Analysis Topic: Commodity Markets - Metals, Softs & Oils

The analysis published under this topic are as follows.Friday, April 03, 2009

Has the G-20 Saved the Financial World? Gold Bull Market Over? / Commodities / Gold & Silver 2009

By: Julian_DW_Phillips

The G-20 has authorized $1 Trillion in Funding for the I.M.F. The Trade package and the beefing up of the I.M.F. were achieved how? Through the synthetic currency of the I.M.F. the S.D.R. . [the Special Depository Receipts] and additional U.S.$ to boost the body internationally. This new money is being freshly printed. Yes, they are ‘created'. Just as “Quantitative Easing” relies on newly issued dollars, so does the international funding the G-20 has issued. The difference is that this policy is an international issue of money so will not be seen in any national context.

The G-20 has authorized $1 Trillion in Funding for the I.M.F. The Trade package and the beefing up of the I.M.F. were achieved how? Through the synthetic currency of the I.M.F. the S.D.R. . [the Special Depository Receipts] and additional U.S.$ to boost the body internationally. This new money is being freshly printed. Yes, they are ‘created'. Just as “Quantitative Easing” relies on newly issued dollars, so does the international funding the G-20 has issued. The difference is that this policy is an international issue of money so will not be seen in any national context. Read full article... Read full article...

Friday, April 03, 2009

Instability & Depletion Add Uncertainty to Energy Sector / Commodities / Energy Resources

By: Joseph_Dancy

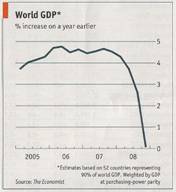

Energy use correlates closely with economic growth. Last month the World Bank forecast the global economy will likely shrink for the first time since World War II. International trade will decline by the most in 80 years according to the report, a stark trend in an economy that has been ‘globalized' over the last several decades.

Energy use correlates closely with economic growth. Last month the World Bank forecast the global economy will likely shrink for the first time since World War II. International trade will decline by the most in 80 years according to the report, a stark trend in an economy that has been ‘globalized' over the last several decades.

Both the IMF and World Bank forecast developing nations will bear the brunt of the economic contraction as they face huge shortfalls to pay for imports and to service debts. “This crisis is the first truly universal one in the history of humanity,” a former IMF Managing Director.

Read full article... Read full article...

Friday, April 03, 2009

Good Reason for Optimism in Industrial Metals Investing / Commodities / Metals & Mining

By: The_Gold_Report

Leonard Melman, prodigious writer (The Melman Report) and leading authority in the metals and mining arenas, sees opportunity for some "really good moves" and "fabulous returns" on the horizon, citing vibrant charts on random juniors whose values have multiplied during the last six months. Also noting the possibility of some "good price pops" in the metals themselves, Leonard considers the price of the base metals as a real key to the future of the economy. On the other hand, he shares some serious concerns about the economy in this exclusive interview with The Gold Report. For example, he is alert to several "ominous red flags" that warn of the potential for devastating hyperinflation and worries that the Humpty Dumpty of savaged financial assets may be beyond repair.

Leonard Melman, prodigious writer (The Melman Report) and leading authority in the metals and mining arenas, sees opportunity for some "really good moves" and "fabulous returns" on the horizon, citing vibrant charts on random juniors whose values have multiplied during the last six months. Also noting the possibility of some "good price pops" in the metals themselves, Leonard considers the price of the base metals as a real key to the future of the economy. On the other hand, he shares some serious concerns about the economy in this exclusive interview with The Gold Report. For example, he is alert to several "ominous red flags" that warn of the potential for devastating hyperinflation and worries that the Humpty Dumpty of savaged financial assets may be beyond repair. Read full article... Read full article...

Friday, April 03, 2009

Commodity Market Forecasts for Copper, Gold and Oil / Commodities / CRB Index

By: Q1_Publishing

Nobel Laureate Neils Bohr once quipped, “ Prediction is very difficult, especially if it's about the future.” In a world filled with different predictions from dozens of news outlets and hundreds of commentators, Bohr has been proven pretty much spot on in his assessment of predictions.

Nobel Laureate Neils Bohr once quipped, “ Prediction is very difficult, especially if it's about the future.” In a world filled with different predictions from dozens of news outlets and hundreds of commentators, Bohr has been proven pretty much spot on in his assessment of predictions.

That's not to say predictions are useless. They are not useless. Predictions (or most of them, at least) are based on a fundamental picture including many variables. In the financial world, they often incorporate economic growth, unemployment, supply and demand, governmental policy changes and a host of other factors.

Read full article... Read full article...

Friday, April 03, 2009

Elite Junior Gold Mining Stocks at Insanely Low levels / Commodities / Gold & Silver Stocks

By: Zeal_LLC

Junior gold stocks are a contingent of the greater junior resources circuit that has simply been obliterated in the recent stock panic . Even though gold has been strong over this stretch, the risk capital that usually finds its way into these gold explorers had all but left the scene.

Junior gold stocks are a contingent of the greater junior resources circuit that has simply been obliterated in the recent stock panic . Even though gold has been strong over this stretch, the risk capital that usually finds its way into these gold explorers had all but left the scene. Read full article... Read full article...

Friday, April 03, 2009

Gold and Silver- To buy or not to buy – That is the question / Commodities / Gold & Silver 2009

By: Peter_Degraaf

Historically, and based on 35 years of data, gold usually puts in a bottom in March and a top in April. We've had the bottom in March (on March 18 th ), and we await a top in April.

Historically, and based on 35 years of data, gold usually puts in a bottom in March and a top in April. We've had the bottom in March (on March 18 th ), and we await a top in April.

This top in April usually lasts for several months, resulting in sideways action with a downward bias and another buying opportunity in June or July.

Read full article... Read full article...

Friday, April 03, 2009

Gold Bouncing Around $900 on Further Bad U.S. Jobs Data / Commodities / Gold & Silver 2009

By: Adrian_Ash

THE PRICE OF PHYSICAL GOLD slipped in a tight range near yesterday's two-week lows early Friday, bouncing around $900 an ounce for US investors as the 3-day jump in world stock markets faded.New data showed the US shedding jobs at a faster pace in March. A revision to Jan.'s figure pushing total job losses so far in 2009 above two million.

Read full article... Read full article...

Friday, April 03, 2009

Silver Market Forecast for 2009 and 2010 / Commodities / Gold & Silver 2009

By: David_Morgan

silberinfo: David, 2008 had a great beginning with silver over $21 but it ended poorly. From a fundamental point of view not much has changed. Why the high volatility?

silberinfo: David, 2008 had a great beginning with silver over $21 but it ended poorly. From a fundamental point of view not much has changed. Why the high volatility?

D. Morgan : From my perspective the market was overbought in March 2008 and in fact I sent a sell signal to all Morgan Report subscribers telling them to take some money off the table. Many did. I did not put out a buy signal until September 2008 but was too early and watched the market go down further. The last buy signal was around the 10th of December 2008, after the metals market had made a clear bottom. We have already taken partial profits on that.

Read full article... Read full article...

Friday, April 03, 2009

Bob Prechter on Silver & Gold / Commodities / Gold & Silver 2009

By: EWI

In case you hadn't noticed: Over the past year of financial turmoil, the "safe haven" premium of precious metals has offered about as much support as a rubber ducky in a tsunami. Despite a string of powerful rallies, silver and gold remain well below their March 2008 peaks.

In case you hadn't noticed: Over the past year of financial turmoil, the "safe haven" premium of precious metals has offered about as much support as a rubber ducky in a tsunami. Despite a string of powerful rallies, silver and gold remain well below their March 2008 peaks. Read full article... Read full article...

Thursday, April 02, 2009

G20 on IMF Gold Sales and SDRs / Commodities / Gold & Silver 2009

By: Adrian_Ash

"...Additional resources from agreed sales of IMF gold will be used, together with surplus income..."

APRIL FOOL'S CAME a day late to the gold market this week.

Thursday, April 02, 2009

Gold Falls as G20 Fight Deflation by Any Means / Commodities / Gold & Silver 2009

By: Adrian_Ash

THE PRICE OF physical gold fell against all major currencies early Thursday, dropping 2% versus the Dollar as global stock markets jumped and Treasury bonds were sold lower.

THE PRICE OF physical gold fell against all major currencies early Thursday, dropping 2% versus the Dollar as global stock markets jumped and Treasury bonds were sold lower. Crude oil bounced hard, back above $50 per barrel, as base metals and foodstuffs crept higher.

Read full article... Read full article...

Thursday, April 02, 2009

Gold Extra Scrap Supply Countered by Middle East Demand / Commodities / Gold & Silver 2009

By: Mark_OByrne

Gold rose slightly yesterday as the dollar fell out the outset of the G20 Summit in London. In trading in London, gold is down some 1% this morning as risk appetite returns to markets with stocks surging internationally.Read full article... Read full article...

Wednesday, April 01, 2009

When Gold Ruled the Earth, Part I / Commodities / Gold & Silver 2009

By: Adrian_Ash

"Gold's investment performance has dominated this decade. How come so few people have noticed...?"

"Gold's investment performance has dominated this decade. How come so few people have noticed...?"

NO FOOLING! It doesn't matter which currency you earn, spend or invest, gold bullion has been the best-performing asset class bar none this decade.

Read full article... Read full article...

Wednesday, April 01, 2009

Commodities Base-building into May / Commodities / CRB Index

By: Donald_W_Dony

KEY POINTS:

KEY POINTS:• The CRB continues to build a solid foundation for the next advance

• Gold expected to remain near $900 in April as US$ holds above support; $1,200 target

• Oil slowly follows gold’s lead upward; first target is $60

Read full article... Read full article...

Wednesday, April 01, 2009

Gold Sentiment and Trend Analysis / Commodities / Gold & Silver 2009

By: Jordan_Roy_Byrne

In recent writings I have forecasted a consolidation or small correction in Gold. It rebounded $300/oz while most markets sputtered. Yet, at $1,000/oz Gold was overbought and meeting technical resistance while stock indices and commodities were in the process of bottoming. As predicted, the Fed's monetization and “reflation” trade has thus far failed to lift Gold past $1,000/oz. Money is moving into other markets at a time when Gold is relatively extended, but extremely extended in relation to these other markets. Various sentiment data provide us with greater confirmation that the ancient metal of kings is in a period of consolidation.

In recent writings I have forecasted a consolidation or small correction in Gold. It rebounded $300/oz while most markets sputtered. Yet, at $1,000/oz Gold was overbought and meeting technical resistance while stock indices and commodities were in the process of bottoming. As predicted, the Fed's monetization and “reflation” trade has thus far failed to lift Gold past $1,000/oz. Money is moving into other markets at a time when Gold is relatively extended, but extremely extended in relation to these other markets. Various sentiment data provide us with greater confirmation that the ancient metal of kings is in a period of consolidation. Read full article... Read full article...

Wednesday, April 01, 2009

Gold Up as G20 Battle-Line Drawn Between Franco-Germany & Anglo-America / Commodities / Gold & Silver 2009

By: Adrian_Ash

THE SPOT PRICE of physical gold rose in London trade early Wednesday, while Asian stock markets caught up with Tuesday's US gains but European shares slipped back.Government debt – set to swell $3 trillion worldwide in 2009 on the back of stimulus spending – held flat, keeping the yield offered by 10-year US Treasury bonds below 2.70% per annum.

Read full article... Read full article...

Wednesday, April 01, 2009

G20 Summit Dominates Markets / Commodities / Gold & Silver 2009

By: Mark_OByrne

Gold rose 0.8% yesterday (silver -0.4%), as the dollar came under pressure ahead of the G20 gathering in London.

It was the last day of the first quarter which saw gold rise 4.3% which is a second straight quarterly gain. In the quarter, gold was up some 10% in euro terms and some 6% in pound terms.

Read full article... Read full article...

Tuesday, March 31, 2009

Gold, Copper and Uranium Stocks Outlook for 2009 / Commodities / Metals & Mining

By: The_Gold_Report

George Topping, a research analyst specializing in the mining sector at Blackmont Capital, pays closer attention to uranium and copper than he does gold and silver, but in this exclusive interview with The Gold Report, he shares what he foresees: gold flat at $950 per ounce (in real terms) through 2011, copper at $1.80 per pound in two years, and uranium nudging up $100 per pound within five years.

George Topping, a research analyst specializing in the mining sector at Blackmont Capital, pays closer attention to uranium and copper than he does gold and silver, but in this exclusive interview with The Gold Report, he shares what he foresees: gold flat at $950 per ounce (in real terms) through 2011, copper at $1.80 per pound in two years, and uranium nudging up $100 per pound within five years. Read full article... Read full article...

Tuesday, March 31, 2009

Huge Upside Potential for Gold Miners GDX ETF off of Base / Commodities / Gold & Silver Stocks

By: Mike_Paulenoff

Truth be told, I am not the only one who sees the huge base pattern and the upside potential off of the Market Vector Gold Miners ETF (AMEX: GDX) base. So what will differentiate who gets the benefit of the forthcoming upmove that realizes the potential of the pattern?

Truth be told, I am not the only one who sees the huge base pattern and the upside potential off of the Market Vector Gold Miners ETF (AMEX: GDX) base. So what will differentiate who gets the benefit of the forthcoming upmove that realizes the potential of the pattern? Read full article... Read full article...

Tuesday, March 31, 2009

Gold Benefits from U.S. Debt Monetization / Commodities / Gold & Silver 2009

By: Ned_W_Schmidt

The world does not need a New World Money backed by government IOUs. We already have an ideal One World Money in the form of Gold. It satisfies fully all the requirements of money. And most important, it has clearly demonstrated durability as a store of value. Gold, however, has one failing that prevents it from it being adopted by the nations of the world as the One World Money. Politicians cannot “print” more of it with which to buy votes. Can anyone imagine a U.S. Congress denying itself the right to spend money?

The world does not need a New World Money backed by government IOUs. We already have an ideal One World Money in the form of Gold. It satisfies fully all the requirements of money. And most important, it has clearly demonstrated durability as a store of value. Gold, however, has one failing that prevents it from it being adopted by the nations of the world as the One World Money. Politicians cannot “print” more of it with which to buy votes. Can anyone imagine a U.S. Congress denying itself the right to spend money? Read full article... Read full article...