Category: Crude Oil

The analysis published under this category are as follows.Tuesday, March 03, 2009

Moment of Truth for Crude Oil Prices / Commodities / Crude Oil

By: Mike_Paulenoff

The moment of truth for nearby crude oil prices, as they press against the 20 Day MA at 39.29, which also represents the mid-point of the Bollinger Bands-- and usually supports the price structure on a pullback IF (and only IF) the dominant trend direction is UP. Right now, the technical work shows a possible upside reversal off of the 2/12 low at $33.55, which climbed to 45.30 on 2/26 prior to turning lower.

The moment of truth for nearby crude oil prices, as they press against the 20 Day MA at 39.29, which also represents the mid-point of the Bollinger Bands-- and usually supports the price structure on a pullback IF (and only IF) the dominant trend direction is UP. Right now, the technical work shows a possible upside reversal off of the 2/12 low at $33.55, which climbed to 45.30 on 2/26 prior to turning lower. Read full article... Read full article...

Monday, March 02, 2009

Could Obama Push Crude Oil to $300 Per Barrel / Commodities / Crude Oil

By: Q1_Publishing

John Maynard Keynes is one of the most influential and controversial economists in history. He warned of the huge burden war reparations placed on Germany and its allies after WW I. He played an integral role in establishing the post-WW II financial world. His economic theories established the impetus for governments to spend like mad during downturns. He made, lost, and made back a massive fortune in the stock market. He counted Pablo Picasso and Virginia Wolf as friends.

John Maynard Keynes is one of the most influential and controversial economists in history. He warned of the huge burden war reparations placed on Germany and its allies after WW I. He played an integral role in establishing the post-WW II financial world. His economic theories established the impetus for governments to spend like mad during downturns. He made, lost, and made back a massive fortune in the stock market. He counted Pablo Picasso and Virginia Wolf as friends. Read full article... Read full article...

Friday, February 13, 2009

Crude Oil Remains a Mush Have Investment Profit Play / Commodities / Crude Oil

By: Money_Morning

Keith Fitz-Gerald writes: Commodities may be down, but they're not out – and they shouldn't be out of your portfolio, either.

Keith Fitz-Gerald writes: Commodities may be down, but they're not out – and they shouldn't be out of your portfolio, either.

As the investment director for Money Morning , I'm invited to a large number of speaking engagements each year. It's something I enjoy, and it's quite useful, too, for the questions that I get tell me a great deal about investor sentiment and the general tenor of the financial markets. The same is true for the questions I receive daily from our readers.

Read full article... Read full article...

Thursday, February 12, 2009

Crude Oil WTI/ Brent Premium Inversion / Commodities / Crude Oil

By: Rob_Kirby

Oh Yes They Did! - I've been trying to resolve what's behind the recent inversion of the historic premium that West Texas Intermediate [WTI] Crude Oil has enjoyed versus Brent Crude? Historically, West Texas Intermediate Crude Oil trades at a premium price to Brent Crude Oil for quality as well as logistical reasons. In recent weeks and months – WTI has been trading at a deep discount to Brent Crude:

Oh Yes They Did! - I've been trying to resolve what's behind the recent inversion of the historic premium that West Texas Intermediate [WTI] Crude Oil has enjoyed versus Brent Crude? Historically, West Texas Intermediate Crude Oil trades at a premium price to Brent Crude Oil for quality as well as logistical reasons. In recent weeks and months – WTI has been trading at a deep discount to Brent Crude:Read full article... Read full article...

Monday, February 09, 2009

Crude Oil Trading Range Tightens / Commodities / Crude Oil

By: Kingsley_Anderson

Contrary to early 2008, oil and the stock market are now marching in lock-step. As the stock market's trading range tightened, oil's has done likewise. Is crude setting up to take-off? As one may already know, explosive moves in either direction usually occur after a tight consolidation. However, in which direction it may go is difficult to say at this time.

Contrary to early 2008, oil and the stock market are now marching in lock-step. As the stock market's trading range tightened, oil's has done likewise. Is crude setting up to take-off? As one may already know, explosive moves in either direction usually occur after a tight consolidation. However, in which direction it may go is difficult to say at this time. Read full article... Read full article...

Thursday, February 05, 2009

Crude Oil USO ETF Advances Off of New All-Time Low / Commodities / Crude Oil

By: Mike_Paulenoff

The US Oil Fund ETF (NYSE: USO) is showing interesting strength today after making a new all-time low this morning. As we speak the USO is pushing against initial key near-term resistance at 29.00, which if hurdled should trigger upside follow-through to test more important resistance at the prior recovery rally peak of 29.50. If such a scenario unfolds, then the confrontation at 29.50 will determine if the USO has established a very significant intermediate-term low.Read full article... Read full article...

Thursday, February 05, 2009

Crude Oil Investors Made 566% the Last Time This Happened / Commodities / Crude Oil

By: Q1_Publishing

No one really knew what to expect when Sid Bass took over the family oil business in 1968. Sid's father and uncle were wildcatters who struck it rich in the 1930's. The two built an oil company with 120 wells and a combined fortune of $50 million over the next three decades.

No one really knew what to expect when Sid Bass took over the family oil business in 1968. Sid's father and uncle were wildcatters who struck it rich in the 1930's. The two built an oil company with 120 wells and a combined fortune of $50 million over the next three decades.

In 1968, the family fortune was handed over to Sid. Once at the helm, Sid hired Richard, one of his old college buddies, away from Goldman Sachs to help him invest the family's fortune.

Read full article... Read full article...

Wednesday, January 28, 2009

The Wrong Way to Profit From Crude Oil / Commodities / Crude Oil

By: Investment_U

You might think you're properly invested in oil, but you could be wrong.

You might think you're properly invested in oil, but you could be wrong.

Despite reaching lows since 2004, the long-term outlook for oil is still up. Maybe not $147 a barrel like the old days (i.e. six months ago), but because of supply, demand, turmoil in the Middle East, and the fact that we will eventually resume worldwide economic growth, oil prices have only one way to go.

Read full article... Read full article...

Tuesday, January 27, 2009

Further Confirmation of Crude Oil Depletion / Commodities / Crude Oil

By: Ronald_R_Cooke

Of all the very large companies in the oil business, one has to particularly admire the business strategy of Schlumberger. This company is the world's leading supplier of technology, integrated project management and information solutions to customers working in the oil and gas industry. Employing more than 87,000 people in approximately 80 countries, Schlumberger attempts to work with the national governments that actually own the world's oil resources on a cooperative basis. This non-competitive, cooperative, strategy brought Schlumberger revenues of $27.16 billion in 2008.Read full article... Read full article...

Monday, January 26, 2009

Where is Crude Oil and USO ETF Going Next? / Commodities / Crude Oil

By: Kingsley_Anderson

Ever since the bubble burst in Oil last Summer, OPEC has been feverishly cutting production levels. At this point, OPEC has a goal of cutting 2.2 million barrel a day for this month. However, while the downtrend in prices has slowed, why has the price not rebounded, as some might expect? Part of the reason is that the economic forecast for 2009 is still grim. The reasoning is that if the world continues to be stuck in a recession for a greater remainder of 2009, the desire or need for crude oil will decrease. Businesses will use less resources and consumers will spend less.

Ever since the bubble burst in Oil last Summer, OPEC has been feverishly cutting production levels. At this point, OPEC has a goal of cutting 2.2 million barrel a day for this month. However, while the downtrend in prices has slowed, why has the price not rebounded, as some might expect? Part of the reason is that the economic forecast for 2009 is still grim. The reasoning is that if the world continues to be stuck in a recession for a greater remainder of 2009, the desire or need for crude oil will decrease. Businesses will use less resources and consumers will spend less. Read full article... Read full article...

Sunday, January 25, 2009

Crude Oil Buy Signal Developing / Commodities / Crude Oil

By: Chris_Vermeulen

Crude Oil, The Picture Perfect Chart - Crude Oil is something that I think has huge potential because of its prolonged down trend without any real bounces and also because there is so much interest from traders and investors around the world who want to catch its bounce. The weekly chart is starting to look amazing and the daily chart looks ready to pop.

Crude Oil, The Picture Perfect Chart - Crude Oil is something that I think has huge potential because of its prolonged down trend without any real bounces and also because there is so much interest from traders and investors around the world who want to catch its bounce. The weekly chart is starting to look amazing and the daily chart looks ready to pop.Read full article... Read full article...

Saturday, January 24, 2009

How Low Can Crude Oil Go? / Commodities / Crude Oil

By: Money_and_Markets

Sean Brodrick writes: Just a year ago, many people, including me, were bracing for much higher oil prices, and making some good money on energy trades, too. Now, we are seven months into the steepest decline the oil market has ever seen!

Sean Brodrick writes: Just a year ago, many people, including me, were bracing for much higher oil prices, and making some good money on energy trades, too. Now, we are seven months into the steepest decline the oil market has ever seen!

Are we near a bottom?

Read full article... Read full article...

Tuesday, January 20, 2009

Crude Black Gold vs Yellow Gold, Who’s Ready to Rally? / Commodities / Crude Oil

By: Chris_Vermeulen

While gold was extremely popular the past few years, I think its safe to say crude oil is unbeatable for popularity, as it's a resource which almost everyone uses on a daily basis and it effects all of us in the wallet when oil prices rise as fuel, shipping costs and petroleum products start to cost more and more. This is the first time I have REALLY noticed everyone is following the price of oil. When kids start talking about it, then you know its being watched like a hawk from all types of individuals and traders.

While gold was extremely popular the past few years, I think its safe to say crude oil is unbeatable for popularity, as it's a resource which almost everyone uses on a daily basis and it effects all of us in the wallet when oil prices rise as fuel, shipping costs and petroleum products start to cost more and more. This is the first time I have REALLY noticed everyone is following the price of oil. When kids start talking about it, then you know its being watched like a hawk from all types of individuals and traders. Read full article... Read full article...

Saturday, January 17, 2009

Prospects for Crude Oil Recovery During 2009 / Commodities / Crude Oil

By: Q1_Publishing

Last Sunday 60 Minutes posed the question, “Did speculation fuel oil price swings?”

Last Sunday 60 Minutes posed the question, “Did speculation fuel oil price swings?”

The news show's investigative team naturally delved into the personal story of how a small-town heating oil company can't predict the oil prices. Although I'm sure they left out his solution of charging a very high premium to his customers to ensure he doesn't get left holding the bag.

Read full article... Read full article...

Friday, January 16, 2009

Crude Oil Record Contango Situation Causing Producers to Hoard Supplies / Commodities / Crude Oil

By: Mike_Shedlock

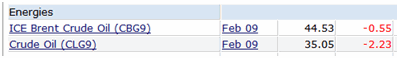

West Texas Intermediate Crude ( WTIC ) typically trades at a premium to Brent Crude (North Sea). Lately the pattern has reversed and now the WTIC discount to Brent is staggering as the following chart of the February contract captured on Thursday shows.

West Texas Intermediate Crude ( WTIC ) typically trades at a premium to Brent Crude (North Sea). Lately the pattern has reversed and now the WTIC discount to Brent is staggering as the following chart of the February contract captured on Thursday shows.

Read full article... Read full article...

Thursday, January 15, 2009

Bear Market in Crude Oil / Commodities / Crude Oil

By: David_Shvartsman

Crude oil was off as much as 10 percent during Thursday's trading on the NYMEX, before closing the session 5 percent lower at $35.40. Reuters has the story ." Oil prices fell more than 10 percent on Thursday to a one-month low as thickening economic gloom added to expectations that world energy demand would keep shrinking.

Read full article... Read full article...

Thursday, January 15, 2009

The Pump is Primed, Crude Oil Set To Go Higher / Commodities / Crude Oil

By: Mac_Slavo

Off over $100 since its high in mid-2008, oil seems set to be set for some upward movement. Internationally renound commodities investor Jim Rogers was recently quoted on his forecast:

Off over $100 since its high in mid-2008, oil seems set to be set for some upward movement. Internationally renound commodities investor Jim Rogers was recently quoted on his forecast:

We're going to see US$200 oil at some point, it may be by 2013. It's a sad fact but the world is running out of known oil. Oil will make a big comeback

Read full article... Read full article...

Wednesday, January 14, 2009

Forecasting Crude Oil Price Through the Gold Ratio / Commodities / Crude Oil

By: Richard_Shaw

If you assume (and that is a uncertain assumption) that gold is fairly priced, and that oil is in search of its fair price, it may be possible to glimpse the “fair value” of crude oil by examining the historical price relationship between the two commodities.

If you assume (and that is a uncertain assumption) that gold is fairly priced, and that oil is in search of its fair price, it may be possible to glimpse the “fair value” of crude oil by examining the historical price relationship between the two commodities. Read full article... Read full article...

Tuesday, January 13, 2009

Upside Continuation for Crude Oil USO ETF / Commodities / Crude Oil

By: Mike_Paulenoff

Let's have a look at my updated hourly chart analytics of the US Oil Fund ETF (NYSE: USO), and bear in mind, that the API (American Petrol Institute) inventory data now come out on Tuesday's after the close (I think 4:30 PM ET), while the DOE data come out on Wed.'s at 10:35 AM ET, which adds a bit of volatility and decision-making to situation.

Let's have a look at my updated hourly chart analytics of the US Oil Fund ETF (NYSE: USO), and bear in mind, that the API (American Petrol Institute) inventory data now come out on Tuesday's after the close (I think 4:30 PM ET), while the DOE data come out on Wed.'s at 10:35 AM ET, which adds a bit of volatility and decision-making to situation. Read full article... Read full article...

Sunday, January 11, 2009

Crude Oil, Trade the Market Not the Economy / Commodities / Crude Oil

By: INO

What do I mean when I say... trade the market and not the economy? It may sound like I'm saying to trade the same thing... but in many cases they're different. The difference is that the market is driven by fear and greed, while the economy is driven by fundamentals. Our "Trade Triangle" technology allows us to analyze the market... leaving the fundamentals and our own emotions at the door. Let's look at some of the major markets and see which direction the trend is headed.

What do I mean when I say... trade the market and not the economy? It may sound like I'm saying to trade the same thing... but in many cases they're different. The difference is that the market is driven by fear and greed, while the economy is driven by fundamentals. Our "Trade Triangle" technology allows us to analyze the market... leaving the fundamentals and our own emotions at the door. Let's look at some of the major markets and see which direction the trend is headed. Read full article... Read full article...