Analysis Topic: Commodity Markets - Metals, Softs & Oils

The analysis published under this topic are as follows.Friday, April 13, 2007

South Wyoming's Best Uranium Discovery? / Commodities / Uranium

By: James_Finch

Until the previous uranium cycle ended in the 1980s, Juniper Ridge had reportedly been the site of 12 small open-pit uranium mines. Many in the industry had called it the ‘best uranium discovery in southern Wyoming.'

In yesterday's conversation with Dr. Robert Rich, we determined he had the credentials and industry knowledge to provide Yellowcake Mining (YCKM) with credibility in the uranium space. But, what about the geology? Many juniors have skated onto the radar by using a ‘big name' to attract investors. Too often, the property's geology is lacking the factors which would lead to actual uranium mining. Often, the industry-celebrity name is barely familiar with the company's property.

Read full article... Read full article...

Thursday, April 12, 2007

Uranium Expert: Consolidation, But No ‘Price Crash’ Ahead / Commodities / Uranium

By: James_Finch

Soaring yellowcake prices have accelerated a greater number of uranium juniors rolling off the assembly line. As fast as stock promoters can revive old shells, joint venture a more serious uranium company's castaway property into the re-named shell, and then wheel a former ‘big name' out of retirement (or a nursing home), the company will announce they are in the ‘hunt' for uranium.

Nearly all are mining the stock market – that means you, specifically the investor. Very few, probably less than 10 percent, have any realistic chance of ever putting a shovel to the ground and coming up with uranium ore. Fewer still are likely to intersect sufficiently economic delineation holes which might someday become a uranium mine.

Read full article... Read full article...

Wednesday, April 11, 2007

The Gold Sector Starts a New 13 Week Bullish Cycle / Commodities / Gold & Silver

By: Donald_W_Dony

From the correction low in early October 2006, gold has shown increasing technical strength as each new 13-week trading cycle unfolds and lifts the metal higher. This sequence of improving prices gives a good indication of expanding strength and also helps forecast the movement of this precious metal over the next few months. With a new 13-week trading cycle developing in the first half of April (see the lower portion of Chart 1), a price peak can be anticipated mid-point (second half of May) at a level of near $720. The next trough should form in late June.Read full article... Read full article...

Wednesday, April 11, 2007

Molybdenum Mining Stocks? Check with Locals, Natives First / Commodities / Metals & Mining

By: James_Finch

Institutions and investors are climbing aboard as greater interest emerges in molybdenum. The silvery white metal adds anti-corrosive properties to everything from pipelines and power plants to desalination plants, automotive parts and air pollution systems. Find out if the project has permits before jumping into the moly mania. We interviewed Adanac Molybdenum executive chairman Larry Reaugh about the dozens of junior resource companies, which now proclaim they are part of the Molybdenum Bull Market. His company appears as a potential molybdenum producer on the horizon.Read full article... Read full article...

Wednesday, April 11, 2007

Uranium prices rise 19% to $113 in one week! / Commodities / Uranium

By: Money_and_Markets

Sean Brodrick writes :Boy, I sure hope you're holding some uranium investments … because at the latest auction for the white-hot metal, the spot price of uranium oxide (U3O8) soared $18 to $113 per pound!

That's a 19% rise in just one week. According to Nuclear Market Review , it's the largest single weekly price increase since uranium has been tracked!

And you know what?

You ain't seen nuthin' yet!

Read full article... Read full article...

Tuesday, April 10, 2007

Molybdenum and Uranium: Vital for Nuclear Reactors / Commodities / Uranium

By: James_Finch

Molybdenum plays a more vital role in the global nuclear renaissance than you might suspect. Without the silvery white metal, the world's energy infrastructure would somewhat suffer. But, nuclear power plants would be set back at least two decades. The new high performance stainless steels (HPSS) contain as much as 7.5 percent molybdenum and can add more than three times the life to the world's aging nuclear fleet condenser tubes.

Molybdenum plays a more vital role in the global nuclear renaissance than you might suspect. Without the silvery white metal, the world's energy infrastructure would somewhat suffer. But, nuclear power plants would be set back at least two decades. The new high performance stainless steels (HPSS) contain as much as 7.5 percent molybdenum and can add more than three times the life to the world's aging nuclear fleet condenser tubes.

Monday, April 09, 2007

Commodities Market Wrap - Gold, Silver, Crude Oil and Mining Stocks / Commodities / Gold & Silver

By: Douglas_V_Gnazzo

Gold

Gold put in another good week closing up $10.40 to $679.40 (+1.55%). This was gold's highest weekly close in 6 weeks, and was the daily high close for the week as well.

Gold's next target is the Feb. high of $686.70 on a closing basis and $692.50 on an intra-day basis. From there the next target is the multi-year high of May 2006 at $730.40 (intra-day).

Read full article... Read full article...

Monday, April 09, 2007

War with Iran? - The Crude Oil Crisis Leads to Gold and Silver / Commodities / Crude Oil

By: Julian_DW_Phillips

All is not well in the oil market. Not simply because of the demand supply pressures.

Oil supplies, to a large enough extent to exert overwhelming pressure on the oil price, reside in nations that are not only involved in conflict within themselves over their own branches of Islam, but in nations that are thoroughly disposed to loathe the West, particularly the U.S. of A.

Now add to that the wealth they themselves have in their pockets, which is sufficient to influence the flow of the U.S.$ market to its detriment, a market that is already under pressure from an over issuance of the currency to support the bleeding Trade deficit now at destructive proportions, and the potentially overwhelming surpluses in the hands of all the nations of the world.

Read full article... Read full article...

Monday, April 09, 2007

In Situ Recovery Uranium Mining - The Water Factor / Commodities / Uranium

By: James_Finch

Our interview with Glenn Catchpole of Uranerz Energy explains what investors should know about water's role in ISR uranium mining. Companies with an ISR project may disappoint shareholders because of the water location, or lack of water, in relation tothe ore body.

As part of our efforts to better educate not only uranium stock analysts and investors, but also the media and environmental groups, we have expanded upon last year's introduction to In Situ Recovery uranium mining with our Advanced ISR Series. Water plays an integral role for In Situ Recovery (ISR) uranium mining.

If the water is not in the right place, ISR mining can not take place. A company's ‘pounds in the ground' are nearly worthless or may have to be extracted through other means.

Sunday, April 08, 2007

Commodity Markets Analysis, Meat, Gold, Corn and Peak Oil / Commodities / Inflation

By: David_Petch

Where's the Beef?? It Better be in Your Freezer - Several different things I want to address first before getting to analysis of the HUI. The first one has to do with meat. The governments do not include the price of food or energy in the core rate of inflation (soon they will be including those that lie in graveyards into their index to further “average” the price down I am sure of it) so everything that you or I have to buy in the grocery store no matter how much costs rise is not “their definition of inflation”. This is the government's way of hiding the volumes of money being created out of thin air.

The coming of Peak Oil is causing a movement in the US to produce ethanol in order to provide an alternate fuel source. The big corporations are pushing for corn because it is big money. Use of straw grass, sugar beets etc. is far more efficient in the energy balance of the production equation.

Read full article... Read full article...

Sunday, April 08, 2007

Will Rising World Crude Oil Prices Fuel Inflation In Volatile Times / Commodities / India

By: Submissions

Petroleum prices have started racing to $70 a barrel after staying below $60 for the better part of the winter, now coming to an end around the world. What does this portend? Does it signal that the good times are over and recession is about to be triggered in America and a number of advanced countries? The housing boom in the US is beginning to bust and a crisis is looming on the horizon. This has already created a degree of concern, if not alarm, around the world, including India.How does it affect India and the rest of the world? Because the US dollar value is being eroded and the rupee, yen, euro, Chinese and several other currencies are being valued upwards, there is an implied cushioning of the high petroleum prices, but exporters are losers in cheaper dollars as they earn fewer rupees. The worst affected are the outsourcing companies engaged in providing information technology through service centers as well as call centers, which cover a wide spectrum of the industry.

Read full article... Read full article...

Wednesday, April 04, 2007

Real Investment Returns Are What Count...SO BUY GOLD! / Commodities / Money Supply

By: Richard_J_Greene

There is no shortage of commentary in financial newspapers, hemming and hawing over such matters as GDP growth, or the CPI data, or even the same store sales of major retailers. The fact of the matter is that all such releases are virtually worthless since their unit of measure being reported is in a fluctuating measure that is constantly changing – the US dollar; (or any other paper currency for that matter).

It is akin to weighing yourself on a bathroom scale but allowing the amount of ounces in a pound to constantly fluctuate. What good would that kind of data be to anyone? Yet this is precisely what analysts and commentators debate with constantly in the financial press and on stock market shows such as CNBC.

Read full article... Read full article...

Wednesday, April 04, 2007

Could Uranium hit $1,000 a pound? / Commodities / Uranium

By: Money_and_Markets

Sean Brodrick writes : If you knew about an investment that, by conservative estimates, would increase in value 47% in the next 18 months, would you buy it?

Well, today I want to tell you about such an investment — uranium. Heck, just a few months ago, I said uranium would hit $100 per pound by the end of this year. It looks ready to hit that target this month !

In just the past year, the white-hot metal has surged 137% to $95 per pound. That's far beyond the expectations of most market analysts. So now they're rolling out new estimates — higher and higher.

Read full article... Read full article...

Tuesday, April 03, 2007

Gold Mining Companies - Why larger exploration budgets won't mean higher gold mining output / Commodities / Metals & Mining

By: Adrian_Ash

AS THE TREND for spot gold prices to move higher rolls on, the big gold mining companies keep racing to re-stock their shrinking reserves.Three of the larger gold miners just said they're going to spend record sums trying to find new gold-in-the-ground. Trying to pick the winners – and selecting junior miners on the brink of receiving a hot takeover bid – might just pay off handsomely.

But don't neglect the bigger picture as you chase these short-term M&A profits. "Route One" to growing proven and probable reserves in the ground is more than likely to eat up total exploration budgets in 2008 and beyond.

Read full article... Read full article...

Tuesday, April 03, 2007

Commitment of Traders Reports Analysis - Net Commercials and the US Dollar Setup / Commodities / Technical Analysis

By: James_West

Volatility Index

VIX [ http://www.buythebottom.com/vix.html ]

Commercials are recent buyers of the VIX. Thus far, the setup looks more neutral than anything else. A classical COT setup to the long side would result if net-commercial position rose near or above 4,000 contracts.

Last week I mentioned that the VIX looked overextended to the downside and would probably retest its 10-day moving average (MA). Over the next several days, the VIX did indeed rally and is now trading above its 10-day MA in the 14 to 16 dollar range. With the bullish setup in the stock market right now, I would expect the VIX to decline over the next little while, and ultimately end up under $12. However, if we see the VIX rallying and closing above $16, that would tell me that volatility decided to stick around. Speaking of which, a move above $16 for the VIX would probably also translate into further weakness in the stock market.

Read full article... Read full article...

Tuesday, April 03, 2007

Permitting of New US Uranium Mines Takes Many Years / Commodities / Uranium

By: James_Finch

Permitting a uranium mine requires more than a simple application to mine. And, as we discovered, the process can take between three and six years (sometimes even longer), costing several million dollars and requiring numerous scientific studies on a company's property. This could add additional pressure to uranium prices.

Few investors and analysts have a firm grasp of the length of time environmental studies and the approvals process requires. Having visited numerous investor forums, we realized many investors believe a property is drilled and then mined, after a brief permitting period. Quite the opposite is true, as explained to us by Richard Blubaugh, environmental manager for Powertech Uranium.

Read full article... Read full article...

Monday, April 02, 2007

Honest Money - Gold and Silver Technical Report & Forecast / Commodities / Gold & Silver

By: Douglas_V_Gnazzo

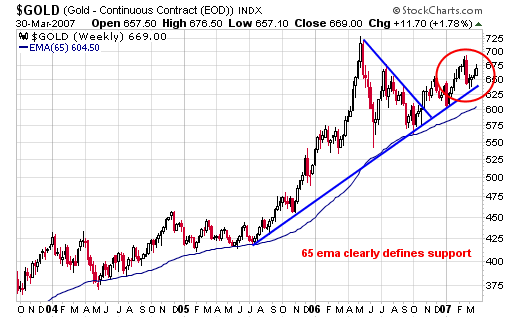

Gold had a good week rallying up $11.70 to close the week out at $669 (+1.78%). It was the highest daily close of the week and the highest weekly close in 5 weeks.

The weekly chart below clearly distinguishes the long term trend line that continues to remain above its 65 week moving average. The rising trend line has support at just under $650.00, while the 65 ema comes in at $604.50.

Sunday, April 01, 2007

Silver's Failure to Breakout above Resistance increases risks of a Sharp Fall / Commodities / Gold & Silver

By: Clive_Maund

The silver chart looks considerably less inspiring than the gold chart at this juncture, which is perhaps not so surprising as after outperforming gold last year, it has been underperforming it so far this year. On the 10-year chart the trading range that has followed the ramp from September 2005 through April last year does not look to be of sufficient duration to support another strong advance, and the uptrend channel drawn on this chart looks unsustainably steep and for these reasons the chances of a breakdown are considered to be quite high.Read full article... Read full article...

Sunday, April 01, 2007

The Gold Bull Market Remembers How Gordon Brown Sold Half of Britains Reserves at the Lowest Price / Commodities / Gold & Silver

By: Clive_Maund

An increasing number of goldbugs and traders are getting bewildered and frustrated at gold's pedestrian performance and refusal to break higher, even with a possible attack on Iran looming, especially as oil has been romping ahead, and are, of course, looking around for people to blame, which usually winds up being the poor old cartel, those dastardly faceless individuals whose job it is to suppress the price of gold and silver so that the financial world at large doesn't cotton on to the precarious state of the world financial system in general and the Fiat money system in particular, much less mortgaged-up-to-the-hilt Joe Sixpack, whose chief distinguishing feature is that he hasn't got a clue about anything, apart from the details of upcoming ball games etc.Read full article... Read full article...

Sunday, April 01, 2007

April Uranium Price Forecast to hit $110/Pound / Commodities / Uranium

By: James_Finch

Bids are due in Corpus Christi, Texas on April 3rd for the sealed-bid auction, conducted by Mestena Uranium LLC, for another modest lot of 100 thousand pounds of U3O8. “Buyers are once again expected to compete aggressively for the material,” Nuclear Market Review (NMR) editor Treva Klingbiel wrote in the monthly edition of the nuclear industry trade magazine. “Any material offered at fixed price is highly sought after by potential buyers.”

Earlier this past week, Entergy Corp’s (ETR) director of nuclear fuel told Dow Jones MarketWatch, “There’s a period where the market is going to be very ugly from a buyer’s standpoint.” The New Orleans-based nuclear utility holds the second largest number of nuclear power plants behind Exelon Corp (EXC). Jim Malone, Exelon Corp’s nuclear fuels vice president, expects the impact of the rising uranium price to impact utilities at some unspecified future date, but not now.

Read full article... Read full article...