Analysis Topic: Commodity Markets - Metals, Softs & Oils

The analysis published under this topic are as follows.Sunday, June 03, 2007

Gold and Silver Analysis - Precious Points: Why This Rebound Looks Real / Commodities / Gold & Silver

By: Dominick

Joe Nicholson writes : “With the market all but giving up on rate cut relief this week, the proliferation of leveraged buyouts and junk bond issuance, and the steady surge in bank loans and global liquidity, give every indication that real interest rates might be too low.” ~ Precious Points: No Lack of Support , May 27, 2007

Weeks ago this update said that what gold needs to get back its shine is a rebound in the U.S. economy. As you know, this is exactly what recent data has suggested, and the metals have acted accordingly. The focus for some time here has been on the Fed's open market activity, and specifically the “sloshing” repo funds. After breaking the streak of reverses two weeks ago with a modest $3 billion net addition, last week concluded with a net add of $6.75 billion. In a rate-targeting regime, this reflects perception of a stronger economy driving demand for more base money, and the overall liquidity is an ideal environment for appreciation of precious metal.

Read full article... Read full article...

Sunday, June 03, 2007

Weekly Gold and Silver Technical Analysis Report - 3rd June 2007 - Technically Precious with Merv / Commodities / Gold & Silver

By: Merv_Burak

A bounce off the long term moving average line and it looks like more smiles ahead. What could go wrong? We'll soon know if anything.

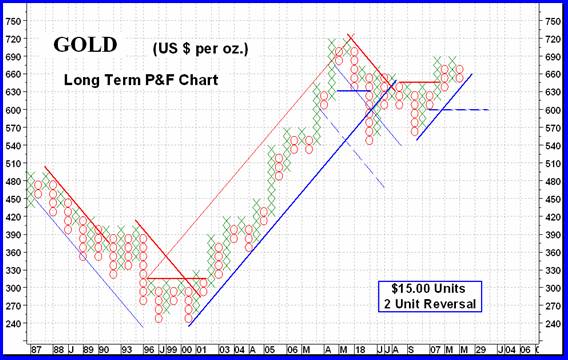

GOLD: LONG TERM

Saturday, June 02, 2007

Cycle Turn and Trend Indicators and a Look at Crude Oil and Gasoline / Commodities / Crude Oil

By: Tim_Wood

Earlier this past week I had intermediate-term sell signals on both crude oil and unleaded gasoline. Given that we are just now approaching the hurricane and summer driving seasons, I have to wonder if these signals are going to be brief or if they are discounting the season ahead and if lower energy prices truly lie ahead.Read full article... Read full article...

Saturday, June 02, 2007

Silver: The Long Term View / Commodities / Gold & Silver

By: Roland_Watson

Back in the depression year of 1932 silver was suffering. It had hit a low price of 24 cents per troy ounce as the forces of deflation assaulted commodities across the board. Could things get any worse as no end seemed in sight to the widespread massacre of assets across America and the world?

As it turned out, this was the nadir year for silver as prices began an upturn that led to a zenith as yet unparalleled. Between 1932 and 1980 silver advanced from 24 cents to 50 dollars an ounce. That is a 200-fold increase over 48 years!

Read full article... Read full article...

Saturday, June 02, 2007

France is Still a Nuclear Power Global Leader / Commodities / Uranium

By: Elliot_H_Gue

Vive La France !

France remains a key global leader in the use of nuclear power, garnering more than 80 percent of its electricity from nuclear plants. The recent election of Nicolas Sarkozy as president of France has bullish implications for the future of nuclear power.

Read full article... Read full article...

Friday, June 01, 2007

China Diversifying Reserves into Equities and into Gold? / Commodities / China Economy

By: Julian_DW_Phillips

Last year the Chinese government decided to change its policy on the composition of its reserves to reflect the composition of its trading partners. This was an effort to hold currencies sufficient to cover 'rainy days' with these partners. But as reserves are at levels way above those needed for a 'rainy day', the Chinese government finds itself holding well over a $ trillion more than it needs and this amount is rising by $250 billion a year and sure to rise.Read full article... Read full article...

Friday, June 01, 2007

Copper Long-Term Bull Market - 2 / Commodities / Metals & Mining

By: Zeal_LLC

Scott Wright writes : Five years into its amazing bull market, the king of the base metals continues to hold strong through a renewed onslaught of adversity. After an exciting 2006 that saw copper shatter all-time highs, this red metal continues to trade at levels that most thought improbable several years ago.

Copper's success has given it quality time in the spotlight which has ultimately garnered it increasing mainstream attention. Even on CNBC when headline metals quotes are periodically displayed, copper now shares real estate with gold and silver. But is the fame and fortune that copper had thrust upon it sustainable?

Read full article... Read full article...

Thursday, May 31, 2007

Silver has Turned the Corner with the Resumption of the Bull Market / Commodities / Gold & Silver

By: Peter_Degraaf

The fundamental outlook for silver continues to be extremely bullish!

In 2003 I remember reading an article by Douglas Kanarowski titled: “ 70 Approaching Forces for Higher Silver prices ”. If Mr. Kanarowski were to re-write the article today, he could add several more reasons! [*]

Silver is being utilized more and more in nanotechnology applications. According to a recent report from NanoMarkets, a leading industry analyst firm based in California, the market for silver conductive inks is expected to rise from the current 176 million dollars per annum to 1.2 billion dollars during next 7 years. A seven-fold increase!

Read full article... Read full article...

Thursday, May 31, 2007

Gold $666 Closes at Fourth Best Month Ever and Rising? / Commodities / Gold & Silver

By: Adrian_Ash

"...Gold just closed out its fourth best month ever. Its monetary opponents, meantime, continue scrapping over which currency can sink the lowest, the fastest..."

OIL DOWN, gold up – and still the mass of investors, led by Wall Street, can't figure out what's driving this six-year bull market in bullion.

Read full article... Read full article...

Thursday, May 31, 2007

America's Uranium Solution is In-Situ Recovery Mining / Commodities / Uranium

By: Money_and_Markets

Sean Brodrick writes: Last week, while at the U2007 Global Uranium Symposium, I visited three uranium projects. Two were on the conference agenda, one I was lucky to attend on a smaller, private tour. These tours taught me a lot about a particular type of uranium mining — one that will likely become the future face of uranium mining in the U.S.

Sean Brodrick writes: Last week, while at the U2007 Global Uranium Symposium, I visited three uranium projects. Two were on the conference agenda, one I was lucky to attend on a smaller, private tour. These tours taught me a lot about a particular type of uranium mining — one that will likely become the future face of uranium mining in the U.S.

Is there profit potential in this? You bet!

All three projects I visited use In-Situ Recovery (ISR). Basically, ISR uses water pumped under high pressure to extract uranium from rocks. At the Texas sites, the water is injected with a mix of either oxygen or carbon dioxide to dissolve the uranium from the surrounding rock.

It sounds weird, but it works. Oh, man, does it work! Using basically carbonated water, you can recover about 75% of a uranium resource and never dig a pit. Let me tell you why this technology is so important here in America …

Read full article... Read full article...

Thursday, May 31, 2007

Uranium Targets $150 whilst Gold Investors Worry / Commodities / Gold & Silver

By: David_Vaughn

I know this subject probably gets boring to hear about, but it is still at the top of the charts so it deserves coverage.

We are talking about uranium of course. But what about gold? Everyone is panicking over gold and I can tell by the emails I receive that many are wringing their hands in worry and anxiety. Do I know what gold will do tomorrow? Yes, I do. It will do what it wishes to do regardless of projections from optimists or the dooms day club.

Read full article... Read full article...

Wednesday, May 30, 2007

Why is Gold Trending Lower? / Commodities / Gold & Silver

By: Christopher_Laird

Gold and the HUI have been trending down. I hear various reasons proffered about why – central banks are selling – that is why gold is down – etc. Indeed, the Spanish central bank has sold 80 tons of gold in the last two months because they are seriously low on foreign reserves. That is another story.

But, I see very good macroeconomic reasons for gold to be tepid and down now. In fact, things like what the USD does are far more weighty to gold, than temporal central bank selling of gold. True, 40 tons is a lot, but compared to the financial mass of the USD for instance, that is literally a drop in the bucket.

Read full article... Read full article...

Wednesday, May 30, 2007

The Dollar: An Agonizing Reappraisal / Commodities / Gold & Silver

By: Professor_Emeritus

Part One of a New Series Gold Standard University : Gold Vanishing into Private Hoards

Introduction. While doing research in the Library of the University of Chicago in the early 1980's I came across the unfinished manuscript of a book with the title: The Dollar: An Agonizing Reappraisal . It was written in the year 1965. It has never been published (although it has received private circulation). The author, monetary scientist Melchior Palyi, a native of Hungary, died before he could finish it. Monetary events started to spin out of control in 1965, culminating in the default on the international gold obligations of the United States of America six years later in August,1971. Palyi had correctly prophesied that event which occurred after he died.

Read full article... Read full article...

Wednesday, May 30, 2007

The Bank of Montreal Follies, the Mainstream Media and More.. / Commodities / Derivatives

By: Rob_Kirby

These guys should take this comedy routine on the road. It was just 10 days ago that I penned a piece called, Derivative Disaster: Deriving the Truth , where I commented,Read full article... Read full article...

Monday, May 28, 2007

Gold and Silver Analysis - Precious Points: No Lack of Support / Commodities / Gold & Silver

By: Dominick

Oroborean writes: This week saw a full cycle in the 60-min gold trend cycle chart and, as warned, the move up did not see a dramatic increase in price. This, of course became it's own warning signal. Stocks and metals both saw a pullback on Thursday that had most major indices breaking through long-standing trendlines and the 60-min gold chart racing back towards the bottom.Read full article... Read full article...

Sunday, May 27, 2007

Weekly Gold and Silver Technical Analysis Report - 27th May 2007 - Technically Precious with Merv / Commodities / Gold & Silver

By: Merv_Burak

Gold just keeps moving one day up and another day down, but in the end, mostly down. Is there an end?

GOLD : LONG TERM

Friday, May 25, 2007

Silver Stocks on the Rise / Commodities / Gold & Silver Stocks

By: Roland_Watson

While we await silver to press onto new highs, what is the current situation with silver mining stocks? If you go to Yahoo! Finance, you will find various indices to represent various mining companies with an emphasis on gold such as the HUI and the XAU. You will of course be able to check up on your favourite silver stock but there is no silver stock index one can consult. For that reason, I formulated my own Silver Analyst Stock Composite index or the SASC index for short. Its chart for the last 5 years is shown below being a composite of 14 well known stocks with a silver background. The 50 day and 200 day moving averages are also shown in red and green.Read full article... Read full article...

Friday, May 25, 2007

Fade the Futures Gurus, Gold Futures CoT 2 / Commodities / Gold & Silver

By: Zeal_LLC

Adam Hamilton writes: I have loved reading my entire life, so when I am not studying the financial markets one of my favorite pastimes is reading great fiction. My favorite genre these days is the rich adventure/action stories spun out by brilliant authors like Clive Cussler, Jack Du Brul, and James Rollins. A good book makes even the very best movies seem like shallow grade-school plays by comparison.

Adventure stories often have history woven in as the heroes chase after some priceless artifact. Usually some ancient priest-type caste existed that hid the artifact away to protect it from a calamity in the past so our heroes can unlock its secrets in the present. These historical priests often used special knowledge that only they had, usually scientific in nature, to cement their power in the society.

Read full article... Read full article...

Friday, May 25, 2007

Exelon VP Thanks Speculators for Uranium Price Rise / Commodities / Uranium

By: James_Finch

We thought by now we'd heard it all. But the quote which follows, given to us in a tape-recorded telephone interview by the man who obtains nuclear fuel for the largest nuclear utility in the United States, surprised even us.Read full article... Read full article...

Thursday, May 24, 2007

Silver Market Update : Silver Bull Set to Resume / Commodities / Gold & Silver

By: Clive_Maund

While looking weaker than gold at this time, silver is expected to turn up shortly for the same reason as gold - the inflationary implications of an impending sharp rise in the oil price – the expected breakout by oil from its large Head-and-Shoulders bottom formation will project it to a minimum target at $80.Read full article... Read full article...