of information are all about I guess I should finish and explain the last of the information columns. There is still the RATINGS (RATE) column but I'll leave that for possibly next week.

Read full article... Read full article...