Analysis Topic: Commodity Markets - Metals, Softs & Oils

The analysis published under this topic are as follows.Saturday, November 13, 2010

Why Some Think a Gold Standard Wouldn’t Work / Commodities / Gold and Silver 2010

By: Richard_Daughty

There is a lot of wailing and gnashing of teeth from Moron Keynesian Trash (MKT) about the brave Robert Zoellick, president of the World Bank, saying that what the world needs is a modified gold standard for currencies, which it does, in spades.

There is a lot of wailing and gnashing of teeth from Moron Keynesian Trash (MKT) about the brave Robert Zoellick, president of the World Bank, saying that what the world needs is a modified gold standard for currencies, which it does, in spades.

The Financial Times, long a champion for Keynesian stupidity despite constant inflation in prices, had an editorial from one of these MKT, who opines, “Could a gold standard help international currency co-ordination? In theory it could, if the state were willing to accept the restrictions on national monetary policy and the currency account adjustments that a gold standard entails.”

Read full article... Read full article...

Saturday, November 13, 2010

Panic Time for Peak Oil Pundits / Commodities / Crude Oil

By: Dian_L_Chu

It seems the panic time for both green enthusiasts and peak oil pundits.

According to a new paper by two researchers at the University of California – Davis, it would take 131 years for replacement of gasoline and diesel given the current pace of research and development; however, world's oil could run dry almost a century before that.

Saturday, November 13, 2010

Volume Signals Gold and U.S. Dollar Counter Trend Move / Commodities / Gold and Silver 2010

By: Jeb_Handwerger

Price action that comes after a major announcement reveals a lot about underlying economic trends and the psychology of the market. Leading up to the election investors became enthusiastic on precious metals and commodities as QE2 was celebrated. Then the official announcement of QE2 caused the precious metals to gap higher as euphoria of the Fed's move were celebrated. As the celebration continued for gold bugs, as hard as it was, I believed was time to fight the investment herd and take profits. I warned readers that a healthy correction could begin and do not buy the recent breakout. Key high volume reversal days and negative divergences indicated there could be 15-20% correction and a countertrend rally in the dollar.

Price action that comes after a major announcement reveals a lot about underlying economic trends and the psychology of the market. Leading up to the election investors became enthusiastic on precious metals and commodities as QE2 was celebrated. Then the official announcement of QE2 caused the precious metals to gap higher as euphoria of the Fed's move were celebrated. As the celebration continued for gold bugs, as hard as it was, I believed was time to fight the investment herd and take profits. I warned readers that a healthy correction could begin and do not buy the recent breakout. Key high volume reversal days and negative divergences indicated there could be 15-20% correction and a countertrend rally in the dollar.

Friday, November 12, 2010

Trading Gold Options with Long-term Calendar Spreads / Commodities / Gold and Silver 2010

By: J_W_Jones

At this point anyone following financial markets realizes that current market conditions are directly impacted by the movement of the U.S. dollar. Recently the dollar has shown strength and could potentially be putting in an intermediate or potentially longer term bottom. At this point it is a fool’s game making predictions, but the current Dollar Index daily chart shows that the price is above the 20 day simple moving average which is generally a bullish signal. The daily chart of the Dollar Index (.DXY) can be seen below.

At this point anyone following financial markets realizes that current market conditions are directly impacted by the movement of the U.S. dollar. Recently the dollar has shown strength and could potentially be putting in an intermediate or potentially longer term bottom. At this point it is a fool’s game making predictions, but the current Dollar Index daily chart shows that the price is above the 20 day simple moving average which is generally a bullish signal. The daily chart of the Dollar Index (.DXY) can be seen below.

Friday, November 12, 2010

Silver Consolidation and Monetary Reforms Give Gold Seal of Approval / Commodities / Gold and Silver 2010

By: Przemyslaw_Radomski

Now it’s official! The yellow metal has gotten the golden seal of approval. This week none other than the President of the World Bank said leading economies should consider readopting a modified global gold standard to guide currency movements. Writing in the Financial Times, Robert Zoellick, the bank’s president since 2007, says we need a successor to what he calls the “Bretton Woods II” system of floating currencies.

Now it’s official! The yellow metal has gotten the golden seal of approval. This week none other than the President of the World Bank said leading economies should consider readopting a modified global gold standard to guide currency movements. Writing in the Financial Times, Robert Zoellick, the bank’s president since 2007, says we need a successor to what he calls the “Bretton Woods II” system of floating currencies.

Friday, November 12, 2010

Can Gold Do Now What The Rentenmark Did For Germany In 1923? / Commodities / Gold and Silver 2010

By: Julian_DW_Phillips

What was a "Rentenmark"?

What was a "Rentenmark"?

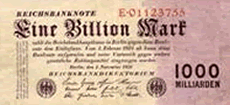

At the left you see a one billion Mark note that was among the last printed notes of the Weimar Republic which saw the dreadful hyperinflation from the war's end to August 1923. At the right was a currency that replaced it and which helped terminate the hyperinflation that infested Europe, but was at its worst in Germany.

Read full article... Read full article...

Friday, November 12, 2010

Silver Extremely Overbought, Tops Analysis / Commodities / Gold and Silver 2010

By: Zeal_LLC

Since emerging out of the usual summer doldrums, silver’s performance has been dazzling. Buyers are returning to this hyper-speculative metal en masse, driving some fast-and-furious gains. And the Fed poured rocket fuel on silver’s hot rally last week when it announced its newest inflationary campaign.

Since emerging out of the usual summer doldrums, silver’s performance has been dazzling. Buyers are returning to this hyper-speculative metal en masse, driving some fast-and-furious gains. And the Fed poured rocket fuel on silver’s hot rally last week when it announced its newest inflationary campaign.

The broad commodities rally the Fed sparked helped catapult silver up a massive 11.4% in just 3 trading days! This amazing surge capped a total run of 58.3% in the several months since silver’s summer lows. It’s been a lot of fun watching some life return to this long-neglected metal, and we’ve enjoyed some big realized gains in silver stocks thanks to this silver upleg.

Read full article... Read full article...

Friday, November 12, 2010

Gold and Silver Tumble as Dollar Rises on Irish Crisis / Commodities / Gold and Silver 2010

By: Adrian_Ash

THE PRICE OF GOLD gave back the last of this week's move to new Dollar and Sterling record-highs in London trade on Friday, but held nearly 1.8% stronger for Eurozone investors as the Irish debt crisis forced a joint statement from European leaders attending the G20 summit in Seoul.

THE PRICE OF GOLD gave back the last of this week's move to new Dollar and Sterling record-highs in London trade on Friday, but held nearly 1.8% stronger for Eurozone investors as the Irish debt crisis forced a joint statement from European leaders attending the G20 summit in Seoul.

US stock markets opened the day 0.5% lower – and broad commodity markets fell over 1.5% – as rumors spread of a possible tightening in Chinese interest rates following yesterday's stronger-than-expected consumer price inflation figures.

Friday, November 12, 2010

The Gold Standard Never Dies, Despite Bankster's Best Efforts to Kill it / Commodities / Gold and Silver 2010

By: LewRockwell

John Maynard Keynes thought he had pretty well killed gold as a monetary standard back in the 1930s. Governments of the world did their best to help him. It took longer than they thought. Gold in the money survived all the way to Nixon, and it was he who finally drove the stake in once and for all. That was supposed to be the end of it, and the beginning of the glorious new age of paper prosperity.

John Maynard Keynes thought he had pretty well killed gold as a monetary standard back in the 1930s. Governments of the world did their best to help him. It took longer than they thought. Gold in the money survived all the way to Nixon, and it was he who finally drove the stake in once and for all. That was supposed to be the end of it, and the beginning of the glorious new age of paper prosperity.

Friday, November 12, 2010

Gold Profit Opportunities and Threats from The Debt Bomb Exploding / Commodities / Gold and Silver 2010

By: DeepCaster_LLC

Here is the glaring hole in the United States Federal Reserve's approach to what it calls stimulus, and what history will one day categorize as fraud: You can't use your own debt to purchase more debt when you can't repay the original debt. The crime is compounded when you know you're never going to repay the debt. It amounts to treason to intentionally destroy the integrity of the nation's money."

Here is the glaring hole in the United States Federal Reserve's approach to what it calls stimulus, and what history will one day categorize as fraud: You can't use your own debt to purchase more debt when you can't repay the original debt. The crime is compounded when you know you're never going to repay the debt. It amounts to treason to intentionally destroy the integrity of the nation's money."

Friday, November 12, 2010

Natural Gas Investing, Something Important You Need to Know / Commodities / Natural Gas

By: The_Energy_Report

Shale gas changed everything, according to professional geologist and Pierce Points Newsletter Writer Dave Forest. Using hydraulic fracturing technology, North American gas producers have unlocked trillions of cubic feet of new, unconventional gas reserves from shale over the past decade. "U.S. natural gas output has taken off since 2006," he says, "as shale plays like the Haynesville, Marcellus and Eagle Ford have come online." So, with all this new supply, why has U.S. gas demand remained relatively flat? Obviously, the new world of gas supply and demand has not been kind to prices. What will drive them higher? In this Energy Report exclusive, Dave reveals that Eagle Ford producers could give their gas away and still make a tidy profit on the shale wells selling nat gas liquids.

Shale gas changed everything, according to professional geologist and Pierce Points Newsletter Writer Dave Forest. Using hydraulic fracturing technology, North American gas producers have unlocked trillions of cubic feet of new, unconventional gas reserves from shale over the past decade. "U.S. natural gas output has taken off since 2006," he says, "as shale plays like the Haynesville, Marcellus and Eagle Ford have come online." So, with all this new supply, why has U.S. gas demand remained relatively flat? Obviously, the new world of gas supply and demand has not been kind to prices. What will drive them higher? In this Energy Report exclusive, Dave reveals that Eagle Ford producers could give their gas away and still make a tidy profit on the shale wells selling nat gas liquids.

Thursday, November 11, 2010

When to Sell Gold / Commodities / Gold and Silver 2010

By: Casey_Research

Terry Coxon, Senior Editor, Casey Research writes: By now you have plenty of reason to congratulate yourself for having boarded the gold bandwagon. The early tickets are the cheap ones, and you've already had quite a ride. The best of the ride, I believe, is yet to come, and it should be very good indeed. It should be so much fun that your wallet may start to feel a bit giddy - which can be dangerous. So it would be wise to consider, now, how things will be and how they will feel when the current bull market in gold reaches its "end of days." Because it will end.

Terry Coxon, Senior Editor, Casey Research writes: By now you have plenty of reason to congratulate yourself for having boarded the gold bandwagon. The early tickets are the cheap ones, and you've already had quite a ride. The best of the ride, I believe, is yet to come, and it should be very good indeed. It should be so much fun that your wallet may start to feel a bit giddy - which can be dangerous. So it would be wise to consider, now, how things will be and how they will feel when the current bull market in gold reaches its "end of days." Because it will end.

Thursday, November 11, 2010

Fed QE2 $600 Billion of Money Printing Over the Next Eight Months / Commodities / Gold and Silver 2010

By: Gary_Dorsch

Crossing the Rubicon into the World of QE - “Imagination is more important than knowledge,” the brilliant Albert Einstein used to say. Imagine for just a moment that the Dow Jones Industrials has become a key instrument of national economic policy, and that by “actively managing” its direction, the Federal Reserve could impact the wealth of tens of millions of US households, and by extension, influence consumer confidence and spending. By ramping up the money supply, and slashing interest rates to zero percent, in order to inflate stock market bubbles, the Fed could in theory, fuel an economic rebound.

Crossing the Rubicon into the World of QE - “Imagination is more important than knowledge,” the brilliant Albert Einstein used to say. Imagine for just a moment that the Dow Jones Industrials has become a key instrument of national economic policy, and that by “actively managing” its direction, the Federal Reserve could impact the wealth of tens of millions of US households, and by extension, influence consumer confidence and spending. By ramping up the money supply, and slashing interest rates to zero percent, in order to inflate stock market bubbles, the Fed could in theory, fuel an economic rebound.

Thursday, November 11, 2010

Why $100 Dollar Crude Oil Is Rational / Commodities / Crude Oil

By: Andrew_McKillop

At the present time, because "currency wars" are the new Call of Duty for finance ministers and central bankers worldwide, it could be risky to predict oil prices attaining US$ 100 a barrel before year end. If the rash of competitive devaluation and depreciation of leading moneys continues, especially the US dollar and the euro, with the Chinese Yuan still receiving the same treatment, a tilt back into global economic recession is in no way impossible. And any dip in global economic growth will slay oil prices, like other commodities and equity values.

At the present time, because "currency wars" are the new Call of Duty for finance ministers and central bankers worldwide, it could be risky to predict oil prices attaining US$ 100 a barrel before year end. If the rash of competitive devaluation and depreciation of leading moneys continues, especially the US dollar and the euro, with the Chinese Yuan still receiving the same treatment, a tilt back into global economic recession is in no way impossible. And any dip in global economic growth will slay oil prices, like other commodities and equity values. Read full article... Read full article...

Thursday, November 11, 2010

Gold, The Market's Global Currency / Commodities / Gold and Silver 2010

By: Robert_Murphy

World Bank president Robert Zoellick has stirred up a hornet's nest with his recent call for a return to a gold anchor[1] in the global financial system. The usual suspects immediately denounced him, with Keynesian Brad DeLong anointing Zoellick the "Stupidest Man Alive."

World Bank president Robert Zoellick has stirred up a hornet's nest with his recent call for a return to a gold anchor[1] in the global financial system. The usual suspects immediately denounced him, with Keynesian Brad DeLong anointing Zoellick the "Stupidest Man Alive."

Thursday, November 11, 2010

Gold Jumps Back Above $1400, as Contagion Hits Eurozone Bonds / Commodities / Gold and Silver 2010

By: Adrian_Ash

THE PRICE OF GOLD gave back an earlier rise in London trade on Thursday morning, still recording its third-highest ever Gold Fix – and the fourth Fix this week above $1400 an ounce – as Asian stock markets closed marginally higher but European share markets stalled.

THE PRICE OF GOLD gave back an earlier rise in London trade on Thursday morning, still recording its third-highest ever Gold Fix – and the fourth Fix this week above $1400 an ounce – as Asian stock markets closed marginally higher but European share markets stalled.

Thursday, November 11, 2010

Invest in Gold with Mining ETFs / Commodities / Gold and Silver 2010

By: Ron_Rowland

Do you like to dig? I have to admit, it’s not my favorite thing. But if I knew there was gold in the ground I might think differently.

Do you like to dig? I have to admit, it’s not my favorite thing. But if I knew there was gold in the ground I might think differently.

In fact, there is gold in the ground — and plenty of other valuable minerals, too. The hardest part is finding it. However, the digging gets a lot easier when you know where to aim.

Read full article... Read full article...

Thursday, November 11, 2010

West Loses Resources War, China Controls Rare Earths and Middle East Has Crude Oil / Commodities / Metals & Mining

By: Dian_L_Chu

While most are anxiously anticipating a grand currency showdown at the G20 summit in Seoul this month, rare earths is bound to be one act of the G20 high Korean Drama amid the mounting worries among corporations and governments around the world about China’s recent export restrictions and embargo,

While most are anxiously anticipating a grand currency showdown at the G20 summit in Seoul this month, rare earths is bound to be one act of the G20 high Korean Drama amid the mounting worries among corporations and governments around the world about China’s recent export restrictions and embargo,

Thursday, November 11, 2010

SILVER Junior Miners May Lead To Fortune / Commodities / Gold and Silver 2010

By: Bob_Clark

"There is a tide in the affairs of men, which taken at the flood, leads on to fortune." I have always loved that quote from Shakespeare's "Julius Caesar". Every trader and investor should know it by heart.

"There is a tide in the affairs of men, which taken at the flood, leads on to fortune." I have always loved that quote from Shakespeare's "Julius Caesar". Every trader and investor should know it by heart.

Are we a float on a full sea? What vessel will serve us best?

Thursday, November 11, 2010

Going Back to a Gold Standard? / Commodities / Gold and Silver 2010

By: Adrian_Ash

Three reasons you need your own private Gold Standard, rather than waiting on "sound money" from government...

Three reasons you need your own private Gold Standard, rather than waiting on "sound money" from government...

DID GOLD's first foray over $1,400 mean we're going back to a Gold Standard?

Read full article... Read full article...