Analysis Topic: Commodity Markets - Metals, Softs & Oils

The analysis published under this topic are as follows.Thursday, June 27, 2013

Time for Gold to Climb the Wall of Worry? / Commodities / Gold and Silver 2013

By: PhilStockWorld

Zeroxzero said it best last night: Reading the apocalyptic tone in many of the comments today — the imminent demise of Japan, the imminent demise of France, the inevitable implosion of China, the Demolition Derby of Euro, Yen, Dollar and Swissie, and the collapse of gold — all viewed against the fiery background of a Middle East abandoned to war because we don't need its oil anymore, a Brazil, Australia, Latam & Africa whose commodities are now worthless, and an Asia and India whose cheap labor has become superfluous — I have been given the sense that we are now riding the Fifth Wave up the Limpopo with Yellow Jack.

Read full article... Read full article...

Wednesday, June 26, 2013

Gold's Price Plunge Not Met by Stronger Physical Demand / Commodities / Gold and Silver 2013

By: Ben_Traynor

SPOT MARKET gold fell to its lowest level since August 2010 Wednesday, trading as low as $1224 an ounce, as stocks rallied along with the Dollar following better-than-expected US economic data a day earlier.

By Wednesday lunchtime in London, gold in Dollars was trading around 4% down on where it started yesterday's London session.

Wednesday, June 26, 2013

Gold and Silver Life Cycle Nears End – The Final Stage of Denial / Commodities / Gold and Silver 2013

By: Chris_Vermeulen

The life cycle of most things not matter what it is (living, product, service, ideas etc…) go through four stages and the stock market is no different. Those who recently gave in and bought gold, silver, mining stocks, coins will be enter this stage of the market in complete denial. They still think this is a pullback and a recover should be just around the corner.

The life cycle of most things not matter what it is (living, product, service, ideas etc…) go through four stages and the stock market is no different. Those who recently gave in and bought gold, silver, mining stocks, coins will be enter this stage of the market in complete denial. They still think this is a pullback and a recover should be just around the corner.

Well the good news is a recovery bounce should be nearing, but if technical analysis, market sentiment and the stages theory are correct then a bounce is all it will be followed by years of lower prices and dormancy.

Read full article... Read full article...

Wednesday, June 26, 2013

The Ben Bernanke Gold Correction - Why I Own Gold / Commodities / Gold and Silver 2013

By: Axel_Merk

I am an optimist. I'm no conspiracist. I just happen to think the road to hell is paved with good intentions. As a result, I own gold. Let me expand.

I am an optimist. I'm no conspiracist. I just happen to think the road to hell is paved with good intentions. As a result, I own gold. Let me expand.

Wednesday, June 26, 2013

The Fed’s Forked Tongue, Means Gold's Price Rise Will be Explosive / Commodities / Gold and Silver 2013

By: Darryl_R_Schoon

When Helicopter Ben Bernanke

When Helicopter Ben Bernanke

Said the helicopter would descend

The markets reacted and quickly fell

Fearing the party would end

But they forgot that Ben’s a banker

A breed whose trust is low

And they didn’t stop to consider

It might only be part of the show

Wednesday, June 26, 2013

Gold Expected Rally Could Taper off by Mid July / Commodities / Gold and Silver 2013

By: Ed_Carlson

The $88/oz. drop in gold last Thursday surely got the attention of a few - instilling fear in those who are still long the metal and greed in those who are not. While I doubt a final low will be seen in gold until the end of the year (the subject of another commentary) the time for a short bounce appears to be upon us.

Read full article... Read full article...

Wednesday, June 26, 2013

Still Waiting For The Gold Rally, The Good News Bears / Commodities / Gold and Silver 2013

By: HRA_Advisory

Gold continues to struggle and so do explorers. I am seeing encouragement in the trading of some discovery stories but this is a very small subset of the junior sector.

Gold continues to struggle and so do explorers. I am seeing encouragement in the trading of some discovery stories but this is a very small subset of the junior sector.

I think the precious metals markets are well set up for a rally but gold rallies don’t usually happen in the summer. It’s still possible but I don’t think a rally strong enough to drag the juniors along for the ride can be assumed in the short term.

Read full article... Read full article...

Wednesday, June 26, 2013

Are You Protected from Crude Oil Price Downside? / Commodities / Crude Oil

By: The_Energy_Report

Remember when oil shot up to $148 a barrel? Chen Lin does, and he sees potential for Wall Street market manipulation to push the oil price in the opposite direction—as low as $47 a barrel. Plus, he's bearish on China now. The good news is that Lin, publisher of What Is Chen Buying/Selling?, was willing to share his personal investment strategy in his interview with The Energy Report. Find out where Lin booked profits this year and get the names he's turning to for protection against oil price downside.

Remember when oil shot up to $148 a barrel? Chen Lin does, and he sees potential for Wall Street market manipulation to push the oil price in the opposite direction—as low as $47 a barrel. Plus, he's bearish on China now. The good news is that Lin, publisher of What Is Chen Buying/Selling?, was willing to share his personal investment strategy in his interview with The Energy Report. Find out where Lin booked profits this year and get the names he's turning to for protection against oil price downside.

The Energy Report: What have been the most important changes in the oil and gas markets since your last interview in February?

Read full article... Read full article...

Tuesday, June 25, 2013

Now is the Time to Buy the "New Gold" / Commodities / Gold and Silver 2013

By: Money_Morning

Peter Krauth writes: On May 15, Christie's auction house sold a huge diamond to the Harry Winston firm for $27 million, setting a new record price for a colorless diamond in the process.

Peter Krauth writes: On May 15, Christie's auction house sold a huge diamond to the Harry Winston firm for $27 million, setting a new record price for a colorless diamond in the process.

And while diamonds have been a girl's best friend long before Marilyn Monroe crooned those words, it's always been tough for investors to get into the game. Diamonds are considered one of those esoteric fields; an area of investing too small, complex, and exclusive to bother with for most.

Read full article... Read full article...

Tuesday, June 25, 2013

Gold Price Forecasts Cut by Bank Analysts Again as US Fed Tries to Temper "Taper Talk" / Commodities / Gold and Silver 2013

By: Adrian_Ash

PRECIOUS METALS rallied in London on Tuesday morning as European stock markets also bounced with commodity prices.

PRECIOUS METALS rallied in London on Tuesday morning as European stock markets also bounced with commodity prices.

Gold and silver recovered half of yesterday's 1.7% and 3.1% drops respectively.

The US Dollar eased back on the currency market, as did major government bond yields.

Tuesday, June 25, 2013

Buying Gold On Dip - Russia, Kazakhstan, Azerbaijan, Kyrgyz Republic, Turkey / Commodities / Gold and Silver 2013

By: GoldCore

Today’s AM fix was USD 1,285.00, EUR 979.42 and GBP 831.88 per ounce.

Today’s AM fix was USD 1,285.00, EUR 979.42 and GBP 831.88 per ounce.

Yesterday’s AM fix was USD 1,283.25, EUR 978.98 and GBP 836.21 per ounce.

Gold fell $11.70 or 0.90% yesterday and closed at $1,282.30/oz. Silver slid to a low of $19.453 and finished down 2.14%.

Read full article... Read full article...

Tuesday, June 25, 2013

Prediction for a Brand New World for Gold / Commodities / Gold and Silver 2013

By: The_Gold_Report

The quant who produces Trader Tracks newsletter tells The Gold Report that the technical charts project a brightening future for precious metals. Technical market analyst Roger Wiegand tracks annual trading cycles while keeping an expert eye on potentially disruptive world events. He is a stickler for fundamentals, though, when it comes to picking out the best juniors for safe bets in a cash-poor industry.

The quant who produces Trader Tracks newsletter tells The Gold Report that the technical charts project a brightening future for precious metals. Technical market analyst Roger Wiegand tracks annual trading cycles while keeping an expert eye on potentially disruptive world events. He is a stickler for fundamentals, though, when it comes to picking out the best juniors for safe bets in a cash-poor industry.

The Gold Report: In early 2012, Roger, you predictedthat the price of gold would rise to over $2,000/ounce ($2,000/oz) during the year. But as the overall stock market increased in value, the yellow metal went in the opposite direction. What happened?

Read full article... Read full article...

Tuesday, June 25, 2013

Ben Bernanke's Real Message for Gold Investors / Commodities / Gold and Silver 2013

By: The_Gold_Report

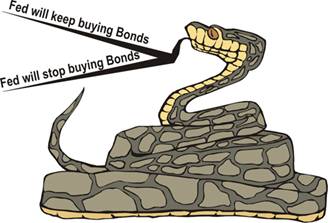

Don't fall for propaganda from the Federal Reserve about tapering quantitative easing, says ShadowStats editor John Williams in this interview with The Gold Report. His corrected economic indicators show the U.S. is nowhere near a recovery and the Fed will have to increase rather than decrease bond buying to prop up the banks and push off inevitable dollar debasement. That could be very bad for savers, but good for gold.

Don't fall for propaganda from the Federal Reserve about tapering quantitative easing, says ShadowStats editor John Williams in this interview with The Gold Report. His corrected economic indicators show the U.S. is nowhere near a recovery and the Fed will have to increase rather than decrease bond buying to prop up the banks and push off inevitable dollar debasement. That could be very bad for savers, but good for gold.

The Gold Report: On Wednesday, the Federal Reserve hinted that it might begin tapering quantitative easing by the end of the year based on signs of an improving economy. Gold immediately dropped from $1,347 an ounce ($1,347/oz) to $1,277/oz, a 7% decline and the lowest price in more than two years. The Dow Jones Industrial Average and NASDAQ were also off more than 2%. You called this "jawboning" and said that due to stresses in the banking system the Fed would be obliged to continue bond buying. Why would the central bank threaten to cut off the flow if it didn't plan to do it?

Read full article... Read full article...

Tuesday, June 25, 2013

Is Gold Price Trying to Tell Us Another 2008 Crisis is Lurking in the Shadows? / Commodities / Gold and Silver 2013

By: Michael_J_Kosares

This monthly gold chart is drawn on the logarithmic scale in order to remove some of the melodrama to the latest correction. Linear charts emphasize nominal price movement while a log chart emphasizes the percentage movement. By reviewing gold’s latest correction on a percentage basis, we can put things into a little bit better perspective. The 2008 correction was 26%; the current correct thus far has been 30%. In short, we’ve been here before though you wouldn’t know it from all the catterwauling at our favorite financial cable network and other media outlets (not to mention Wall Street itself). Granted we might not, as yet, have reached bottom, but then again, we could be close.

This monthly gold chart is drawn on the logarithmic scale in order to remove some of the melodrama to the latest correction. Linear charts emphasize nominal price movement while a log chart emphasizes the percentage movement. By reviewing gold’s latest correction on a percentage basis, we can put things into a little bit better perspective. The 2008 correction was 26%; the current correct thus far has been 30%. In short, we’ve been here before though you wouldn’t know it from all the catterwauling at our favorite financial cable network and other media outlets (not to mention Wall Street itself). Granted we might not, as yet, have reached bottom, but then again, we could be close.

Tuesday, June 25, 2013

Gold Investors Keep Calm and Carry On / Commodities / Gold and Silver 2013

By: Frank_Holmes

Legendary businessman Steve Forbes once said, "Everyone is a disciplined, long-term investor until the market goes down." It's challenging to have the fortitude to hold on to investments during a one-day carnage event like last Thursday. Everywhere you looked there was red on the screen, as U.S. stocks lost 2.5 percent, commodity equities lost 3 percent and gold declined 5 percent. Gold stocks took one of the biggest blows, falling about 7.5 percent.

Legendary businessman Steve Forbes once said, "Everyone is a disciplined, long-term investor until the market goes down." It's challenging to have the fortitude to hold on to investments during a one-day carnage event like last Thursday. Everywhere you looked there was red on the screen, as U.S. stocks lost 2.5 percent, commodity equities lost 3 percent and gold declined 5 percent. Gold stocks took one of the biggest blows, falling about 7.5 percent.

So what should an investor do after a day like Thursday? Stay calm and invest on, as I believe there is opportunity in picking up what the bears left behind. Here are a few ideas to ponder.

Read full article... Read full article...

Tuesday, June 25, 2013

Resources Sector Nuclear Winter? Not Yet! / Commodities / Resources Investing

By: Casey_Research

By Andrey Dashkov, Research Analyst

By Andrey Dashkov, Research Analyst

The late 1990s for the resource sector was so challenging that it is now often referred to as the "nuclear winter" of the industry. Some analysts are comparing our current circumstances to that period, while others purport we haven't hit bottom yet.

Tuesday, June 25, 2013

Changes in the Silver Market / Commodities / Gold and Silver 2013

By: Adrian_Ash

Miguel Perez-Santalla writes: Photographic demand for silver has fallen 70% from its peak. What could possibly fill that gap...?

BACK in the good old days, a physical silver trader's dream would be to land a photographic company as a customer.

Polaroid, Kodak, Fuji and many more were on this list of prospects. This industry was a tremendous behemoth in the silver market.

Monday, June 24, 2013

Stunning Chart Shows Gold and Silver Defy Bulls' Optimism / Commodities / Gold and Silver 2013

By: EWI

Gold and silver have been all over the financial news.

Gold and silver have been all over the financial news.

On Thursday, June 20, silver fell below $20 (-60% from 2011 high), and gold fell below $1300 (-30% from 2011 high).

We first published the chart below after metals plunged in mid-April. It shows EWI's forecasts not only leading up to those big moves ... but during the past three years of opportunity.

Read full article... Read full article...

Monday, June 24, 2013

Extreme Energy, Extreme Implications / Commodities / Energy Resources

By: OilPrice_Com

If oil and gas is a profoundly dynamic phenomenon, then so too must be environmental risk and conflicts over natural resources--and we are not getting the full picture from the mainstream media, according to Michael T. Klare, professor of peace and world security studies at Hampshire College, TomDispatch blogger, and author of Rising Powers, Shrinking Planet: The New Geopolitics of Energy (Metropolitan Books, 2008). As risk multiply, conventional sources evaporate and we are left with "extreme" energy, renewables may be the only way to avoid war and disaster.

If oil and gas is a profoundly dynamic phenomenon, then so too must be environmental risk and conflicts over natural resources--and we are not getting the full picture from the mainstream media, according to Michael T. Klare, professor of peace and world security studies at Hampshire College, TomDispatch blogger, and author of Rising Powers, Shrinking Planet: The New Geopolitics of Energy (Metropolitan Books, 2008). As risk multiply, conventional sources evaporate and we are left with "extreme" energy, renewables may be the only way to avoid war and disaster.

Monday, June 24, 2013

Marc Faber - Incredibly Bad Sentiment Makes Gold and Bonds a Buy / Commodities / Gold and Silver 2013

By: Adrian_Ash

PRECIOUS METALS fell for the 5th session in six Monday morning in London, with gold retreating to $1280 per ounce as the US Dollar rose and most other tradable assets fell once again.

PRECIOUS METALS fell for the 5th session in six Monday morning in London, with gold retreating to $1280 per ounce as the US Dollar rose and most other tradable assets fell once again.

London and Paris' stock markets dropped 2.0% by lunchtime. Commodities also fell, extending their worst 1-week drop since October.