Analysis Topic: Stock & Financial Markets

The analysis published under this topic are as follows.Sunday, September 22, 2024

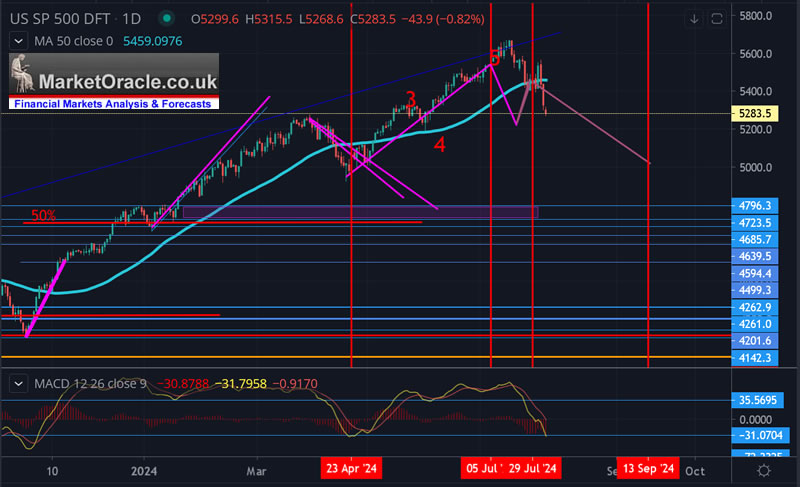

US Rate Cut FOMO In Stock Market Correction Window / Stock-Markets / Stock Markets 2024

By: Nadeem_Walayat

Dear Reader

It's your lucky day, you get access to my latest market brief made available to patrons 22nd September.

.....

Stock Market Brief - 22nd Sept - 7pm (UK Time)

US 0.5% rate cut signals that the Fed wants to bring rates down fast from the 5.5% peak, with likely another 0.5% cut before year end and probably targeting sub 4% by the end of 2025 to maybe to around 3.5% which will act as a huge wind behind the stocks bull markets sail as multiples expand. Which in fact is contrary to that which most expect i.e. the analogs being peddled across the blogosfear point to the Fed deep cuts being associated with bear markets which is true! BUT those cuts were in response to FINANCIAL and ECONOMIC CRISIS which is not so today. Remember the market DISCOUNTS THE FUTURE IN THE PRESENT, so is discounting strong economic and earnings growth for 2025 following the 0.5% rate cut by expanding multiples in the present. Rate cuts should act to boost downtrodden stocks such as NIKE and Walt Disney that I accumulated some exposure to.

Read full article... Read full article...

Sunday, September 22, 2024

Stock Market Sentiment Speaks:Nothing Can Topple This Market / Stock-Markets / Stock Markets 2024

By: Avi_Gilburt

Every now and then, I peruse articles written on Seeking Alpha to glean a flavor for what the average investor feels about the current market environment. And, to that end, I will scan the comments section for some nuggets of anecdotal sentiment.

So, over the last week or so, I have seen quite a few comments about the S&P500 such as these:

"We could hit 10k sometime around 2028 but I wouldn't be surprised with 2027 either."

"At this point it's clear that nothing will sink stocks. Even a full blown recession event like 2008 wouldn't be able to do much damage to the stock market at this point. In fact it would be bullish because Fed would print trillions to pump stocks again."

Tuesday, September 17, 2024

Are Stocks Overheating? / Stock-Markets / Stock Markets 2024

By: Paul_Rejczak

Stock prices continued their uptrend on Friday, with the S&P 500 gaining 0.54% and breaking above the 5,600 level. The market is once again nearing its July 16 record high of 5,669.67. But will it continue upward? Today, the index is expected to open 0.1% lower as markets await the FOMC rate decision on Wednesday. In the short term, the market appears more and more overbought, making a correction likely at some point.

Last week, the investor sentiment worsened, as shown by AAII Investor Sentiment Survey on Wednesday, which reported that 39.8% of individual investors are bullish, while 31.0% of them are bearish, up from 24.9% last week.

Tuesday, September 17, 2024

Sentiment Speaks: Silver Is At A Major Turning Point / Stock-Markets / Stock Markets 2024

By: Avi_Gilburt

I want to start this article with a little background about Elliott Wave analysis, and begin with a quote from Paul Tudor Jones, one of the most successful money managers of all time:

"I attribute a lot of my success to Elliot Wave Theory. It allows one to create incredibly favorable risk reward opportunities"

Back in the 1930’s, an accountant named Ralph Nelson Elliott identified that markets represent unconscious, non-rational reactions which follow a repeating fractal pattern, which means they move in variably self-similar patterns at all degree of trends. This repeating fractal pattern represents overall societal sentiment which is governed by the natural law of the universe as represented through Fibonacci Mathematics.

Read full article... Read full article...

Tuesday, September 17, 2024

If The Stock Market Turn Quickly, How Bad Can Things Get? / Stock-Markets / Stock Markets 2024

By: Kelsey_Williams

HOW BAD CAN THINGS GET?

Pretty damn bad. Which means that it will likely be much worse than most of us can imagine. Other than Covid and its forced shutdown of economic activity by governments world-wide, the most recent learning experience for investors is the Great Recession of 2007-09. Beginning in October 2007 and ending in February 2009, the S&P 500 Index lost 53%…

Read full article... Read full article...

Friday, September 06, 2024

Stocks Face Uncertainty Following Sell-Off / Stock-Markets / Stock Markets 2024

By: Paul_Rejczak

My speculative short position in the S&P 500 futures contract from August 20, opened at the 5,626 level, is in profit.

Wednesday’s trading session saw a slight rebound of the S&P 500 index, but it closed 0.16% lower, hovering near its short-term low following Tuesday’s decline of over 2%. The index broke below its recent trading range on Tuesday, which could signal the start of a new short-term downtrend, though it currently looks like a downward correction.

This morning, futures contracts indicate the index will open 0.2% lower, reacting to economic data: a lower-than-expected ADP Non-Farm Employment Change and a slightly weaker Unemployment Claims report.

Tuesday, September 03, 2024

AI Stocks Portfolio and Bitcoin September 2024 / Stock-Markets / Investing 2024

By: Nadeem_Walayat

Dear Reader

It's your lucky day, you get access to my latest market brief made available to patrons early 3rd September.

.....

AI Stocks Portfolio Brief Going into September - 3rd Sept - 5am UK Time

Read full article... Read full article...

Friday, August 30, 2024

Stocks Likely to Extend Consolidation: Topping Pattern Forming? / Stock-Markets / Stock Markets 2024

By: Paul_Rejczak

Wednesday’s trading session brought declines for the stock market, but overall, the market remained within its short-term consolidation. The S&P 500 index lost 0.6% after rebounding from the daily low of around 5,561. The eagerly-awaited NVDA earnings didn’t change much, although today, the market is set to open 0.2% higher, retracing some of yesterday’s decline and further extending its consolidation.

Last Wednesday, I wrote “Recently, the market has continued to climb following the brief Yen crisis at the start of August, surprising many traders. The question is whether the market will continue to new highs or reverse course and retrace the recent rally. I think there is a chance the market will reverse its course and correct some of the advances, retracing a large part of the rally.”

Investor sentiment remains elevated, as shown by the yesterday’s AAII Investor Sentiment Survey, which showed that 51.2% of individual investors are bullish, while 27.0% of them are bearish – up from 23.7% last week.

Friday, August 30, 2024

Why Stock-Market Success Is Usually Only Temporary / Stock-Markets / Stock Markets 2024

By: EWI

Here's a sample of record sentiment readings for stocks

Recession coming or not, people are still EXTREMELY bullish.

Read this excerpt from the May 17, 2024 Elliott Wave Theorist:

Read full article... Read full article...

Friday, August 23, 2024

Stock Market Surefire Way to Go Broke / Stock-Markets / Investing 2024

By: Stephen_McBride

Summary:

- After a strong start to the year, markets have cooled off and the Fear & Greed Index is signaling “extreme fear.” Despite this, stocks have rallied and remain up 14% for the year.

- Investors are hardwired to be pessimistic, but optimists are generally the ones who make more money.

- Despite many crashes, the odds of making money in US stocks is 88% over any five-year period in history. That’s why optimists have a higher chance of making money over the long term.

Saturday, August 17, 2024

AI Computers Hype / Stock-Markets / AI

By: Nadeem_Walayat

Lots of hype in the media about AI computers such as which Microsoft announced. Only problem is there is no compelling reason to upgrade to an AI computer, what are you going to do with it?

Read full article... Read full article...

Friday, August 16, 2024

Is Stocks Rally Showing Signs of Exhaustion? / Stock-Markets / Stock Markets 2024

By: Paul_Rejczak

Stocks further accelerated their uptrend yesterday, with the S&P 500 index closing 1.61% and reaching new local highs above the 5,500 level. The market has retraced almost all of its declines from the August 1 local high of 5,566.16. The rebound surprised a majority of traders and the question is: Will the market go straight to new highs, or will it reverse at some point and retrace the rally? For now, there have been no confirmed negative signals; however, this morning, the S&P 500 is likely to open 0.6% lower, as indicated by futures contracts.

Read full article... Read full article...

Thursday, August 15, 2024

We got the Stock Market Selloff — Now what? / Stock-Markets / Stock Markets 2024

By: Submissions

Editor’s note: Today, RiskHedge Executive Editor Chris Reilly sits down with Stephen McBride to discuss the recent market selloff and what investors should expect leading up to the US presidential election...

***

Chris Reilly: Stephen, we got the selloff you’ve been anticipating.

Here’s your warning from June:

Markets aren’t usually this easy or consistent. And remember, in an average year, the S&P 500 suffers a decline of 14%. My guess is we’ll get a correction in that ballpark sometime before November’s election.

Thursday, August 15, 2024

BRICS, Inflation, Turmoil, and CDBC – What to DO? / Stock-Markets / Financial Markets 2024

By: Andy_Sutton

Our column last week prompted so many questions from new readers that we decided to start from scratch. Long-time readers will recognize much of what we’re about to say, but we ask that you take the time regardless since we’re adding in valuable context that has been provided over time. Just looking at the world today, your first thought might be: crazy! However, compared with even a few years ago, things are much clearer. So, without further ado…

Read full article... Read full article...

Tuesday, August 13, 2024

US Stock Market vs M2 Money Supply Vs House Prices / Stock-Markets / Financial Markets 2024

By: Nadeem_Walayat

This graph shows the US stock market total market cap divided by M2 money supply as a measure of relative valuations which shows stocks in October 2022 were just as cheap as they were during the depths of the 2000 pandemic crash, remember October 2022? When most feared much lower prices and thus failed to buy when stocks were cheap, as is usually the case at every market bottom!

Also whilst stocks are nowhere at the bubble territory of the dot com bubble they are definitely not cheap hence why I am currently approx 70% invested in stocks after taking off the 10% invested in cyclical crypto's that I will probably completely disinvest from over the next 12 months.

Read full article... Read full article...

Monday, August 12, 2024

Stock Market Mainstream Financial Media Narratives vs Reality / Stock-Markets / Stock Markets 2024

By: Nadeem_Walayat

So much for the "Sell in May and go Away" narrative that gets peddled out each year. Near term the S&P has basically traded sideways for the past 3 weeks nevertheless the stock market has delivered opportunities galore to both trim and accumulate in key target stocks such as buying the dips in ADSK, DIOD, and GPN and selling the rips in TSM, Qualcom and WDC, whilst seeking to capitalise on opportunities presented by the plunge in cloud computing stocks such as CRM, VEEV, Adobe, and SNOW of which SNOW is the bigger gamble of the bunch.

Current state of the stock market is that the S&P put in a new all time high of 5373, which is what tends to happen during a bull market as I often state that the risk is to the upside.

Read full article... Read full article...

Monday, August 12, 2024

Stock Market Rollercoaster: Analyzing the Recent Meltdown and Recovery / Stock-Markets / Stock Markets 2024

By: MoneyMetals

The financial landscape experienced a seismic shift last week, reminiscent of hitting rumble strips on the interstate—jerking investors awake to the underlying economic dangers.

Monday’s drastic stock market selloff, triggered by various catalysts, left investors reeling, though the panic seemed to abate by week's end. But is everything truly back to normal, or was this a premonition of more significant issues to come?

Monday, August 12, 2024

Stocks Rebounded: What’s Next? / Stock-Markets / Stock Markets 2024

By: Paul_Rejczak

Tuesday's trading session was mixed; stock prices bounced, but they closed well below the daily highs. The S&P 500 reached a local high of 5,312.34 but closed more than 70 points below that level, gaining 'just' 1.04%. Overnight, calming words from the Bank of Japan were released, and this morning, the S&P 500 is likely to open 1.0% higher in another attempt to retrace more of its recent sell-off.

Before the current turmoil, investor sentiment had slightly improved last week, as indicated by the last Wednesday's AAII Investor Sentiment Survey, which showed that 44.9% of individual investors are bullish, while only 25.2% of them are bearish – down from 31.7% last week.

Saturday, August 10, 2024

AI Will Turn Everyone Into Gamblers! The Greatest Wealth Transfer In History is Coming.. Part 1/2 / Stock-Markets / Financial Markets 2024

By: Nadeem_Walayat

Dear Reader

Have you managed to capitalise on the stock market correction as many patrons have in key target AI tech stocks?

Saturday, August 10, 2024

Plunging Stocks, Gold Miners, and Lucrative Implications / Stock-Markets / Gold & Silver Stocks 2024

By: P_Radomski_CFA

The stock markets around the world are sliding, and so does bitcoin – just as I warned.

Miners invalidated their tiny breakout, closed below the July low on Friday, and they are poised to slide even more.

That’s just the beginning.

Let’s start with a quote from my Friday’s Gold Trading Alert:

Stocks might have had their “oops” moment this week. (…)